For some people, the topic of Roth Matching probably sounds more like Death Marching. But if you like money and the nifty things it can buy such as food and tasty beverages, and you also dislike paying taxes, you might want to read on because this new legislation can both put more money in your pocket and potentially lower your lifetime tax burden.

What is Matching Like Now?

If you put money into the TSP/401(k)/403(b)/457(b) offered by your employer and your employer incentivizes your contributions by contributing matching funds, that’s great news. Your total annual compensation includes this match. Specific to the TSP, service members that joined after 2017 and or switched into the Blended Retirement System (BRS) are eligible for up to a 5% match (potentially tens of thousands of dollars over a career).

Until the SECURE Act 2.0 passed, those matching dollars were pre-tax. Your employer got a tax break at the time of the match, but you got to (actually, you had to) skip paying taxes at the same time on matching dollars. That’s great if you’re in a high tax bracket when you receive the match, but if you’re a participant in the BRS, there’s a good chance you’re not in a high tax bracket. Those pre-tax matching contributions hangout in your account waiting to be taxed later.

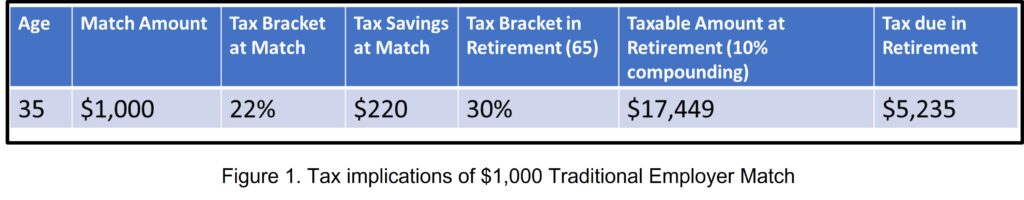

Figure 1 below shows the effect of skipping taxes today in a relatively low 22% tax bracket, letting the matching dollars compound at a notional 10%, then paying tax at 30% (not including a state income tax…) at age 65 when accessing the dollars in retirement. You skip paying $220 today but incur a $5,235 tax bill down the road. A great way to think about this is, “Would you rather pay tax on the seed or the harvest?” If you have any reason to think your tax rate will be higher in the future, the seed is your friend. If you have a crystal ball and know that your tax rate will be the same, paying tax on the harvest is mathematically the same. If your crystal ball tells you that taxes will be lower, pay tax on the harvest and please share your crystal ball with me!

To summarize, until this new law passed, employers always matched in pre-tax dollars. For military members this usually implies a tax time bomb that you can’t diffuse until you leave the military because you can’t do Roth conversions on TSP dollars until you separate from service. Most people don’t even wake up to the issue until their 60’s, so if you’ve read this far, you’re already pulling lead pursuit!

Roth Matching 101

The new rules took effect when the SECURE 2.0 law passed, so they’re in effect now. As is often the case with 11th hour (December) law changes, companies (and governments) will need time to adjust to this new Roth Matching option, so it’s unlikely that your company/Uncle Sam will be knocking down your door about Roth Matching for a few months.

Roth Matching is optional. It remains to be seen if the TSP will offer Roth Matching. If the TSP decides to offer Roth Matching, it’s probably a year or more away given the glacial pace of government bureaucracy. If you work for a civilian employer, it’s never too soon to start lobbying for Roth Matching.

If an employer offers Roth Matching, you’ll likely retain the choice between pre-tax and Roth (after-tax) matching. The employer won’t gain or lose any benefit from offering Roth matching—this is about your tax bill. Your employer probably won’t break down your door to notify you when/if Roth Matching becomes available, so it’ll be up to you to keep your eyes peeled for the chance to opt in.

Roth Matching Pros

The main benefit of Roth Matching is that you build up your arsenal of tax-free retirement dollars faster and potentially at lower tax rates by taking Roth Matching early and at low tax rates (e.g., 22% or 24%). In retirement when your tax bracket could be higher and you might live in a state with income taxes, you’ll skip paying taxes on the harvest, because you already paid tax on the seed.

As second benefit occurs if you have a Solo 401(k) that allows additional after-tax contributions, you could theoretically contribute $66K (under age 50 and in 2023), all in Roth dollars and with minimal account gymnastics—no in-plan conversions or in-service withdrawals in order to perform Roth conversions.

Another benefit is that you don’t have to waste brain bytes wondering, “When should I convert my Traditional (pre-tax) dollars into Roth (dollars)?” for your employer plan. While it may seem like a straightforward math equation, the reality is there are many variables that only get more complex as you age and build wealth. If all your other retirement contributions have been Roth (E.g., Roth IRA, Roth TSP, Roth 401(k)), then Roth Matching eliminates one of the more complex financial planning problems that your future self will anguish about.

