Top 10 TSP Quirks

The Thrift Savings Plan (TSP) is the largest employer-sponsored plan in the country, but if you’ve ever compared it to your spouse/friend/colleague’s 401(k), you’ve probably noticed that it’s not quite the same as it’s civilian counterparts.

Some of the TSP’s quirks come from the fact that government isn’t known for evolving much faster than the speed of stop. Regardless of the reason, you’ll want to know about some of these issues as you’re likely to keep your TSP account into your 60’s and maybe beyond.

TSP Recap

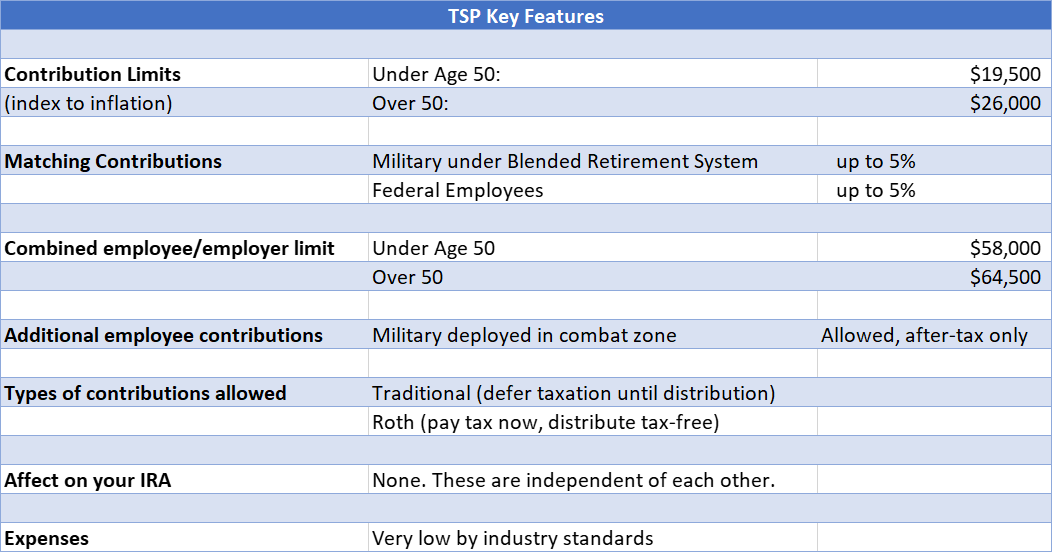

As a quick recap, the TSP is like a 401(k) but for federal employees and military members. It mimics many of the same rules that bound 401(k) and 403(b) plans. This chart shows some of the key features that are good to stay familiar with:

TSP Quirks

While the basics of the TSP feel much like your IRA—put money in, receive favorable tax treatment, use money in retirement… the TSP has quite a few rules that can make you scratch your head if you’re not tracking them ahead of time. Some are very favorable and present a great argument for staying in the TSP to your last breath. Others… not so much!

- Minimum balance: $200 for separated employees. As long as you leave at least $200 in the TSP, you can keep the account open. This is great because you never know when a change in employment or tax law will make it advantageous to roll money into the TSP.

- Accepts rollovers: Except for a Roth IRA dollars, you can roll Traditional IRA, and most other employer plan (e.g., 401(k)) funds into the TSP. This can be great for simplifying your roster of accounts.

- 3 Withdrawal options after separation:

- Installments: The TSP can send you fixed or life-expectancy-based payments in any amount of at least $25. The duration you choose for installments can have side effects. g., if you choose installments for less than 10 years, you can rollover the distributions to your IRA. Over 10 years—you can’t.

- Single withdrawal: The minimum is $1,000 and you can only do one every 30 days due to lethargic TSP processing times.

- Purchase an annuity. While uncommon, some retirees trade all or part of their TSP balance for an immediate annuity. This locks in a fixed stream of payments, but forfeits any right to leave the annuity balance to heirs.

- Roth or Traditional withdrawals: A great feature of the TSP is that you can choose Roth, Traditional or pro-rata withdrawals. If you’re trying to “fill up tax buckets,” this strategy can help.

- If you have contributions to your Traditional TSP from a combat zone, i.e., the contribution is not taxable but the earnings are—then withdrawals from your Traditional balance will always be pro-rata from pre-tax and after-tax dollars. This usually doesn’t result in a large tax benefit because most members don’t contribute large tax-free sums.

- The ability to withdraw or rollover Roth dollars separately is excellent. Moving a Roth TSP balance to a Roth IRA prevents forced Required Minimum Distributions on the Roth balance at age 72—more on this below.

- Processing delays. If you’ve ever tried to change your TSP contributions or asset allocation, you’ve probably noticed a bit of a delay from flash to bang. Alongside the military and civil service human resource bureaucracy delays, the TSP can be pretty glacial in processing withdrawal requests, change requests, beneficiary change requests… basically all requests. You’ll want to take a lead-turn on accessing your funds because it’s not an ATM machine.

- Spouse rights. If you choose to receive your TSP as a separately-purchased annuity, your spouse will need to consent to anything other than a 50% survivorship feature.

