Winged Wealth offers the following deeper dives on topics relevant to military pilots, military members, veterans, and families.

SORT BY

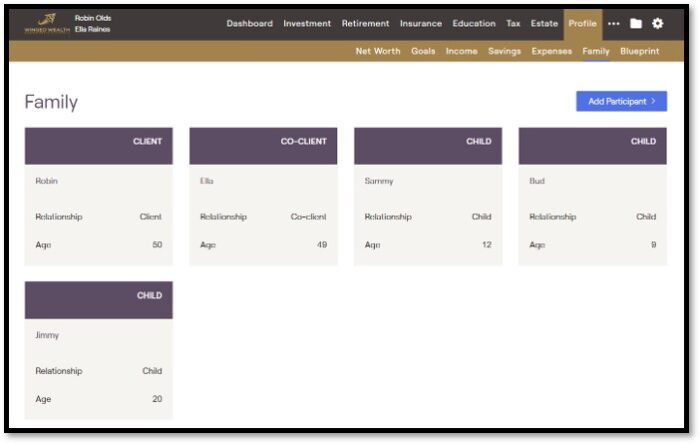

What does Financial Planning Look Like? Part 1 Family and Income

Sometimes a picture and words are worth a thousand pictures and words... lets take a look at real Financial Planning!

Everything is Free

Military service conditions us not to pay for a lot of services, but should we pay even if we don’t absolutely have to?

Why You Should Care about the Number 230

230 might be your fighting weight, but it's also a key number for your IRA!

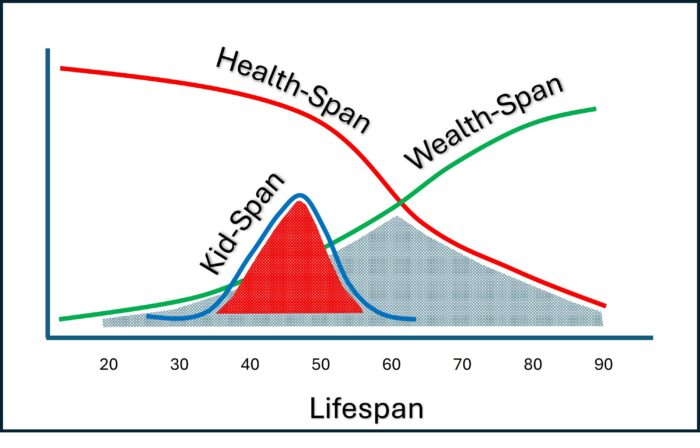

Kid-Span and the Spans

You get maybe 85 laps around the sun. How do you optimize the Wealth, Health, and Kid time during your Lifespan?

Retire to It, Not From It

Retirement has many choices. Choosing to retire may be the easiest one…

All the Single Killers…

Should you get married to pay less taxes? Probably not…

Depreciation for Dummies

Appreciation grows the price of your rental home, Depreciation shrinks the cost of your taxes. Here’s what you need to know about Depreciation.

The End of the Roth Golden Age

The best years of Roth may end in 2025. Read on to find out what you can do with the time left...

In Memoriam

Memorial Day gives us a chance to reflect on our mission—perfecting the Union others died to preserve.

When is PAWing Okay?

Is your net worth on course, on glidepath? How much net worth should you have for your age?

Commanding Money

Commanders are busy, but they’re responsible for financial readiness too. This toolkit makes it easy to lead with money!

How Much is Mom Worth?

Mother’s day is just a few days away. Do you know how much your Mom is worth? Of course she’s priceless, but let’s peel that back a bit!

Prepaid College – Is it a Bargain?

Prepaid college plans can be attractive. Who doesn’t like a guarantee? But what’s the cost of that guarantee and is it right for you?

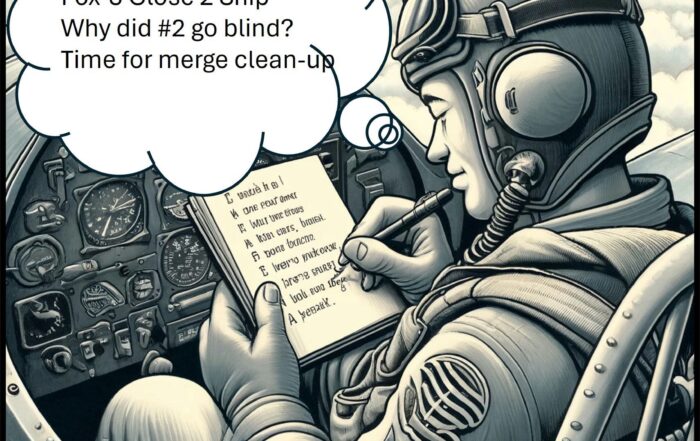

The Haiku Financial Plan

You’ve heard of one-page financial plans, note card financial plans, but what about Haiku?

