What if the Market Crashes?

Apparently, there’s something in the news that could spark a bout of severe market volatility… Maybe it’s a government shutdown. Maybe it’s a debt ceiling showdown. Maybe it’s a clown show masquerading as a serious legislative body. Does it really matter if you have a plan when there are big market gyrations?

Market timers want to pretend that the right choice is to jump out before the crash and jump in after the crash. This strategy is a fool’s errand unless the fool has a functioning crystal ball. But there are a few options to deal with major market volatility. Tax-loss Harvesting is great in a taxable account, but what about Roth Conversions—are those a good idea when the market is down?

Roth Conversion 101

Let’s revisit Roth Conversion basics for a moment. When you save in a pre-tax or Traditional IRA/TSP/401(k) etc., you skipped paying income tax on the dollars you stashed away. The tradeoff is that when the dollars leave that pre-tax account, you know Aunt IRS will be waiting for her share. She is part-owner of the account after all.

Most of us invest in retirement accounts thinking we won’t touch the funds until our sixties or later. But one of the most common tax planning tools involves moving that pre-tax money before we need to spend it. This is called a Roth Conversion.

Simply put, a Roth Conversion is transferring money from a pre-tax or Traditional IRA/TSP/401(k) etc., to a Roth IRA. A Roth Conversion is an informed speculation that you can pay lower lifetime taxes by paying slightly higher taxes in the current year.

The act of moving the dollars out of the pre-tax account means that a 1099-R will arrive the following February and a tax bill will come due on April 15th.

(Note that it’s also possible in some employer plans to do Roth Conversions while keeping money inside the plan. The TSP does not currently allow this.)

The benefit of a Roth Conversion is that the dollars continue to grow without annual taxation and can be accessed in retirement, tax-free in most cases. A Roth Conversion changes the taxation characteristics of your money not only for the rest of your life, but for at least the first 10 years that your heirs inherit it!

Roth Conversion Timing

The most common time for investors to do Roth Conversions is during low-income years—typically after flipping the “paycheck off switch,” and before claiming Social Security (age 62 to 70) or taking Required Minimum Distributions (age 75 for most).

