How Lieutenants Become Millionaires, Part 2

The Five Pillars of Investing

In Part 1 of this series, we examined the most crucial element of investing: time. You have to spend time in the market. Conversely, we intentionally made no mention of timing the market. Compounding returns over the decades are the driver of your future million-dollar-plus nest egg, but you have to start investing as soon as possible… but how to invest?

Unfortunately, our conspicuous-consumption society coupled with non-stop financial infotainment on TV and the internet clouds the topic of investing. What’s worse is that millennia of evolution have trained us to seek and enjoy immediate gratification. When mixed with investing, these cable-talking-head-infused appetites for investment returns combined with our natural desire to get more returns today can result in self-defeating investing behavior. You’re reading this article, which indicates you’re on the right path to self-regulating into better investment behavior. Here’s how to go about it.

There are 5 Pillars to Investing—They continuously interact.

- Investment location. To avoid overpaying the tax man, you generally want to take advantage of tax-advantaged investment accounts such as the Thrift Savings Plan and an IRA (individual retirement arrangement) before investing in a taxable brokerage account.

- Investment allocation. Simply put: don’t place all your eggs in one basket. Invest in a sound mix of stocks, bonds, real estate (usually inside of passive index mutual funds) and potentially other assets. Develop a decades-long mix and stick with it.

- Investment cost. Investing costs money. Custodians have employees to pay and regulatory costs to bear, but research continually proves that paying managers to actively select assets to buy and sell causes investors to under-perform market indexes. Passively-managed index funds assure you the return of the market (minus comparatively-tiny fund expenses) and deliver pretty much zero chance of under-performing the market. Those are good odds as long as you believe that the market will continue to be positive over the decades. Buying and selling investments generates both trading costs and potential taxation. Investors need to keep costs down to keep real returns up.

- Investment taxes. Death and taxes- you’ve heard it before. S. tax law demands that you pay legal and required tax on money you (and your money) earn. There is no requirement to leave a tip, but many investors do so by failing to incorporate taxation into investment planning.

- Investor behavior. If there is one to rule them all, this is it. Too many investors buy high and sell low due to the very real emotions we experience as the financial infotainment talking heads try to spike our emotions and their advertising revenue. As we learned in Part 1, investors need the Time Value of Money on their side over the decades to build wealth and earn a dignified standard of living in retirement. A lieutenant that chooses a diversified, tax-efficient portfolio and leaves it alone (except for monthly additions) for the decades is likely to drastically outperform peers insisting on trendy financial maneuvers.

This article can’t tell you everything you need to know about investing, but it can get you out of the chocks.

Investment Location for Lieutenants

My typical recommendation for military investors is called “4-I-4-T.” This mnemonic is the most tax-efficient retirement investment location strategy for most military investors. Here’s what it means:

“4”: Your first retirement investment dollars should go into your 401(k), 403(b), or TSP up to the employer match. For military members investing in the TSP, that means you need to put 5% into the TSP so that you don’t walk away from the 5% matching funds that Uncle Sam wants to pay you.

“I”: If you have more money to invest after putting 5% of your basic pay into the TSP, your next retirement investment dollars should go into an IRA. I’ll leave the discussion of Roth vs. Traditional for another article. An IRA with a low-cost brokerage like Vanguard, Fidelity, or Schwab will give you more investment options than the TSP, often with comparably low investment costs. Invest up to the annual limit if you can, $6,000 in 2021. Even if your spouse doesn’t work outside the home, you can still invest another $6,000 for him/her.

“4”: If you still have more retirement investment dollars after putting 5% of basic pay into the TSP and fully funding an IRA (and potentially spousal IRA), then go back to the TSP and try to max it out- a total of $19,500 in 2021.

“T”: Finally, if you still have retirement dollars to invest, a “T”axable brokerage account is usually your last choice. It’s imperative to invest tax-efficiently in a taxable account. Such strategies include:

- Don’t put bonds in a taxable account. Their coupon payments are taxed at your higher ordinary income rate, e.g. 22% vs. the 0% or 15% that stock dividends and gains are (usually) taxed at.

- If you’re already in a very high tax bracket (32% +), you’re probably married to a Kardashian or some such… but you could consider municipal bonds. They are free of federal tax, but may be taxed by some states.

