There are 5 pillars to investment success:

- Investment Location: E.g., Roth IRA, Traditional TSP or a Taxable Brokerage Account.

- Investment Allocation: E.g. Diversifying between types of stocks, bonds, real estate, etc.

- Investment Cost: E.g. Advisor fees, commissions, fund expenses, etc.

- Investment Taxes: E.g. Capital Gains paid annually, Ordinary Income Tax Rates on Bond Income, etc.

- Investor Behavior: E.g. Dollar-cost-averaging through market swings or selling at the bottom, etc.

4 – I – 4 – T and this article are about Investment Location. The importance of investment location is inversely proportional to how adroit most of us are at making investment location choices. Fighter pilots have a PhD in lethality, not investing. Rules of thumb form the foundation for many tactics. They give us a place from which to deviate so we don’t have to crush the atom every time we stand at the mission planning table. Think of 4 – I – 4 – T the same way.

4 – I – 4 – T is an Order of Operations for investment location for fighter pilots. Remember PEMDAS from elementary math? Me neither, but Google says the right order of operations for math is Parenthesis, Exponents, Multiplication, Division, Addition then Subtraction. 4 – I – 4 – T is, thankfully shorter.

The idea behind 4 – I – 4 – T is to maximize the use of tax-advantaged investment locations before using less advantageous locations. Here’s how it works:

- 4 = 401(k) or TSP[1]: Invest your first retirement dollars in the TSP up to the match. For BRS participants, this means a minimum of 5% of basic pay. Anything less and you’re letting Uncle Sam keep free cash. He will not extend you the same courtesy. For now, if you can invest more than 5%, don’t put it into the TSP.

- I = IRA: After securing the TSP match, put your next investment dollars into an IRA for you and your spouse if you have one. In 2020, you can contribute $6K for each of you.

- 4 = (still) 401(k) or TSP: If you still have money available to invest for retirement, come back to the TSP and contribute up to the lower of your available dollars or the annual maximum, $19.5 in 2020.[2]

- T = Taxable Brokerage: Now that you’ve exhausted the Tax-Advantaged Account (TAA) limits, any remaining retirement investment dollars should be located in a taxable brokerage account, ideally in tax-efficient investments that align with your Investment Policy Statement.[3]

That’s the basics of 4 – I – 4 – T, but just like we want to understand how to calculate MAR vs various threat missiles, it’s useful to explore the assumptions of 4 – I – 4 – T.

First, investment location really matters. When you’re starting out and can barely invest $100 per month, it may not seem like it matters much. But it’s never very long before you’re a silverback and making enough to max out the TSP and two IRAs with dough left over for a taxable account. The current pilot bonus all but guarantees it. The annual TSP and IRA limits ($19.5K/$6K in 2020) are a once-in-a-lifetime opportunity. Once that tax year is gone, you can never go back and reclaim that tax-advantaged opportunity. If you only save $10K in 2020, but could have saved at the combined limits for a married couple ($31.5K in 2020), you’ll never again get the same tax advantages investing the remaining $21.5K – you’ll have to put that money in a less tax-advantaged location. In your 40’s and 50’s, that’s going to hurt. See my article on Trapped Gas for more information on that. (future hyperlink)

The First “4”. Silverbacks typically won’t start with the TSP when using 4 – I – 4 – T because they didn’t switch to the BRS and therefore get no match.

- The TSP is superb for its low investment costs (Pillar 3), but for Pillar 2, investment allocation, it’s more limited with only 5 fund choices. I’m not an advocate of building ultra-complex portfolios, but many investors would do well to add a few more funds than the TSP offers.

- Another disadvantage of the TSP, is that with both Roth and Traditional contributions, you have to start taking required minimum distributions (RMDs) at age 72. While the same is true of Traditional IRAs, Roth IRAs do not have RMDs. For those fighter pilots planning on building wealth (you’re reading this article instead of 3-1 after all…), RMDs can really increase your future tax bill. After retirement or separation, you can move TSP money to an IRA, even a Roth IRA, but there may be tax consequences.

The “I”. IRAs can be opened at any number of brokerages such as Vanguard, Fidelity, Charles Schwab, etc. IRAs contributions can be pre-tax (Traditional) or after-tax (Roth)- and that choice is critical but too in-depth for this article. The limits on IRA contributions go up every few years with inflation. IRAs can be self-managed or you can use an advisor or “robo-advisor” to optimize allocation, costs, taxation, and even behavior. Why fill up the IRA limits before the TSP?

- Choice. Most brokerages offer vastly greater investment options. This is the primary reason why I don’t fill up the TSP first. The TSP offers 5 excellent fund choices, but there are entire asset classes that I want in my portfolio that the TSP doesn’t offer- specifically Real Estate and International Bonds.

- Assuming you open your IRA(s) with a low-cost brokerage, then the expenses you’ll pay will be on par with the TSP.

