Why You Should Care about the Number 204

You’re forgiven if you don’t have the foggiest notion why the number 204 might matter, but until I fail to meet people every week that should be using Backdoor Roth IRAs, I’ll keep up the crusade about 204. Let’s take a look at the math behind 204.

Roth IRA Math Nuances

I’ve written enough about Backdoor Roth IRAs that I’ll skip the 101 explainer here. Instead, let’s look at some math nuances about Roth IRAs.

Income limits and phaseout range. The first nuance is that if you’re married filing taxes jointly, then as soon as your Modified Adjusted Gross Income (MAGI) reaches $204,000 you’re not eligible to contribute the full annual limit to a Roth IRA, which is $6,000 for folks under age 50 this year. (For singles in 2022, the phaseout range starts at $129,000.) The ability to contribute phases out completely from a MAGI of $204K to $214K. For example:

MAGI = $209K which is 50% into the phaseout range of $204K-$214K, so you may only make 50% of the full $6K contribution, or $3,000.

It’s worth noting that singles filers get a larger $15,000 phaseout range from $129K to $144K but single military officers do still frequently get taxed higher and faster than their married counterparts.

MAGI. Modified adjusted gross income is not a unitary number in tax world. Adjusted Gross Income (AGI) is, as it’s a specific line on the 1040 tax form, but there are several MAGIs including:

- Roth IRA Contribution MAGI = AGI – Taxable Roth Conversions + IRA Deduction + Student Loan Interest Deduction + Tuition and Fees Deduction + Excluded Foreign Earned Income + Housing

- Student Loan Interest Deduction MAGI = AGI not including student loan interest + Excluded Foreign Earned Income + Housing

- Traditional IRA Deduction MAGI = AGI + Student Loan Interest Deduction + Tuition and Fees Deduction + Excluded Foreign Earned Income + Housing

Focusing on the Roth IRA MAGI, for most readers of this article, MAGI = AGI. Military officers that are looking at Roth IRA contributions typically don’t deduct Traditional IRA contributions in the same year as it defeats the purpose of the Roth IRA contribution. Student loans aren’t exceedingly common for this crowd, but higher earning officers are usually phased out of deducting the interest anyway. Finally, if you’re still on active duty and you’re overseas, you’re don’t have foreign earned income, nor do you pay for housing without an allowance from the government. Thus, Roth MAGI usually equals AGI, or maybe AGI minus Roth conversion amounts.

Tax Rate Arbitrage. Recall that the main reason for contributing to a Roth IRA is that you believe your tax rate is lower today than it will be when you consume those dollars in retirement. If you think the tax rate will be the same, then Roth and Traditional IRAs are mathematically equal. If you think the rate will be lower in retirement, Traditional is your friend if you can deduct the contribution (phase out range is $109K to $129K in 2022).

Oops, I Already Contributed to a Roth and my MAGI is Too High…

When people first start to become aware of the need for a Backdoor Roth IRA, it’s usually because they realize that they’ve already over-contributed to a Roth IRA that year. While there’s few ways to untangle this knot, my preferred method is this:

- Call your custodian and remove the current year contributions, plus any earnings, minus any losses. These funds can be placed right into the Backdoor Roth IRA process, but it may just be easiest to have them transferred to your checking account or, if you have one, your taxable brokerage account at the same institution.

- Execute the Backdoor Roth IRA process. As a reminder that looks like:

- Verify that you have no balance in a traditional IRA (for each spouse that’s doing a Backdoor Roth IRA). If you’re not sure, find out. If you have a balance, you’ll need to solve that before moving on.

- If you don’t have a Traditional IRA, open one.

- Contribute up to the annual limit, $6K in 2022, to the Traditional IRA. Leave it in cash rather than investing it in a fund or stock.

- The next day, convert the amount to your Roth IRA (for ease, you’ll usually want your IRAs all at one custodian).

- Tell your tax preparer that you did a Backdoor Roth IRA so s/he can properly input the Form 1099-Rs that you receive in February.

You definitely don’t want to leave contributions in your Roth IRA if you’re in this situation. The IRS imposes a 6% excise tax on contributions left in the account past the tax filing extension date (usually October 15th). What’s more, you’ll pay a 10% penalty tax on the earnings when you pull them out if you’re under age 59.5.

I’m in the Phaseout Range, Should I Contribute to a Roth IRA?