- Exchange Traded Funds (ETFs) are generally very tax-efficient and will reduce the tax burden of a taxable account.

- Zero-Dividend growth stocks from companies like Amazon.com will not cause annual taxation assuming that you never sell any (for a gain) and the company doesn’t choose to start paying a dividend. However, its price has to continue to appreciate for as long as you hold it, so how’s your crystal ball? (Mine’s Code 3)

Given that you’re a lieutenant, this is good information to know, but you’re probably not making enough to get past the first “4” yet. It may be best to just ensure you’re putting 5% into the TSP so that you don’t leave a tip for the U.S. Treasury.

Investment Allocation for Lieutenants

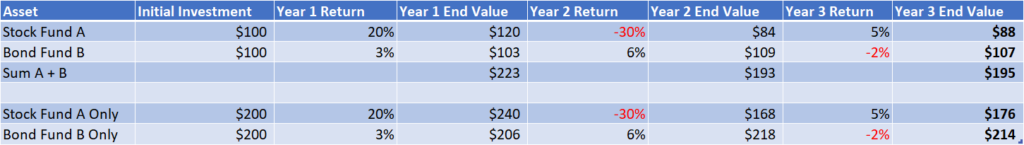

Investment allocation means diversify your investments—don’t put all of your eggs in one basket. Here’s a quick primer: Ideally, you’d like to invest in assets that are not very correlated. For example, in Figure 1 below, we can see the returns of two hypothetical mutual funds, Stock A and Bond B. Because their returns are not correlated—they don’t move in relation to each other, we can get a benefit from investing some money in each.

Figure 1. Hypothetical Uncorrelated Assets

From Figure 1, we can see that after 3 years, an investment portfolio that started at 50% Stock Fund A and Bond Fund B, we end up with $195, which is 2.5% lower than the $200 we started with, but it survived Year 2 when the stock fund was down 30%, partially because the bond fund was up 6% that year. If we invested all $200 in Stock Fund A, we’d only have $176 at the end of year 3, so Bond Fund B prevented an 11% worse return. Now, if we had invested all our money in Bond Fund B, we’d have $214 after 3 years, but inflation will generally devour a 100% bond portfolio over longer periods, so we still need to spread our eggs into other baskets.

Investment Allocation is all about developing a sound mix of assets for the decades, not the day trading, and then sticking with it for the decades with periodic rebalancing (selling and buying to return to the desired allocation percentages). The TSP’s Lifecycle Funds are an excellent method for many investors to achieve sound asset allocation with automatic rebalancing. Asset allocation is a decision you may want to discuss with a professional and your installation’s Personal Financial Counselor is a great (and free!) place to start.

Investment Cost for Lieutenants

If something is free, you’re the product. See the internet if you doubt this axiom. Investments are your desired product and they’re not free. Here are common investment costs.

- Mutual Fund Expenses. Mutual funds have various costs starting with an expense ratio which is typically expressed as a percentage or as basis points (bps), e.g. 1% or 10 bps. A mutual fund with $100,000,000 in assets that charges .1% per year shaves $100,000 out of the fund to cover expenses such a record-keeping, and manager costs. The TSP has very low expense ratios as do many other index funds from low-cost brokerages such as Vanguard, Fidelity, and Schwab. Most index funds are comfortably under .5% and you should have a strong case for investing an index fund with an expense ratio over 1%. Mutual funds can also have sales charges (called loads) at either purchase or redemption, and 12b-1 fees which are additional sales and marketing fees. As investors have become more cost conscious, 12b-1 fees have disappeared from many low-cost index funds.

- A commission is a sales charge to a broker for helping effect a trade. Depending on your brokerage, you may pay a flat fee or even a percentage. For mutual fund, and sometimes even stock purchases, many brokerages will forgo a commission for online trades, especially within retirement accounts.

- Advisor / Manager Fees. Not everyone feels comfortable choosing, buying, (potentially) selling, rebalancing, and monitoring their investments. An advisor (or robo-advisor such as Betterment or Wealthfront) can help, but it’s worth shopping around to see what you get for your money. Human investment managers usually charge around 1% of your portfolio. Robo-advisors typically cost less than half that.

