Lead Turns* that Fighter Pilots Take

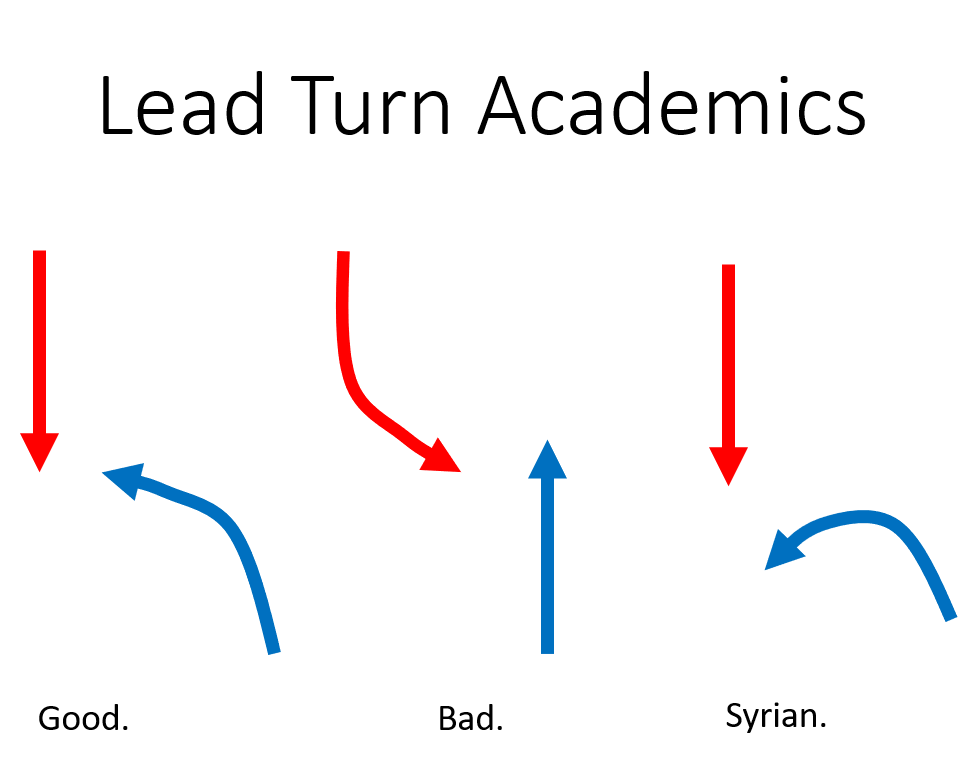

A few weeks back, we took a look at merges you can blow through –financial tools and opportunities that don’t apply to most active duty members. This week, let’s take a look at opportunities that will affect your financial life in 2022, that you can act upon now. (*In fighter jet-speak, a Lead Turn is an attack maneuver where you try to out maneuver your opponent by turning towards him/her prior to passing at a head-on merge.)

Tax Lead Turns

- Buy your tax software early. At the end of one tax year, you might be able to get some angles on the IRS by taking advantage of certain windows that close on December 31st. In order to effectively tax plan, you’ll need some method of making fairly accurate tax projections for the next year. If you use commercial software, waiting until January or February to start pro-forma tax returns could be too late.

- Meet with your tax professional. If you outsource tax preparation, your CPA/EA/Tax Preparer may be a little exhausted until October 15th (the deadline for extensions), but after that, s/he should have time to meet to evaluate opportunities.

- If you’re a hard-core DIY’er, this free MS Excel Spreadsheet is a pretty slick tool. While the 2021 version is still in beta awaiting finalization of IRS rules and forms, you can use this to manually fill out forms and schedules. It’s pretty intuitive and has great instructions.

- Review your 2020 tax return. Tax returns have no shortage of Easter eggs that can help you seize opportunity. Here’s a few to check your return for:

- Line 2b: Taxable interest. Unless you’ve had major changes this year, this number is probably a decent estimate to carry over to the next year.

- Line 3: Same consideration as interest.

- Line 4a: IRA Distributions. If you’ve been using Backdoor Roth IRAs, you should have an amount here.

- Line 7: Capital Gain/(Loss). For many, this is likely the same year to year. If you’ve sold property or securities, it might be different some years. If you’ve sold securities at a loss, this could be a negative number and lower your overall tax bill.

- Line 11: Adjusted Gross Income (AGI). This number bears on many credits and deductions and is a good one to know from year to year.

- Line 12: Standard or Itemized Deductions. Only 10% of taxpayers itemize anymore, but if you’re able, it can lower your tax bill. Diligently tracking charitable giving and medical expenses moves the needle when it comes to itemizing.

- Line 19: Child/Dependent Credit. With the pre-refundable credit for 2021, you may want to pay extra attention to what you’ve received and expect to receive. This will help you estimate any liability or refund headed your way.

- Line 24: This is your bill. It’s also the amount that you need to consider for Safe Harbor to avoid an underpayment penalty.