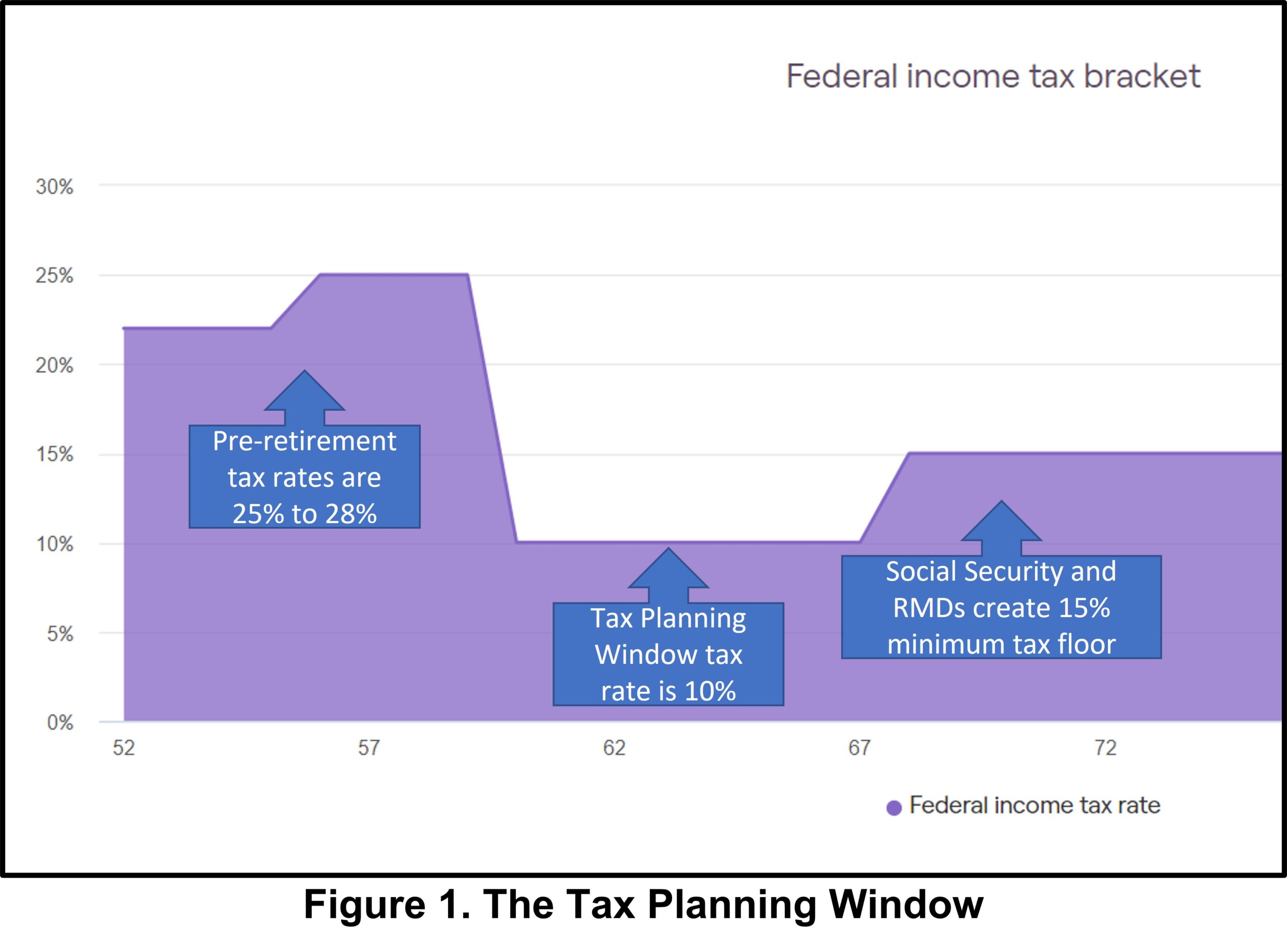

Figure 1 shows a “bathtub” from age 60 when this investor retires to age 67 when the investor starts claiming Social Security. This period is often called the Tax Planning Window. When a retiree starts drawing from their nest egg and there’s no longer a steady paycheck propelling the tax brackets, the Federal Tax Bracket often drops.

In Figure 1, the tax bracket prior to retirement is 28% but then for the first seven years of retirement, the rate drops to 10%. Once Social Security kicks in, the tax rate jumps back up to 15%. This means that Roth Conversions, which look just like other sources of income for federal income tax purposes, can be done at the lower tax brackets after the paycheck years but before Social Security and RMDs kick in.

Put another way, the taxpayer skips paying tax at 25% to 28% and instead pays 10% to 15% on those dollars. This is often called filling up the tax brackets and is best timed in years of predictably low income.