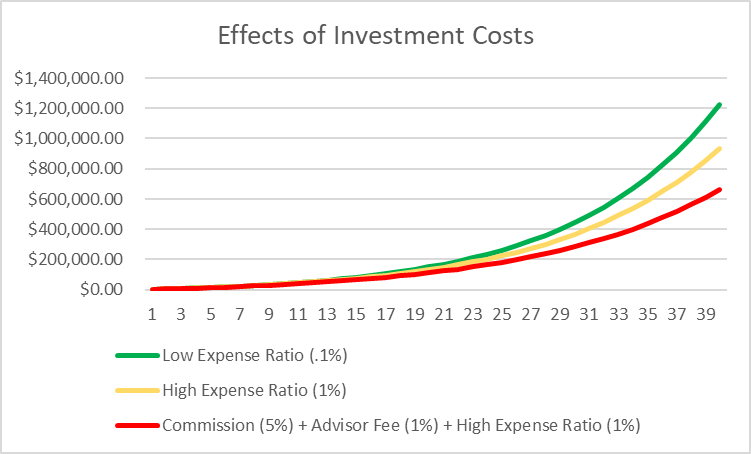

Costs matter. Figure 2 shows the difference over 40 years (a working life time) of various investment costs. The baseline assumption is that you put $200 into a hypothetical mutual fund that earns a compounded annual growth rate of 10%. The green line shows the results of a modest .1% expense ratio- you end up with $1,226,957. The yellow line assumes a more expensive 1% expense ratio it costs $290,693. Ouch. The red line shows the effect of a 1% expense ratio, a 5% commission on each purchase, and a 1% advisor fee which costs $563,666. The moral of the story- investment costs matter and the wealthy get that way by paying attention to them.

Figure 2. Effects of Investment Costs on a Hypothetical Set of Investments

Investment Taxes for Lieutenants

The “4-I-4-T” order of operations discussed above should optimize retirement investing for most young officers, and unless you have additional sources of income, you’re probably not going to need to put money into a taxable account for a number of years, but let’s take a look at the various taxes that could come into play when you start investing beyond the TSP and an IRA.

Capital Gains. When you sell an asset, such as shares of Apple stock, for more than you paid for it, Uncle Sam (and potentially your state) levies a tax. There are two types of capital gains taxes, Long-term and Short-term. Long-term, charged when you hold the asset for longer than one year, is preferrable because the rate you pay is usually lower and it’s tied to your adjusted gross income (AGI). Short-term capital gains tax affects an investment held for a year or less and they’re charged at your marginal income tax rate.

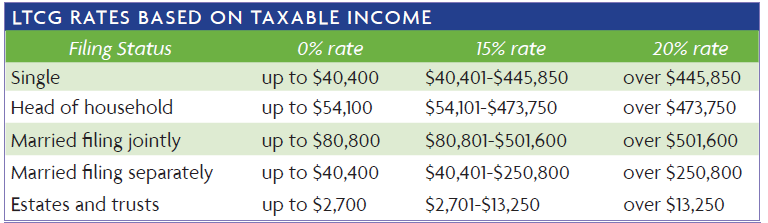

Figure 3. Long-Term Capital Gains Tax Rates in 2021

A key take-away from Figure 3. for Lieutenants, single and married, is that if you have capital gains, your low income keeps your investment taxes low. For example, in 2021 a single O-2 with 3 years earns just over $60,000 in taxable base pay (BAH and BAS are not taxable, flight pay is.). After a standard deduction of $12,400, the Lieutenant will still pay 15% on any Long-Term gains and 22% on any Short-Term gains. A married O-2 fares much better with the same income because the Long-Term rate drops to 0% and the Short-Term rate is only 12%.

But wait, Warren Buffet said the best time to sell investments is “never,” so why would a Lieutenant pay any capital gains tax? You probably shouldn’t. However, if you’ve invested any money into a taxable mutual fund, there’s a good chance that the fund will sell assets throughout the year and pass capital gains to you. Let’s put that on the list of first world problems, but Lieutenants can generally avoid this issue with 4-I-4-T.