Knowing what was on last year’s return helps shape expectations and avoid gross errors for this year’s return.

- Capital Loss Carry-Overs. If you’ve had suspended losses from previous years, you’ll want to know what that number is too. Losses offset gains, and on Line 7 as noted above, you can offset up to $3,000 of ordinary income.

- Tax-loss Harvesting. If you’ve been able to sell shares at a loss, not only can you offset gains with those losses, you can use the proceeds from such a sale to reshape your portfolio if needed.

- Adjust Withholding. If you expect to significantly overpay or underpay, there’s no points for delaying changes in your withholding. Many of us wait until tax filing time, but in April, a third of the year with the wrong withholding amount has already passed.

- Pay Estimated Tax. The 4th in the series of estimated tax payments is due January 15th. If cash is tight around the holidays, it might be best to start funding that January 15th payment now.

Investing Lead Turns

- Fill up the TSP. The 2021 limit for TSP contributions is $19,500. Changes submitted to DFAS now are likely to only make it into December 2021’s pay calculations, maybe November if you’re lucky. The TSP doesn’t allow you to write a check or contribute outside of pay allotments, so while the IRS needs the money in the account by December 31st it’s really the DFAS cycle for making pay changes that matters.

- Backdoor Roth IRAs. As previously noted, the Backdoor Roth IRA is expected to go away after 2021. Contributions to a nondeductible Traditional IRA will need to be made, along with the subsequent Roth conversions, prior to December 31st. Realistically, you should target early December because custodians aren’t known for allowing these at the 11th

- IRAs. If you normally lump-sum invest your IRAs each year, it’s worth considering doing so as early as possible in January. Time in the market beats timing the market.

- Adjust Dollar Cost Averaging Contributions. While the IRS hasn’t announced the 2022 IRA/TSP/401(k) limits, most experts expect the IRA limit to remain static and the TSP/401(k) limits to rise significantly. As soon as those limits are announced, you can adjust your pay withholding to start contributing at the new higher rate in January.

- Prepare to Rebalance. Whether you rebalance annually, quarterly, or based on events, it’s never a bad time to plan out rebalancing—perhaps even put it on the calendar.

- Review your Investment Policy Statement. If you have a written plan that explains what investments you maintain and why, this is a great time to make sure the “why” still applies.

General Financial Lead Turns

- Sinking Funds. If you save for infrequent expenses such as Christmas presents, vacations and cars in a sinking fund, why not revalidate the amounts you deposit each month? If January will bring a COLA or other raise, sinking funds are a great place to put a slice.

- Schedule meetings with your financial professionals. Putting events on the calendar tells time where to go instead of having you wonder where it went. Your tax professional is getting ready to surge again, so no time like the present to schedule necessary meetings.

- Review Flexible Spending Account. Assuming you have one (military-only couples, not so much) then it’s just about Open Season for making choices about using an FSA. How much did you use last year? Any risk of forfeited funds this year? Any medical needs that you didn’t us the FSA for?

- Review Key Spending Categories. If you have budget-buster spending categories like clothes, groceries, or entertainment, this is a good time of year to review those and develop a plan to spend inside your lines next year.

Cleared to Rejoin

Our culture likes to wait for January 1st to make improvements on the next year. The reality is that the new year is already making angles on you by then. To win the financial fight, use the time available now, especially before contribution windows close, to take financial lead turns today!

Fight’s On!

Winged Wealth Management and Financial Planning LLC (WWMFP) is a registered investment advisor offering advisory services in the State of Florida and in other jurisdictions where exempted. Registration does not imply a certain level of skill or training.

This communication is for informational purposes only and is not intended as tax, accounting or legal advice, as an offer or solicitation of an offer to buy or sell, or as an endorsement of any company, security, fund, or other securities or non-securities offering. This communication should not be relied upon as the sole factor in an investment making decision.

Past performance is no indication of future results. Investment in securities involves significant risk and has the potential for partial or complete loss of funds invested. It should not be assumed that any recommendations made will be profitable or equal the performance noted in this publication.

The information herein is provided “AS IS” and without warranties of any kind either express or implied. To the fullest extent permissible pursuant to applicable laws, Winged Wealth Management and Financial Planning (referred to as “WWMFP”) disclaims all warranties, express or implied, including, but not limited to, implied warranties of merchantability, non-infringement, and suitability for a particular purpose.

All opinions and estimates constitute WWMFP’s judgement as of the date of this communication and are subject to change without notice. WWMFP does not warrant that the information will be free from error. The information should not be relied upon for purposes of transacting securities or other investments. Your use of the information is at your sole risk. Under no circumstances shall WWMFP be liable for any direct, indirect, special or consequential damages that result from the use of, or the inability to use, the information provided herein, even if WWMFP or a WWMFP authorized representative has been advised of the possibility of such damages. Information contained herein should not be considered a solicitation to buy, an offer to sell, or a recommendation of any security in any jurisdiction where such offer, solicitation, or recommendation would be unlawful or unauthorized.