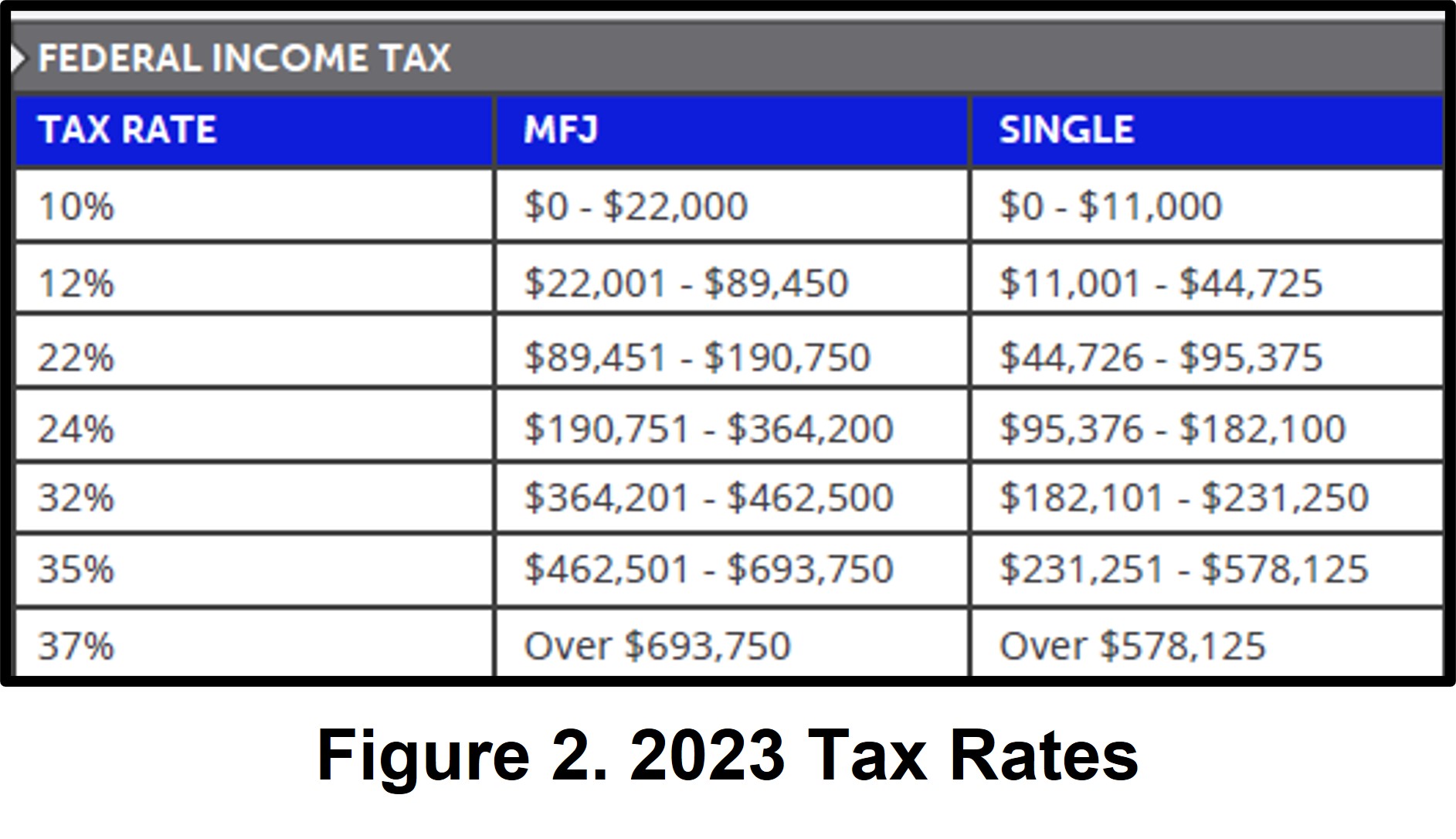

The tax code is written in pencil, so while a planned tax increase is on the books for 2026, we really have no idea what future tax rates will be. Figure 2 shows the brackets for 2023. We can see that a married couple fills up the 10% bracket with just $22K of taxable income and the 12% bracket with $89,450.

If the 12% bracket was the target, then as long as the family had no other taxable income, a married couple could convert $117,150 from Traditional to Roth while staying in the 12% bracket in 2023.

$117,450 (adjusted gross income) – $27,700 (standard deduction) = $89,450 (the top of the 12% bracket of taxable income).

Roth Conversions after a Market Decline

If your goal is to try to eventually convert most or all your Traditional / pre-tax IRA, TSP, or 401(k) to Roth, then a market decline can create a real opportunity. Let’s say you have $400K in a Traditional IRA (or TSP / 401(k)) and because of retirement or other reasons, you’ll have some low-income years coming up.

