Saving versus Investing

Every profession loves its syntax and exercising dominance over the proper use of deeply meaningful words. One such argument in personal finance is “Saving versus Investing.” Is there a difference, and if so, should you care?

Saving: A Working Definition

When we’re young and want a certain toy that happens to cost more than we currently possess, our parents (hopefully) taught use to save our money. This both helps us build the discipline of conserving our resources for important purchases and encourages delayed gratification.

When we’re just starting our adult lives, we usually lack some major items that we’ll need—furniture, cars, fancy china that we’ll never use, etc. We can source those items by borrowing. But when borrowing isn’t an option, we have to save money to afford the things we need or want to buy.

Savings implies a near-term need to make a purchase. If we need to buy a couch in the next few months, we’ll save some amount of each paycheck and when we have enough, we go buy the couch. When we need to purchase a car or home, same-same.

Sometimes we don’t know what or when a need to purchase will come along. Enter the contingency fund… Yes, I know it’s usually called an emergency fund, but the reality is that we’re usually not recovering a dual-hydraulic failure fighter jet nor preventing imminent loss of eyesight when we deploy $10,000 for an air conditioner that’s Code 3. That’s a contingency, not an emergency.

Whether we buy a pre-planned couch or a pop-up air conditioner, we’ll need immediately available cash. So, let’s call saving the act of setting aside cash for known and unknown purchases in the near future.

Investing: A Working Definition

When we’re young and don’t want to live in our children’s basements at age 80 due to lack of funds, we generally think about “saving for retirement.” The problem is that cash reliably loses value to inflation. We need a different activity to create the ability to meet our needs when we no longer earn income. That activity is investing.

Investing implies putting money into an activity that we expect will provide positive returns over a period of time. Those returns need to both beat inflation and provide for our long-term goals.

We can invest in myriad activities such as stocks, bonds, real estate, commodities, currencies, etc. But we need to have a reasoned basis for believing that our investment will deliver our needed returns over a given period of time.

Investing is wildly more complex than saving in that we need to choose both an activity to invest in (from nearly unlimited choices), but also a time horizon for the investment (with time spans ranging anywhere from a few hours to our life expectancy).

For definition’s sake, let’s call investing the act of devoting money to an activity that should outpace inflation and provide needed returns for the allotted time period.

Saving versus Investing: Key Differences

From our working definitions, there are two crucial variables: activity and time. When we save, we put money into activities that we expect to have almost no gain, and an almost certain loss to inflation. The range of activities for saving is pretty small:

- Savings Accounts

- Checking Accounts

- Money Market Accounts

- Certificates of Deposit

- Mattresses

The time associated with saving is generally known or estimable:

- “I need to buy a new A/C system before summer.”

- “I need to buy a $30,000 car in 2 years.”

- “I need $100,000 for a down payment in 5 years.”

When we invest, the range of activities is mind-boggling:

- Put Options

- Call Options

- Futures

- Straddles

- Strangles

- Pork bellies

- Stocks (approximately 4,000 publicly-traded U.S. companies, plus about 40,000 from other countries)

- Bonds (even more than stocks)

- Shall I go on?