- Simplicity. For those allergic to overpaying taxes (read: everyone), a sizeable Roth IRA balance in retirement will be a key wealth management strategy. Putting money directly into a Roth IRA as it’s earned simplifies your financial life. You’ll never have to perform the financial and administrative gymnastics to move TSP money into a Roth IRA while wondering if you owe a tax bill.

- The Back Door… The simplicity argument dries up as your income goes up. If you have a working spouse, or your income is over $206K (in 2020), you can’t invest directly into a Roth IRA. You have to do a penalty lap in a non-deductible traditional IRA (one day will do) (hyperlink to Backdoor Roth article). This is called a Back-Door Roth IRA. It is 100% legal, but it is also an administrative hoop that you have to jump through to build your wealth.

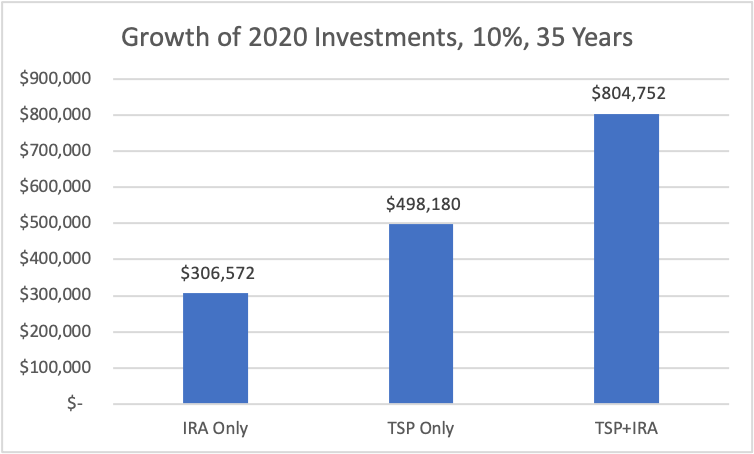

Back to the “4”. While there is no change to TSP/401(k) in its 3rd seed in the investment location lineup, it’s now time to try to fill it up. TSP contribution limits are much higher than IRA limits, even with over-age-50 catch-up contributions ($1K extra for IRAs, $6K extra for TSP/401(k)). If you’re planning to build wealth, this is your afterburner. If you’re following 4 – I – 4 – T, then you’ve already put away at least $12K for retirement. Putting as much as another $19.5K away for 35 years at 10% dumps a lot of gas into your future wealth afterburner.

Figure 1. Note that this chart assumes a hypothtical return of 10% and is not tied to any specific security. Past performance is no guarantee of future returns. All investments carry significant risk and all investment decisions of an individual remain the specific responsibility of that individual.

From Figure 1 above, you can see that maxing out both results in 2.6 times the compounded growth of the IRAs alone.[4] While the TSP has limited investment choices, that is no reason not to use it for the mach it can put into your wealth trajectory.

The “T”. Many of us have money in a taxable brokerage account. At some point, probably most of us will. For retirement savings, only put money in a taxable brokerage account after using Tax Advantaged Account opportunities. To do otherwise invariably overpays the IRS. When you invest in a taxable brokerage account, you need to manage the following issues:

- Each year, as your investments pay dividends (stocks and mutual funds), you’ll pay either capital gains tax (15% for most of us) or ordinary income tax (22-24% for most of us) on those earnings. You paid tax when you earned the money, now your pay tax on the money your money earns.

- If your taxable brokerage account holds bonds or Real Estate Investment Trusts (REITs), you’ll pay ordinary income tax (22-24% for most of us) on that income each year.

- When you, your advisor, or even the fund manager sells assets throughout the year, you’ll pay either capital gain or ordinary income tax on any gains from sales.

- When you finally retire and need to start living off your nest egg, you’ll again pay capital gain or, potentially, ordinary income tax on what you sell in order to fund retirement needs.

- Rebalancing– assuming you plan to periodically rebalance your investment allocation, you’ll often have to sell assets at a taxable gain to do so. Ugh- more taxes!

- The Bright Side- while tax-loss harvesting is beyond the scope of this article, it suffices to say that this technique for tactically incurring periodic investment losses in order to offset taxable gains is only available in a taxable account. If you do have a taxable brokerage account, keeping an eye on tax-loss harvesting opportunities is critical.

There’s a not-so-subtle difference in the descriptions of “4 – I – 4” and “T”. With “T” you pay tax when you earn the initial dollars, then pay each year as your investment tries to grow, then pay again when you finally need the dollars to pay your golf club dues. Putting retirement dollars in a taxable account before you reach the annual TSP/IRA limits is voluntarily over-paying your tax bill. Personal choice to be sure, but one to be very clear-eyed about…

What if you do max out your TSP & IRA- is there any way to avoid getting slammed on taxes? Absolutely, but I’ll save those for another article. The Cliff’s Notes version is that you can invest in a taxable brokerage account with tax-efficient investments such as Exchange Traded Funds, Index Funds, certain types of stocks, and even municipal bonds. You’ll still pay taxes, but they can be suppressed.