Top 10 Tax Mistakes Fighter Pilots Make

No one likes to overpay taxes. Underpaying tends to wind up poorly too. How can you avoid tax mistakes?

Do I Have to Pay Estimated Taxes in 2024?

Tax day is almost here, but you received estimated payment forms. Do you have to pay estimated taxes too?

The C-Word(s)

Culmination, compensation, confusion—check! The are so many C-Words in the financial world, but the really tough ones are Contribution, Conversion and Characterization.

Getting Real About College Again… Part 2

Hangovers are part of College, but how long should they last and do parents get them too?

Getting Real About College Again… Part 1

What is College Really For?

College SOTU (State of the Union)

College decision season is in full afterburner for seniors… what’s coming up for juniors?

Bucket List Planning for the Young

You have a long time before you "kick the bucket," but how long do you have before you don't own your children's time to make memories for your family? Do you need a bucket list for age 14? Maybe 18?

The Power of Mental Accounting

If you could have a superpower, wouldn’t you want it to be mental accounting? Maybe you’re in luck…

Smooth Versus Creep

Lifestyle creep isn’t inherently bad, and consumption smoothing is definitely hard. What path should you choose?

Digital Assets—Like Stocks, but with Additional Risks

Crypto comes in ETF flavors now—is it time to buy?

Top Ten Insurance Mistakes that Fighter Pilots Make

Insurance is like Goldilocks, too much and too little are probably not the right answer…

Single Stocks—An Uncompensated Risk

Investing in single stocks can pay off big (early Apple), result in disaster (Enron), be a long-slow decline (GE), or be a roller coaster (most companies over time).

YNARB

Budgets stink. Maybe there’s another way to make your money behave… YNARB

Diversification: Always Saying You’re Sorry

It’s rare to hear that you shouldn’t diversify your investments, but really, should you?

How to Trust

You’ve decided to get a Revocable Living Trust, but what do you do now?

Up the Score in 2024

It's finally 2024. What should you be doing to max-perform your dollars and your life fulfillment?

The Other DCA

Defensive Counter Air is fun, but could Dollar Cost Averaging be even more fun?

Short, Sweet, to the Point: 10 Quick End-of-Year Steps You Can Still Take to Max-Perform Your Money

It’s almost the end of the year, but there’s still time to max-perform your money!

RMD–Why Does this Matter to Me?

What goes in, must come out. What are RMDs and how should you think about these Required Minimum Distributions?

How to Max Perform Holidays with Family

Holidays are stressful enough, but sometimes they're your best chance to have a tough conversation with family members. Read on for tactics to max perform your holidays!

I-Bond Update

Series I-Bonds dipped to 4.3% but now are back up to to 5.27% until May 2024. Should you stay the course with I-Bonds?

Why I Opted Back in to SBP

The SBP Open Season is almost over. Should you get out? Should you get in? What is SBP anyway?

Should Grandparents have 529’s?

Giving to grandkids feels good, paying for their education pays for your Social Security...so what’s the downside of a Grandparent-owned 529?

Don’t Close the Backdoor (Roth IRA)

Backdoor Roth season is in full swing. You'll need to maneuver before December 31st, so here's what you need to know about Backdoor Roth IRAs!

Old Money

You know how to handle your money, but your parents are starting to need some help. Where do you even start?

Life Insurance Q & A

Life Insurance-- Boring? Ghoulish? Crucial? Confusing? Yes.

Top 10 Tax Planning Tips for Fighter Pilot Families

Wouldn't it be great to only worry about taxes in April? So sad, but these tips can help you max-perform tax planning before it's trapped at your six!

How Fighter Pilots Save for College

College is expensive, but there are a lot of ways to save for college. Read on to arm yourself with the best tactics!

The Premium or the Pain

We all like our cards. They provide a lot of convenience. But what do we trade for that convenience?