Dividends. When a stock pays a dividend, whether through direct ownership or a mutual fund, you’ll be taxed on this source of earnings too. Dividends receive preferable Long-Term Capital Gains rates if they are qualified and for buy-and-hold investors, most dividends will be qualified. Non-qualified dividends are tax like Short-Term Capital Gains- at your top individual tax rate. The lever you can pull is usually the holding period of the investment. Day traders beware.

Net Investment Income Tax (NIIT). The final tax related to investments is the 3.8% NIIT. This is triggered at fairly high income levels and shouldn’t be a factor for lieutenants. Frankly if you’re a lieutenant paying the NIIT, congratulations on your outsized income, but I’ll hold shots on a deeper explanation of the NIIT for now.

Investment taxes could be a factor for lieutenants, but following 4-I-4-T will make sure that you don’t have to worry about taxes on your investments for a few more years until you’ve maxed out your TSP and IRA opportunities.

Investment Behavior for Lieutenants

There is an entire field of study called Behavioral Finance. It exists because the MK-1 human is widely renowned for irrational investment behavior. Rather than explore that whole space, the following are the critical behaviors to exhibit and avoid.

- Ignore financial infotainment. There is nothing but short-term thinking and investment regret down that path.

- Start today. Time value of money is on your side and the sooner you start retirement investing, the sooner your have options in life. Put hard things like investing on auto-pilot by having deductions taken directly from your paycheck.

- Time in the market beats timing the market. If you think the market is high now, wait until you see it 20 years from now. If you think it’s low and might fall more, beware that missing the best days in the market while sitting on the sidelines costs hundreds of thousands over and investing lifetime.[1]

- Develop an investment policy statement that describes:

- What you’ll invest in and why.

- How much you’ll invest and when.

- Triggers for selling or buying more and why (e.g., Tax-Loss Harvesting).

- Triggers for rebalancing.

- If #4 is a heavy lift, target-date retirement funds are great place to start for your retirement dollars. Again- a good discussion with your installation’s Personal Financial Counselor will help.

- Live on less than you make so you can pay yourself (with investment contributions) first. Don’t get caught up hyper-consumption just because others around you are doing it.

There’s a little secret about the 5 Pillars of investing- they aren’t just for lieutenants. It just happens that lieutenants have the most to gain from them, because they have the most time. In fact, a dollar invested at age 22, could be worth $74 on day one of retirement down the road.[2] To reap that benefit, lieutenants have to be wise about the 5 Pillars: Investment Location, Allocation, Cost, Taxes, and Behavior. It is simple, but it is not easy—much like becoming an officer. You have your mission. It’s time to get started!

[1] http://tinyurl.com/3famv8pn

[2] Assuming 10% growth and retirement at full Social Security age in 2020 of 67.

Winged Wealth Management and Financial Planning LLC (WWMFP) is a registered investment advisor offering advisory services in the State of Florida and in other jurisdictions where exempted. Registration does not imply a certain level of skill or training.

This communication is for informational purposes only and is not intended as tax, accounting or legal advice, as an offer or solicitation of an offer to buy or sell, or as an endorsement of any company, security, fund, or other securities or non-securities offering. This communication should not be relied upon as the sole factor in an investment making decision.

Past performance is no indication of future results. Investment in securities involves significant risk and has the potential for partial or complete loss of funds invested. It should not be assumed that any recommendations made will be profitable or equal the performance noted in this publication.

The information herein is provided “AS IS” and without warranties of any kind either express or implied. To the fullest extent permissible pursuant to applicable laws, Winged Wealth Management and Financial Planning (referred to as “WWMFP”) disclaims all warranties, express or implied, including, but not limited to, implied warranties of merchantability, non-infringement, and suitability for a particular purpose.

All opinions and estimates constitute WWMFP’s judgement as of the date of this communication and are subject to change without notice. WWMFP does not warrant that the information will be free from error. The information should not be relied upon for purposes of transacting securities or other investments. Your use of the information is at your sole risk. Under no circumstances shall WWMFP be liable for any direct, indirect, special or consequential damages that result from the use of, or the inability to use, the information provided herein, even if WWMFP or a WWMFP authorized representative has been advised of the possibility of such damages. Information contained herein should not be considered a solicitation to buy, an offer to sell, or a recommendation of any security in any jurisdiction where such offer, solicitation, or recommendation would be unlawful or unauthorized.