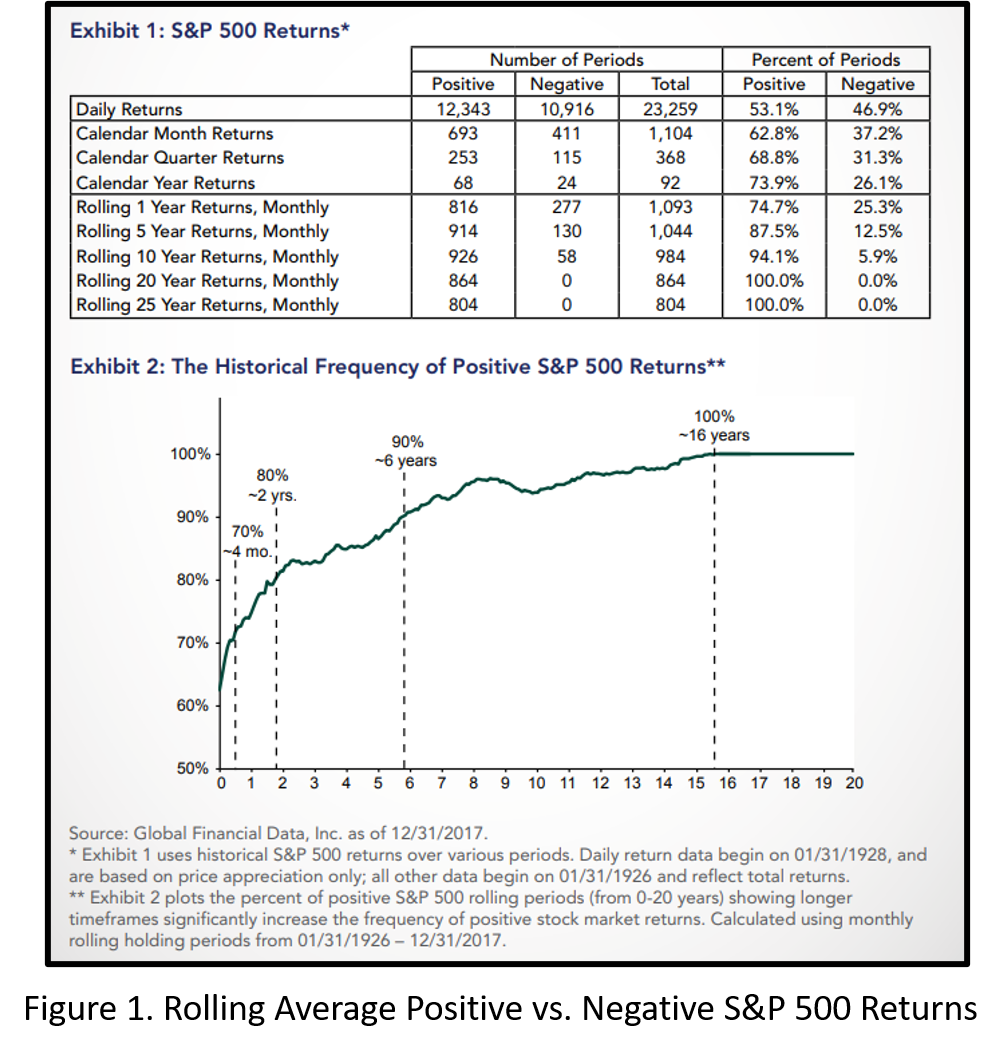

The time associated with investing is where the problem really gets complicated. Figure 1 below, produced by Fisher Investments with data from 1926 through 2017 shows the rolling 1, 5, 10, 20, and 25-year returns of the S&P 500 index. If you’re investing in Pork bellies, this is highly irrelevant. But most readers of this article will have some significant exposure to the U.S. large companies in the S&P 500.

While the stock market is not the economy, (Certainly a 500-company subset of the stock market is very much not the economy!) and the economy is not the stock market, we often see correlation. As such, the S&P 500 is often regarded as a proxy for the general trend of the stock market and often becomes a leading indicator of the economy’s growth or contraction overall.

There are some great take-aways from this chart that help us solve the time variable. If we expect these averages to hold, then it’s reasonable to say things like:

“If my goal is 1 year away, I’ve got a 25.3% chance of not having enough money if I invest in stocks.”

“If my goal is 5 years away, I’ve got an 87.5% chance of not losing money if I invest in stocks.”

“If my goal is 20 years away, I’ve got a 0% chance of losing money if I invest in stocks.”

Clearly, we need to acknowledge that past performance is no guarantee of future performance, but we’re looking for decision support here, not crystal ball-ology.

Now that we have a method to compare the time horizon of our goal with the likelihood of losing money, we can assess our own risk tolerance and risk capacity and make a decision about whether to save or invest in order to achieve our goals.

Recall that risk tolerance is how you feel about the chance of losing money. Does it keep you up at night? Does it cause you to bail out of sound financial strategies?

Risk capacity is your ability to handle the outcome of an adverse event. If the stock market is down when you need your money, do you have other ways to achieve your goals? Can you delay your goals?

Our risk tolerance and risk capacity actually help us solve both the investing activity and time variables. With research or professional help, we can understand the expected volatility of different types of investments. That helps us understand what risk we must tolerate for the expected returns of a given type of investment.

Knowing when we need money to buy a home, fund a year of retirement, or pay a tuition bill helps us understand both whether to save versus invest and how long we likely have to invest in order to manage the risk of losing money.

Cleared to Rejoin

Saving is a short-term activity. It’s a replacement for investing when we can’t tolerate the loss of our money to anything other than inflation. Most families would benefit from planned savings for things that are too large to fit in a single month’s budget like:

- Cars

- House Down Payments

- Major Appliances / Repairs

- Vacations / Travel

- Holiday Gifts

- Contingencies / Deductibles

Investing is more appropriate for categories like:

- College… until the bills cross your personal risk threshold, e.g., 5 years away from each year of college spending.

- House down payments… until the expected funds cross your personal risk threshold, e.g., 5 years away from needing the down payment.

- Retirement… until the need for each year of income crosses your personal risk threshold, e.g., 5 years away from needing each year of income.

- Sense a theme here?

Action steps that you can take today to determine whether to save or invest:

- Talk to your spouse or financial accountability partner about your goals and list them in chronological order

- Evaluate your risk tolerance and capacity, preferably with your financial planner

- If you’re already invested for something you should be saving for, discuss strategies to redefine the goal or convert from investing into saving for that goal.

Fight’s On!

Winged Wealth Management and Financial Planning LLC (WWMFP) is a registered investment advisor offering advisory services in the State of Florida and in other jurisdictions where exempted. Registration does not imply a certain level of skill or training.

This communication is for informational purposes only and is not intended as tax, accounting or legal advice, as an offer or solicitation of an offer to buy or sell, or as an endorsement of any company, security, fund, or other securities or non-securities offering. This communication should not be relied upon as the sole factor in an investment making decision.

Past performance is no indication of future results. Investment in securities involves significant risk and has the potential for partial or complete loss of funds invested. It should not be assumed that any recommendations made will be profitable or equal the performance noted in this publication.

The information herein is provided “AS IS” and without warranties of any kind either express or implied. To the fullest extent permissible pursuant to applicable laws, Winged Wealth Management and Financial Planning (referred to as “WWMFP”) disclaims all warranties, express or implied, including, but not limited to, implied warranties of merchantability, non-infringement, and suitability for a particular purpose.

All opinions and estimates constitute WWMFP’s judgement as of the date of this communication and are subject to change without notice. WWMFP does not warrant that the information will be free from error. The information should not be relied upon for purposes of transacting securities or other investments. Your use of the information is at your sole risk. Under no circumstances shall WWMFP be liable for any direct, indirect, special or consequential damages that result from the use of, or the inability to use, the information provided herein, even if WWMFP or a WWMFP authorized representative has been advised of the possibility of such damages. Information contained herein should not be considered a solicitation to buy, an offer to sell, or a recommendation of any security in any jurisdiction where such offer, solicitation, or recommendation would be unlawful or unauthorized.