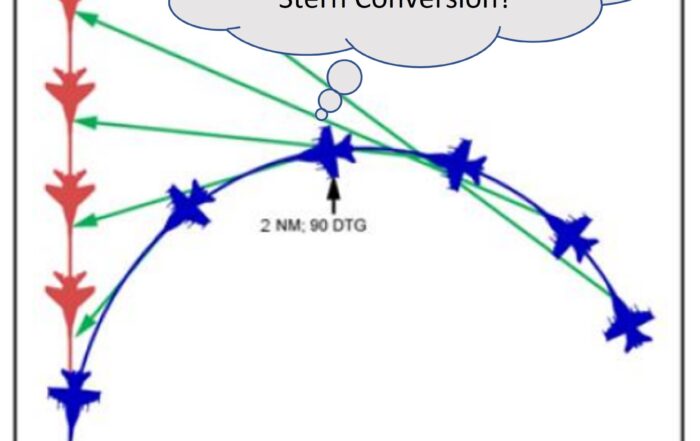

When is the Best Time for Roth Conversions?

Roth Conversions are mysterious until they're not. They can lower your lifetime tax bill, which is the bill you should be worrying about!

Where to Stash Your Cash

Interest rates are finally interesting (for savers), but where should your really stash your cash?

Why You Should Care about the Number 218

Personal finance has a lot of key numbers, but 218 is critical this year, because the success of your Roth IRA depends on it!

Peak Stuff

Stuff is everywhere. Do you have enough? Too much? Is it time to declare “Peak Stuff?”

How Fighter Pilots KISS Part 2

Diversification is good, but how much of a good thing do you need? Can too much diversification harm your portfolio?

How Fighter Pilots KISS

Everything has its place, but do you really need separate accounts all over the place? How many IRA's are enough?

Markets Versus Mattresses

The market is too high to invest in, right? Wait, how do you know? When do you jump in? All at once, or a little at a time?

Non-Traditional Investments

Investing in dollars is necessary, but not sufficient. To solve for happiness, we need to invest in other ways too.

Everything is Free

Military service conditions us not to pay for a lot of services, but should we pay even if we don’t absolutely have to?

Why I Opted Back in to SBP

The SBP Open Season is halfway over. Should you get out? Should you get in? What is SBP anyway?

How Lieutenants Become Millionaires, Part 3

Now Lieutenants know what to do, but WHY? And How?

How Lieutenants Become Millionaires, Part 2

Graduating from a 20-year military career with a million-dollar nest egg is well within reach for new officer. Modest savings in the Thrift Savings Plan (TSP) added to the traditional defined benefit pension for 20+ year military retirees can make today’s butter bars into tomorrow’s millionaire next door, but you have to act now!

How Lieutenants Become Millionaires, Part 1

Building sufficient wealth isn't the first thing on a young officer's mind, but it can't be the last either.

Artificial Scarcity

There are many tools for building wealth. You can discover the next amazing stock, you can buy real estate on the cheap, you can build a successful business, and you can even convince a bunch of people to pay for a collection of ones and zeros with a made-up story behind them. But what about other tools like artificial scarcity?

The Wrong Time for Financial Planning

Financial Planning solves a lot of problems, but there are times when it may not solve yours…

What if the Market Crashes?

The news says the debt ceiling might crash the markets, what should you do?

Top Ten Insurance Mistakes that Fighter Pilots Make

Insurance is like Goldilocks, too much and too little are probably not the right answer…

The C-Word(s)

Culmination, compensation, confusion—check! The are so many C-Words in the financial world, but the really tough ones are Contribution, Conversion and Characterization.

The Financial Value of a Mom

Mother’s day is just a few days away. Do you know how much your Mom is worth? Of course she’s priceless, but let’s peel that back a bit!

Financially Launching Kids to College

Financially savvy adults aren’t born, they’re made. The start of college is the time to prepare your young adult for max-perform money.

Top 10 Tax Mistakes Fighter Pilots Make

No one likes to overpay taxes. Underpaying tends to wind up poorly too. How can you avoid tax mistakes?

Do I Have to Pay Estimated Taxes?

Tax day is here, but you received estimated payment forms. Do you have to pay estimated taxes too?

Should you Die with Zero?

You’re saving for retirement, but should you be spending to make memories too? And when should you give your kids an inheritance?