4 – I – 4 – T is efficient, simple and executable for retirement accounts. However, I’m invariably asked some follow-up questions. Each of these deserves more discussion, but here’s a quick-n-dirty:

- What about College Savings? 4 – I – 4 – T is for retirement investing. If you want to invest in say, a 529 plan for junior’s college, those dollars are invested after covering down on retirement. The order of operations for college saving is even simpler and for most people will be: “529 – T or S”, where “S” is a savings account that you might use for tangential education expenses that might be disallowed for a 529 and “T” is a taxable brokerage account that you might use as a hedge against over-saving in a 529 or junior skipping college.

- What about Life Insurance? Cash Value life insurance such as Whole/Variable/Universal is a generally expensive way to get insurance. It’s a universally lousy way to earn investment returns. It’s a fine way to get your insurance salesman’s kids through college. More on this topic here (insert hyperlink).

- What about Real Estate? Real Estate is an excellent way to get after Pillar #2- investment allocation. It’s generally less correlated with stocks and bonds and helps diversify a portfolio. It can generate income (at ordinary income tax rates) and sometimes tax-free capital gains. It’s also an immense amount of work. There’s no way to cover all of the considerations for real estate in a retirement investment plan, but I would start with a sound reasoning for what percentage of your portfolio you’d like real estate to represent.

- What about my Military Pension? I personally believe in investing as though I would get no pension, then let the pension be a nice tailwind to your retirement flight path. A lot can happen to eliminate your opportunity for a military pension.

- $31.5K- Seriously? I’m struggling to save $6K for one IRA now! But you also just got this far into an article about building retirement wealth. Stay the course. The best time to plant a tree was 20 years ago, the second-best time is today. Step one for getting more of your income into retirement investments is to design and execute a budget, unique to each month, and pay yourself first (e.g., 15% into retirement investing). Every month is unique for expenses and often income. Budget for each month and keep at it. I personally use Excel for designing each month, and Mint.com for tracking my budget execution. I find it to be a needed, but sobering reality check on how I spend and save.

- This isn’t how my Financial Advisor does it– what gives? This is a worthy discussion to have with your advisor. Many advisors are compensated by a percentage of the assets they directly manage. They cannot directly manage your TSP (and probably not your 401(k)). They may have an incentive to get you loading up your IRA and Taxable Brokerage accounts because they earn from those accounts. If the bulk of your money is in the TSP, you’re less lucrative to many advisors. I recommend being crystal clear on how your advisor is compensated and make sure you revisit the topic frequently to keep an eye on conflicts of interest. Those conflicts exist in every Financial Advisor relationship, but you should stay keen to manage them.

4 – I – 4 – T is a superb way to organize your retirement investing locations. Combined with sound Roth vs. Traditional choices, it helps you optimize your tax bill both this year and over the decades that you will spend investing and then living off of your investments. If you don’t currently have a competing method for organizing your investment dollars. Give it a try. As the saying goes, “If you aim at nothing, you’ll hit it every time.” 4 – I – 4 – T is a great way to take aim at wealth and life-long tax reductions.

[1] In most respects the TSP is functionally identical to a civilian 401k, and T-I-T-T was a more problematic mnemonic.

[2] If deployed while contributing, the limit is substantially higher!

[3] See my Article on Investment Policy Statements for Fighter Pilots (future hyperlink) for more information.

[4] Assumptions: 10% nominal return, 35 years, no additional investments or withdrawals. IRA only = $12K initial investment. TSP Only = $19.5K initial investment.

Winged Wealth Management and Financial Planning LLC (WWMFP) is a registered investment advisor offering advisory services in the State of Florida and in other jurisdictions where exempted. Registration does not imply a certain level of skill or training.

This communication is for informational purposes only and is not intended as tax, accounting or legal advice, as an offer or solicitation of an offer to buy or sell, or as an endorsement of any company, security, fund, or other securities or non-securities offering. This communication should not be relied upon as the sole factor in an investment making decision.

Past performance is no indication of future results. Investment in securities involves significant risk and has the potential for partial or complete loss of funds invested. It should not be assumed that any recommendations made will be profitable or equal the performance noted in this publication.

The information herein is provided “AS IS” and without warranties of any kind either express or implied. To the fullest extent permissible pursuant to applicable laws, Winged Wealth Management and Financial Planning (referred to as “WWMFP”) disclaims all warranties, express or implied, including, but not limited to, implied warranties of merchantability, non-infringement, and suitability for a particular purpose.

All opinions and estimates constitute WWMFP’s judgement as of the date of this communication and are subject to change without notice. WWMFP does not warrant that the information will be free from error. The information should not be relied upon for purposes of transacting securities or other investments. Your use of the information is at your sole risk. Under no circumstances shall WWMFP be liable for any direct, indirect, special or consequential damages that result from the use of, or the inability to use, the information provided herein, even if WWMFP or a WWMFP authorized representative has been advised of the possibility of such damages. Information contained herein should not be considered a solicitation to buy, an offer to sell, or a recommendation of any security in any jurisdiction where such offer, solicitation, or recommendation would be unlawful or unauthorized.