A question that rears its head occasionally is, “I’m in the phaseout range, why not just contribute to my Roth, but only up to the limit?” Let’s assume that you have funds and a desire to contribute the full 2022 limit of $6K, but your MAGI is $207K, so you lose 30% of the $6K contribution capacity.

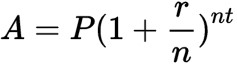

Let’s reference Albert Einstein’s 8th Wonder of the World—Compound Returns:

A = final amount

P = initial principal balance

r = interest rate

n = number of times interest applied per time period

t = number of time periods elapsed

If at age 35, you contribute $6,000 and earn 10% annually then at age 65 you have $104,696. But if you only contributed 70% of $6,000, or $4,200 then you’d end up with $73,287. If you want that extra $30K+, you need to find a way to get the full $6,000 into an IRA.

In fact, you need to get the full amount into a Roth IRA, otherwise you could end up with $104,696 minus say, $30K in taxes if you put the money into a Traditional IRA.

Options in the Phaseout Range

If your MAGI is in the phaseout range but you want to hit the $6,000 annual contribution limit you have these options:

- Contribute the full amount to a Backdoor Roth IRA

- Contribute to both a regular “front door” Roth IRA up to the limit and then to a Backdoor Roth IRA

- Contribute to a front door Roth IRA up to the limit and then leave the remainder in a non-deductible Traditional IRA

- Contribute the money to a taxable account

Assuming you meet the primary Backdoor Roth IRA criteria (no dollars in a Traditional IRA), option 1 is best. It gets the full amount straight into a Roth IRA and you can skip any extra steps, worry, or math.

Option 2 achieves the same effect as option 1, but it could be a lot of steps and you’ll need to be precise in calculating exactly how much you can contribute to the Front door Roth. If you mess that up, you’re back into the baboonery of removing excess contributions.

Option 3 is somewhat of a throw away COA. It fails to maximize the benefit of a Roth IRA and it means that you’ll have a balance in a Traditional IRA that blocks future Backdoor Roth IRA contributions until you clear it out.

Option 4 isn’t inherently bad. Yes, a taxable account has annual tax drag and capital gains tax upon final sale, but capital gains rates are currently lower that ordinary income rates which is what your Traditional IRA dollars will be taxed at. Plus, you don’t have to wait until age 59.5 to access money in a taxable account.

Talk to your financial planner, but you’ll likely find that Backdoor Roth IRA creates the most available dollars to spend in retirement.

Cleared to Rejoin

Roth IRAs are mostly simple—pay tax now, compound, enjoy tax-free income later. They’re devilishly complex when you don’t pay attention to key numbers like $204K. It’s best to estimate your income before the year begins and if in doubt, lean towards the Backdoor Roth IRA since the only real downside is the 5-year conversion “lock-up” period. If worrying about the number 204 isn’t a factor for you this year, heads up, it’s $218K in 2023.

Fight’s On!

Winged Wealth Management and Financial Planning LLC (WWMFP) is a registered investment advisor offering advisory services in the State of Florida and in other jurisdictions where exempted. Registration does not imply a certain level of skill or training.

This communication is for informational purposes only and is not intended as tax, accounting or legal advice, as an offer or solicitation of an offer to buy or sell, or as an endorsement of any company, security, fund, or other securities or non-securities offering. This communication should not be relied upon as the sole factor in an investment making decision.

Past performance is no indication of future results. Investment in securities involves significant risk and has the potential for partial or complete loss of funds invested. It should not be assumed that any recommendations made will be profitable or equal the performance noted in this publication.

The information herein is provided “AS IS” and without warranties of any kind either express or implied. To the fullest extent permissible pursuant to applicable laws, Winged Wealth Management and Financial Planning (referred to as “WWMFP”) disclaims all warranties, express or implied, including, but not limited to, implied warranties of merchantability, non-infringement, and suitability for a particular purpose.

All opinions and estimates constitute WWMFP’s judgement as of the date of this communication and are subject to change without notice. WWMFP does not warrant that the information will be free from error. The information should not be relied upon for purposes of transacting securities or other investments. Your use of the information is at your sole risk. Under no circumstances shall WWMFP be liable for any direct, indirect, special or consequential damages that result from the use of, or the inability to use, the information provided herein, even if WWMFP or a WWMFP authorized representative has been advised of the possibility of such damages. Information contained herein should not be considered a solicitation to buy, an offer to sell, or a recommendation of any security in any jurisdiction where such offer, solicitation, or recommendation would be unlawful or unauthorized.