Should You Prepay for College

Prepaid college plans can be attractive. Who doesn’t like a guarantee? But what’s the cost of that guarantee and is it right for you?

Jinking out of Estimated Taxes

Do you have to pay estimated taxes? If so, how much, when and why? Is there a way to jink out of them?

Backdoor Roth IRA Club

The first rule of Back Door Roth Club… is don’t not talk about Backdoor Roth Club! You might be in Backdoor Roth Club already. Do you know the rules?

Are you Saving Enough?

We all wonder if we’re saving enough or too little, perhaps even too much. How should you think about your savings goals?

In Defense of Paying Taxes

No one likes paying taxes, but is there an upside to getting a tax bill?

Do Fighter Pilots Carry Umbrellas?

Are fighter pilots allowed to carry umbrellas? Maybe there's a case for it...

The Best and Worst Times to Fund an IRA

The IRS tells us when we can and can’t fund an IRA. We have to manage when we will or won’t do it!

How to Fix a Taxable Portfolio

Can you explain why your taxable portfolio looks the way it looks? Would you buy the same things if you were starting over today?

What to Know about Roth Matching

The new SECURE Act 2.0 that passed in late 2022 paved the way for employers to match your 401(k)-type contributions with Roth dollars—here’s what you need to know!

4 – I – 4 – T for 2023

4-I-4-T… Should you put money into the TSP or an IRA or both? What about a taxable account—where does that fit into an investing order of operations?

Retirement Merges to Buy

You've decided to retire, but now the real decisions begin and some of them have some serious dollar signs attached to them!

Do Fighter Pilots Buy CDs?

CDs aren't just for your grandparents. They're paying real interest now. Here's what you need to know...

What to do in 2023

It's 2023. What should you be doing to max-perform your dollars and your life fulfillment?

Why Should you Care About the Survivor Benefit Plan Open Season 2023?

Opting out of the Survivor Benefit Plan is usually a one-way door. Congress has authorized a rare Open Season to get back in. Here's what you need to know...

How to Time the Market

Every choice of when to invest or if to invest is a market timing decision, but we often get stuck on "When is the best time to invest?" Lump Sum and Dollar-Cost Averaging are two techniques that can help.

RMD–Not Just a 4-Letter Word

What goes in, must come out. What are RMDs and how should you think about these Required Minimum Distributions?

Why You Should Care about the Number 204

Personal finance has a lot of key numbers, but 204 is critical this year, because the success of your Roth IRA depends on it!

Where to Stash Your Cash

Where to stash your cash is a perennial problem. Now that interest rates are rising, here's what you need to know to max-perform your cash holdings!

Bucket List Planning for the Young

You have a long time before you "kick the bucket," but how long do you have before you don't own your children's time to make memories for your family? Do you need a bucket list for age 14? Maybe 18?

When is the Best Time for Roth Conversions?

Roth Conversions are mysterious until they're not. They can lower your lifetime tax bill, which is the bill you should be worrying about!

Don’t Close the Backdoor (Roth IRA)

Backdoor Roth season is in full swing. You'll need to maneuver before December 31st, so here's what you need to know about Backdoor Roth IRAs!

Getting Real About College

College costs are brutal, so how can parents think about the college planning process to balance the price tag and the benefits?

Do I have to Wait 5 Years for my Roth IRA?

Roth IRAs are great, but 5 Years is the magic number you need to know to max-perform your dollars and avoid leaving the tax man a tip!

Can Fighter Pilots have 401(k)s?

Saving in the TSP is great, but can you have a 401(k) too? What do fighter pilots need to know about 401(k)s?

Top Financial Lessons from Top Gun: Maverick

Top Gun: Maverick saved your cinematic summer, but what are the Top Financial Lessons from Top Gun: Maverick?

Top 10 Tax Planning Tips for Fighter Pilot Families

Wouldn't it be great to only worry about taxes in April? So sad, but these tips can help you max-perform tax planning before it's trapped at your six!

How Fighter Pilots Save for College

College is expensive, but there are a lot of ways to save for college. Read on to arm yourself with the best tactics!

Cars Steal Wealth

Cars generally sink in value. The current supply chain challenges will abate. When cars depreciate, they steal your wealth!

Top Ten Insurance Mistakes that Fighter Pilots Make

Insurance isn't a fun topic, but you don't want to be over-insured, under-insured, paying too much, paying too little or otherwise saddled with the wrong insurance. Here's the Top Ten Insurance Mistakes to avoid.