- Death Treatment: The TSP has interesting rules surrounding the death of a participant:

- Default beneficiaries are automatically listed as: Spouse, then children/their descendants, then parents, then executor of your estate, then next of kin by state law. You must use form TSP-3 to change this. Your Will, Pre-Nuptial Agreement, nor other legal document will direct the flow of TSP dollars after death. TSP rules supersede those contracts. Keeping your beneficiaries up to date is crucial after family changes such as divorce.

- A spouse that receives your TSP account will find that it’s automatically been invested in an age-determined Lifecycle Fund. A non-spouse beneficiary cannot maintain the TSP account and will need to receive the funds in an Inherited IRA.

- WARNING: If a beneficiary participant dies, the TSP will pay the balance directly to that beneficiary’s beneficiary, potentially creating a “tax bomb.” Here’s an example

-

-

- TSP account owner dies with spouse listed as beneficiary of $500K pre-tax balance, so…

- Spouse receives “beneficiary” account within TSP and lists child as beneficiary, but…

- Spouse dies and TSP pays beneficiary the $500K balance all once, so…

- Child’s tax bracket skyrockets to 35% or more for that year.

-

Therefore, it’s well worth ($175K worth in this example) investigating rolling a TSP beneficiary account to an Inherited IRA. This will allow a successor beneficiary to keep the tax-advantaged status in accordance with current tax law (i.e., probably 10 years to delay withdrawal). To do otherwise may be leaving the tax man a hefty tip.

- The G-Fund. The G-Fund invests in government bonds, but does so in a manner whereby its guaranteed to never lose principal value. You’ll have extreme difficulty finding such a guarantee in a commercial investment. The downside is that the G-Fund is usually the laggard of the 5 core investments. It can make sense as part of a portfolio, but usually isn’t the best for an entire portfolio.

- Withdrawals are pro-rata from all funds. While you can specify that you want to take a withdrawal of only pre-tax or after-tax dollars, you can’t specify that you want to take a distribution from only the G-Fund or C-Fund, etc. If you own all five funds, a withdrawal is pro-rata across them. This prevents a lot of strategies from working well in the TSP, such as:

- Bucket Strategy. If you use “bucket” to delineate near-, mid-, and long-term dollars in retirement, the G-Fund would probably be a major part of the near-term bucket, but every withdrawal will include C-Fund too.

- Buy Low, Sell High. If you’re trying to let your C-Fund recover after a market down turn and want to only take G-Fund dollars… no soup for you.

- Roth RMDs. I mentioned this above, but it bears repeating. A Roth IRA does not have a Required Minimum Distribution (RMD) at age 72. Traditional IRAs, 401(k)s, and the Roth/Traditional TSP all require you to start taking a life-expectancy-based distributions every year starting age 72.

Congress likes RMDs because it finally gets to tax Traditional (pre-tax) dollars and the compounding that occurred over the decades. But an RMD on a Roth account like the TSP only forces you to put those dollars back into circulation (read: expose them to taxes like sales tax or capital gains tax).

Roth RMDs also prevent one of the greatest Roth advantages—passing tax-free wealth to heirs. Thus, proper planning requires at least evaluating movement of Roth TSP dollars into a Roth IRA prior to RMD age.

Cleared to Rejoin

The TSP is inexpensive and pleasantly avoids too much paradox of choice. But it does have some rules that require planning to manage. It may seem fire-and-forget during your accumulation years, but a head-in-the-sand strategy won’t max-perform your dollars after you separate/retire from military or federal service. You’ll want to update your TSP planning every year to make sure your money goes where you want it and you don’t leave the IRS a tip!

Fight’s On!

Winged Wealth Management and Financial Planning LLC (WWMFP) is a registered investment advisor offering advisory services in the State of Florida and in other jurisdictions where exempted. Registration does not imply a certain level of skill or training.

This communication is for informational purposes only and is not intended as tax, accounting or legal advice, as an offer or solicitation of an offer to buy or sell, or as an endorsement of any company, security, fund, or other securities or non-securities offering. This communication should not be relied upon as the sole factor in an investment making decision.

Past performance is no indication of future results. Investment in securities involves significant risk and has the potential for partial or complete loss of funds invested. It should not be assumed that any recommendations made will be profitable or equal the performance noted in this publication.

The information herein is provided “AS IS” and without warranties of any kind either express or implied. To the fullest extent permissible pursuant to applicable laws, Winged Wealth Management and Financial Planning (referred to as “WWMFP”) disclaims all warranties, express or implied, including, but not limited to, implied warranties of merchantability, non-infringement, and suitability for a particular purpose.

All opinions and estimates constitute WWMFP’s judgement as of the date of this communication and are subject to change without notice. WWMFP does not warrant that the information will be free from error. The information should not be relied upon for purposes of transacting securities or other investments. Your use of the information is at your sole risk. Under no circumstances shall WWMFP be liable for any direct, indirect, special or consequential damages that result from the use of, or the inability to use, the information provided herein, even if WWMFP or a WWMFP authorized representative has been advised of the possibility of such damages. Information contained herein should not be considered a solicitation to buy, an offer to sell, or a recommendation of any security in any jurisdiction where such offer, solicitation, or recommendation would be unlawful or unauthorized.