Finally, as with all Roth contributions—you get “tax insurance.” Even if you find a year down the road in which you could have converted Traditional dollars into Roth dollars at a lower tax rate, at least you won’t have to spend or convert dollars at a higher tax rate. A Roth dollar today is insurance against a higher tax rate tomorrow.

Roth Matching (potential) Cons

The first pitfall of Roth Matching occurs when you’re near the threshold of the next higher tax bracket. Imagine you’re a dual-income family and getting close to the top of the 22% bracket ($190,750 in 2023). Roth Matching could push you into the next higher tax bracket. With today’s rates, you’d pay 24% instead of 22%, or a 9% higher tax rate on any boost into the next bracket from Roth Matching.

Another challenge awaits our airline crowd. Many airlines pay a flat match, such as 16% (until they get their sweet new contracts…). Imagine a dual income couple where the airline spouse makes $250K with a 16% flat Roth Match and the non-airline spouse makes $100K with a 5% Roth Match. The family is already close to the 32% bracket. If they make Roth 401(k) contributions and receive Roth Matches of $40K and $5K respectively, they’re nearly certain to trip the 32% bracket at $364,200.

While only the earnings over $364,200 take a 32% haircut for Uncle Sam, 32% is still 33% more than 24%. That kind of increase in tax rate is generally not how we lower our lifetime tax bill.

While it’s possible that 32% paid today is a bargain compared to your projected rate in retirement (or when you do Roth conversions), you’ll need to perform those projections to make an informed decision. Don’t forget state income taxes!

Remember that the use case for Roth contributions is “I expect a higher tax rate in the future than I have today,” thus “I’ll pay taxes today to avoid higher taxes later.”

We usually focus on tax rates when discussing additional income, but there is a whole other world of “shadow” taxes that can launch your way when your income increases including:

- Net Investment Income Tax: $250K starting threshold.

- “Front Door” Roth IRA Contribution Limit: $218K starting phaseout.

- Child Tax Credit: $400K starting phaseout.

- Medicare IRMAA Tier 2: $202K cliff.

These are just a few of the pop-up threats that sneak into your tax reality. The numbers are all for married filing jointly couples, but you get the picture… measure at least twice before deciding the tax implications of income like Roth Matching.

A final potential downside comes with the topic of recharacterization. While it remains to be seen what the IRS will say about changing Roth Matching dollars back to Traditional dollars in employer plans, it’s a safe bet that recharacterization won’t be allowed. If you could recharacterize a Roth Matching dollar back to pre-tax prior to filing your taxes, it would impose a hefty burden on both the 401(k) provider and your employer’s payroll system. Companies will be highly allergic to such activity. Thus, you’ll want to be as certain as you can be about choosing Roth Matching versus Traditional Matching.

Cleared to Rejoin

The SECURE Act 2.0 introduced changes that we’ll be feeling in our retirement accounts for decades. Roth Matching could be some serious afterburner for your arsenal of retirement dollars, but it could also boost your tax bill unnecessarily. If your employer offers Roth Matching, make sure you run the numbers to understand if you’re better off paying taxes on the income today rather than waiting until your tax bracket might be lower in a later year. To do otherwise risks leaving Aunt IRS a pretty fat tip!

Fight’s On!

Winged Wealth Management and Financial Planning LLC (WWMFP) is a registered investment advisor offering advisory services in the State of Florida and in other jurisdictions where exempted. Registration does not imply a certain level of skill or training.

This communication is for informational purposes only and is not intended as tax, accounting or legal advice, as an offer or solicitation of an offer to buy or sell, or as an endorsement of any company, security, fund, or other securities or non-securities offering. This communication should not be relied upon as the sole factor in an investment making decision.

Past performance is no indication of future results. Investment in securities involves significant risk and has the potential for partial or complete loss of funds invested. It should not be assumed that any recommendations made will be profitable or equal the performance noted in this publication.

The information herein is provided “AS IS” and without warranties of any kind either express or implied. To the fullest extent permissible pursuant to applicable laws, Winged Wealth Management and Financial Planning (referred to as “WWMFP”) disclaims all warranties, express or implied, including, but not limited to, implied warranties of merchantability, non-infringement, and suitability for a particular purpose.

All opinions and estimates constitute WWMFP’s judgement as of the date of this communication and are subject to change without notice. WWMFP does not warrant that the information will be free from error. The information should not be relied upon for purposes of transacting securities or other investments. Your use of the information is at your sole risk. Under no circumstances shall WWMFP be liable for any direct, indirect, special or consequential damages that result from the use of, or the inability to use, the information provided herein, even if WWMFP or a WWMFP authorized representative has been advised of the possibility of such damages. Information contained herein should not be considered a solicitation to buy, an offer to sell, or a recommendation of any security in any jurisdiction where such offer, solicitation, or recommendation would be unlawful or unauthorized.