Should Rollover Your TSP to an IRA?

The TSP served you well in uniform, but after retirement or separation, you can finally start jockeying the throttles with this part of your retirement savings. But is it a good idea to rollover your TSP to an IRA?

The Top 10 IRA Mistakes Fighter Pilots Make

Everyone makes mistakes, but IRA mistakes might hurt more than most. Here's what you need to know...

Must You Have Goals to be Successful?

Goals seems to be part of financial plans, but do they have to be? Would another approach work better?

Bonds and Your Military Pension

If you have a military pension coming, do you still need bonds?

Should You Own Bonds?

Some might say stocks are like fighter jet—sleek, sexy, and high-performing. Does that make bonds a C-130—generally reliable, workhorse, but maybe not as fun play around with?

The Best ways to Maximize Post 9-11 G.I. Bill Benefits

The Post 9-11 G.I. Bill benefits are amazing--worth hundreds of thousands of dollars, but how do you integrate them with taxes, 529 plans, and wealth-building?

The Problem(s) with Financial Advice

Financial advice is necessary, but where should you get it and how do you know it's in your best interest?

Should You Consider Indexed Universal Life Insurance?

Indexed Universal Life Insurance is heavily sold, often as the solution regardless of the problem. Is it right for you?

Does a Million Dollars Still Matter?

Our society is infatuated with the concept of a millionaire, but does a million dollars really matter anymore?

Bucket Strategies for Fighter Pilots

A Bucket Strategy helps turn your nest egg into retirement income and may be Bear Market Insurance--here's what you need to know...

When is the Best Time to Give?

The best time to give depends on a lot--taxes, fulfillment goals, and competing uses for your assets. What should you consider about giving?

Nickel on the Grass: Fighter Pilots and Life Insurance

When it comes to Life Insurance, it's usually best to have a little too much, starting a little too soon, and kept for a little too long...

Saving versus Investing

It can be difficult to choose saving versus investing. Let's take a look at the differences, similarities and how to choose.

Should Fighter Pilots do Roth Conversions in a Bear Market?

Bear markets aren't just a good sale on stocks, they can amplify the power of Roth Conversions too. Here's what you need to know.

All (still) in Favor, Say Series I Bonds

Series I Bonds are paying now paying an even juicier 9.62%, but is the juice worth the squeeze?

The Net Present Value of a Mom

None of us would be here without Mom. How should we think about her financial value?

The End of the Roth Golden Age

The best years of Roth may end in 2025. Read on to find out what you can do with the time left...

Do I Have to Pay Estimated Taxes?

Uncle Sam knows what I make, why do I have to make estimated payments too?

TSP (almost) Enters the 21st Century

The TSP is finally modernizing. Will it feel like 2022 or 1997?

Taxes and the Sale of Your Rental House

Selling a rental home can bring relief, cash... and taxes! Here's what you need to know...

How Your Taxable Investments are Taxed

Investing is confusing enough, but how can you understand the impact of taxes on your investments?

Helping Parents with Financial Topics

Like it or not, our parents are going to need a wingman to navigate financial complexity, here's your combat brief to get your started...

What to Know About Tax-Loss Harvesting

Tax-loss harvesting is how investors make lemonade out of lemons--here's what you need to know...

How Lieutenants Become Millionaires Part 3

Now Lieutenants know what to do, but WHY? And How?

How Lieutenants Become Millionaires Part 2

Graduating from a 20-year military career with a million-dollar nest egg is well within reach for new officer. Modest savings in the Thrift Savings Plan (TSP) added to the traditional defined benefit pension for 20+ year military retirees can make today’s butter bars into tomorrow’s millionaire next door, but you have to act now!

How Lieutenants Become Millionaires Part 1

Building sufficient wealth isn't the first thing on a young officer's mind, but it can't be the last either.

Numbers to Help You Sleep at Night

When news reports about stock market gloom stress you out, count sheep with these numbers...

Net Worth Statements: The New Year’s Tradition of Fighter Pilots?

A net worth statement is probably the single best gauge of your financial health. Here's what you need to know about net worth...

Which is Better—A Roth or a TSP?

There's no shortage of confusion about Roth versus Traditional... but which is right for you?

Trapped Gas, Runway Behind You, and the TSP

Trapped gas can be catastrophic to your flight--what does it do to your retirement and tax bill?

Shaping a Taxable Portfolio

Can you explain why your taxable portfolio looks the way it looks? Would you buy the same things if you were starting over today?

4 – I – 4 – T Revisited

Does 4 - I - 4 - T still hold up as the best investment Order of Operations?

What to do in 2022

It's 2022. What should you be doing to max-perform your dollars and your life fulfillment?

Roth IRA Tactics in an Ambiguous Fight

The Crystal Ball says the Backdoor Roth IRA may not quite be dead yet. What should you do?

All in Favor, Say “I” (Bonds)

Series I Bonds are paying 7.12%, but is the juice worth the squeeze?

Best Financial Podcasts for Fighter Pilot Money Nerds

Podcasts are a great way to learn to max-perform your money. Check out this list for some hidden gems!

RMD-Yeah, You Know Me…

What goes in, must come out. How should you think about Required Minimum Distributions?

Life Insurance Q & A

Life Insurance-- Boring? Ghoulish? Crucial? Confusing? Yes.

The True Meaning of Festivus

Holidays and family get-togethers create an opportunity to tackle tough financial conversations. Read on to discover how to start the dialogue!

It’s The End of the Year as We Know it, and my IRA Feels Fine…

The end of the calendar year has a stacked to-do list for you, and changes in tax law will keep you on your toes!

How Fighter Pilots Think About Emergency Funds

Emergencies aren't boring, but emergency funds can feel that way. Should you have one?

Top 10 TSP Quirks You Need to Know

Sometimes the TSP is simple. Sometimes not so much. Here's what you need to know in order to max-perform your money and avoid leaving Aunt IRS a tip!

Die With Zero Book Review… Sort Of

If you're getting an inheritance, you might have to wait until you're 60?

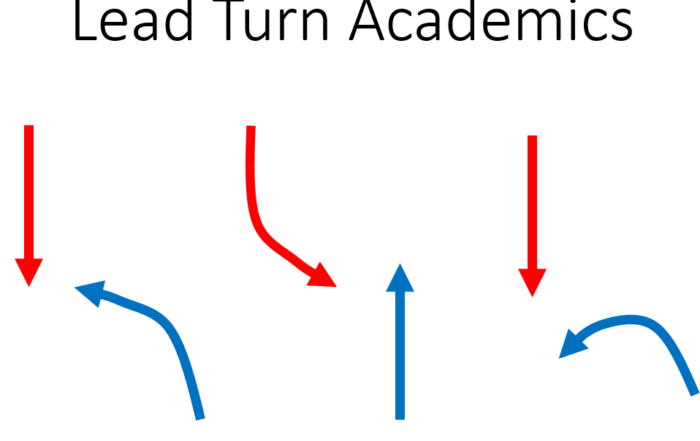

Lead Turns* that Fighter Pilots Take

Why wait for the new year to start winning 2022? Taking financial lead turns today makes tomorrow easier!

Non-Traditional Investments

Investing in dollars is necessary, but not sufficient. To solve for happiness, we need to invest in other ways too.

Basis in your IRA? Try Separating the Jack from the Coke

With the tax year closing, you may still have time to separate basis from an IRA or 401(k) for one last after-tax dollar Roth conversion.

Roth is Dead—Long Live Roth!

Congress has key Roth strategies in it's sights. The Roth IRA isn't quite dead, but some of his friends might be very short-lived.

How Military Families Avoid the “No-Plan Estate Plan”

The No-Plan Game Plan might be good for CT Fridays and your fantasy football league, but it's not good for your estate plan.

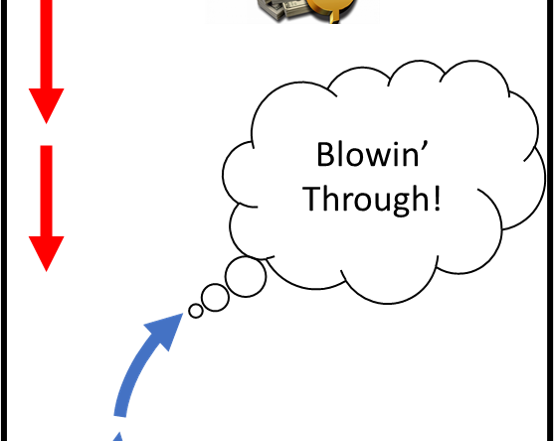

Merges that Fighter Pilots Blow Through

There are so many important topics in the military personal finance world. Which ones are critical? Which merges can you blow through, at least for now?

The Complexity of Conflict

Conflicts of interest are part of every financial relationship. Period dot. How do you recognize and mitigate them?

Roth vs. Charity vs. Tax—Who Wins?

Your Traditional TSP balance is booming, but is that such a great thing? What if you want to convert it to Roth? How will your taxes explode?

Top 10 Ways to Protect Your Financial Life

How do you defend against all of the threats to your financial life? This list is a great start!

The Roth IRA 5-Year Rules

What fun would IRAs be without rules? Read on to learn about the many 5-year rules of Roth IRAs!

Mega-Sized Retirement Savings

If Roth IRAs are good, and Backdoor Roth IRAs can be better, are Mega Backdoor Roth IRAs the best?

Why be a One Percenter When you can be a Four Percenter?

The 4% safe withdrawal rate is a popular number in retirement planning. What is it all about?

Money in the Market or the Mattress?

The market is too high to invest in, right? Wait, how do you know? When do you jump in? All at once, or a little at a time?

Top 10 Mid-Year Tax Planning Tips

Tax planning shouldn't wait until December and April 15th is way too late! What can you do to max perform your taxes before the calendar starts winding down?

Smooth Income, Lumpy Expenses

Budget can be a four-letter word in some homes. Lumpy expenses, those that don't occur in the same amount each month, or happen sporadically throughout the year can wreck the best budget. What if there was a better way?

How Fighter Pilots Pay for Houses

Buying a house can be four dimensional chess. How much should you put down? Should you put anything down? Where should the down payment come from? What are the tax impacts?

Nothing Says Summer like a Custodial Roth IRA!

Summer jobs are great for teaching kids to work hard and save for the future, but the 9-Level lessons come from teaching them about compound returns and 0% income tax rates...

“Left Base, Gear, Stop—What to Think About Before your Fini-Flight”

Retirement sneaks up fast and complex financial issues creep into your life overnight. Here are a few issues and how you might think about them...

How Fighter Pilots Prepare for a Crash

Markets do go down too. What will you do the next time a bear comes to town?

Nickel on the Grass: Fighter Pilots and Life Insurance

Discussions about life insurance can either feel ghoulish or like an impending hard sales pitch, fighter pilots need to know how to do this math.

How Fighter Pilots KISS Part 2

Diversification is good, but how much of a good thing do you need? Can too much diversification harm your portfolio?

How Fighter Pilots KISS

Everything has its place, but do you really need separate accounts all over the place? How many IRA's are enough?

Death, Taxes, and Fighter Pilots: Two of These are Certain

Death and Taxes... who doesn't love a good cliché? But what federal taxes do you really need to know about and what can you do about them?

Old Money

You know how to handle your money, but your parents are starting to need some help. Where do you even start?

The Problem(s) with Financial Advice

Financial advice is usually an informed opinion, but it can be fraught with problems. Chief among the potential pitfalls are the definition of advisor, compensation models, and conflicts of interest.

Car Poverty

New car smell is intoxicating, but it can be toxic to your financial goals...

What’s the Deal with Homeless Fighter Pilots?

Should you rent? Should you buy? How do you know?

TSP: Take it or Leave it?

The TSP has been your retirement workhorse. Should you let it ride or switch to an IRA?

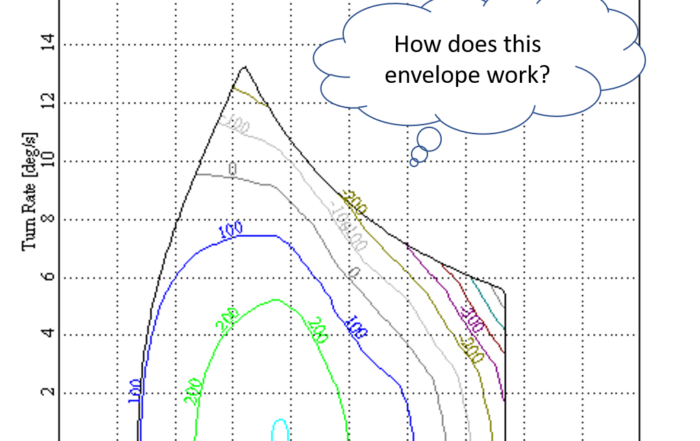

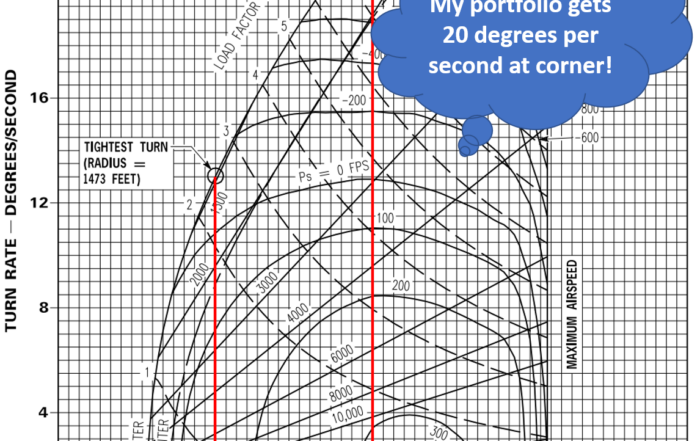

Rate vs. Radius for your Portfolio

Nose position versus energy. Rate versus Radius. Risk versus Return. How do does a fighter pilot makes sense of it all to max perform?

I Know a Fighter Pilot that Carries an Umbrella…

Are fighter pilots allow to carry umbrellas? Maybe there's a case for it...

Does $1 Million Still Matter?

Inflation sneaks up from behind and steals your money, so does $1 Million still matter?

Bond… Not Gold Bond… Part 2

You have a military pension, do you still need bonds?

Roth IRAs and TSP: AMRAAMs for your Retirement?

Roth is usually superior due to low tax cost in the early years, likelihood of a high tax bracket later, insulation against future tax hikes, no tax bill to heirs, and forced high tax bracket floor from Social Security and Military Pension.

Turning Lieutenants into Millionaires? Part 3 (of 3)

Lieutenants, like all military officers, are endowed with the power to lead and potentially end the lives both the enemy and the women and men in their charge. There is no greater power. Born of this power is the responsibility to wield it in good fashion.

Turning Lieutenants into Millionaires? Part 2

Graduating from a 20-year military career with a million-dollar nest egg is well within reach for new officer. Modest savings in the Thrift Savings Plan (TSP) added to the traditional defined benefit pension for 20+ year military retirees can make today’s butter bars into tomorrow’s millionaire next door , but you have to act now!

Turning Lieutenants into Millionaires?

Graduating from a 20-year military career with a million-dollar nest egg is well within reach for new officer. Modest savings in the Thrift Savings Plan (TSP) added to the traditional defined benefit pension for 20+ year military retirees can make today’s butter bars into tomorrow’s millionaire next door , but you have to act now!

Building Wealth by Saving for College?

In addition to walking on water and being uniquely lethal, fighter pilots all have another common trait: a bachelor’s degree. But ask any two fighter pilots about paying for their own kids’ degrees and you might get seven different opinions. This article helps fighter pilots think about unique opportunities that come from saving for college.

Taxes and the Bonus: Food for Fighter Pilot Thought

There’s a saying that trapped gas and runway behind you are two frustrating and useless things. Untouched limits in your TSP and IRA should be on the same list for fighter pilots. Here’s why:

Net Worth Statements for Fighter Pilots

Are you on glidepath? How do you know? Does a credit score matter? Maybe tracking net worth could answer some important questions for you...

Welcome to Winged Wealth Management and Financial Planning

Happy New Year! I’m writing to announce that today I’m officially launching my Financial Planning firm, Winged Wealth Management and Financial Planning LLC.

“Trapped Gas, Runway Behind You, and Unused TSP Limits…”

There’s a saying that trapped gas and runway behind you are two frustrating and useless things. Untouched limits in your TSP and IRA should be on the same list for fighter pilots. Here’s why:

Back-Door Roth IRAs for Fighter Pilots: Ultra-First World Problems

Many pilots with working spouses realize that investing, taxes, and retirement planning get pretty complicated as income approaches $200K. Unfortunately, few take advantage of the Back-Door Roth IRA

4 – I – 4 – T: Where Fighter Pilots Put Their Money

4 – I – 4 – T and this article are about Investment Location. The importance of investment location is inversely proportional to how adroit most of us are at making investment location choices.