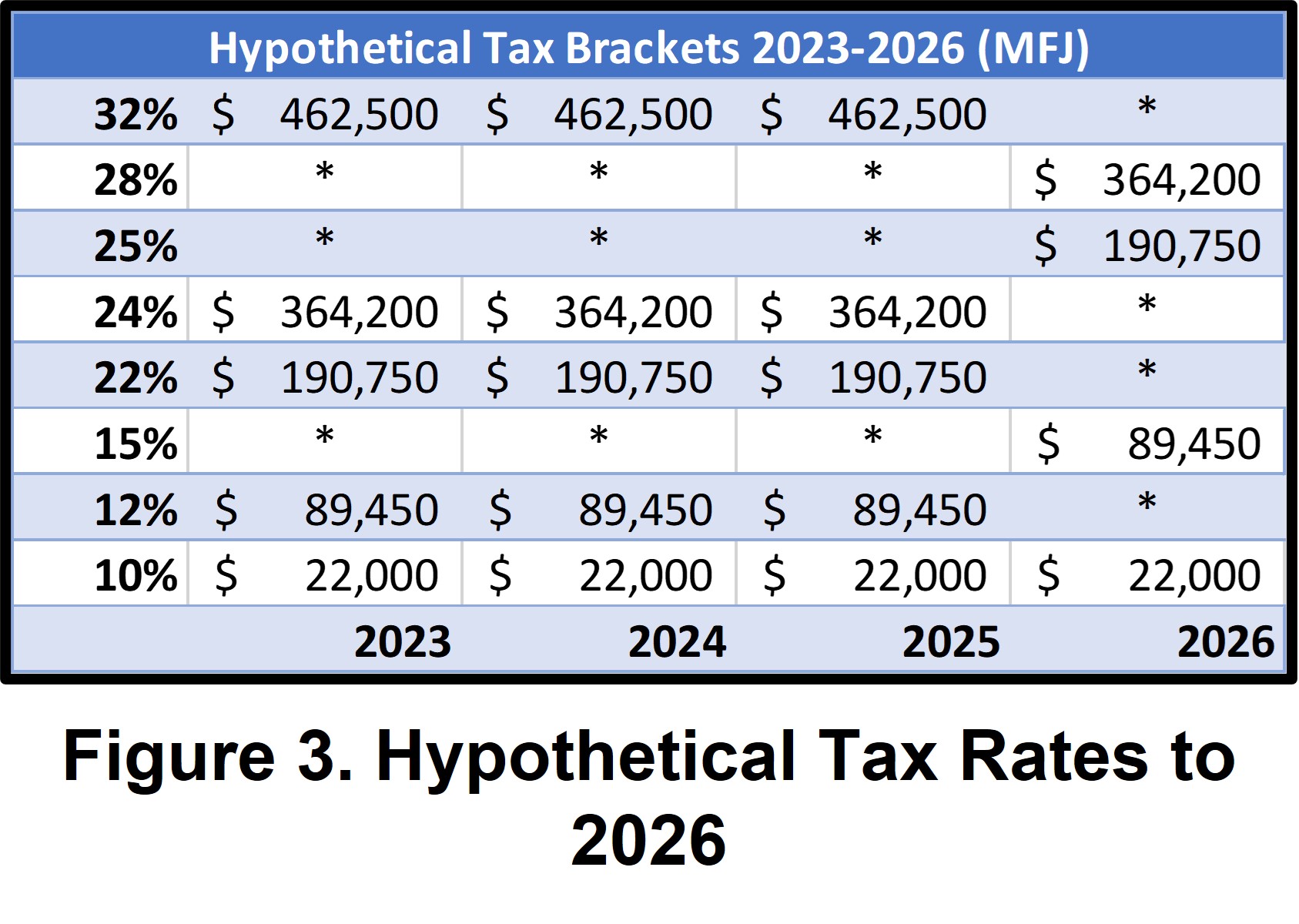

It’s possible to forecast what amount you’ll need to convert each year to avoid climbing too high in the tax brackets. Figure 3 shows the tax brackets from 2023 to 2025 without any inflation (wishful thinking…). In 2026 when the brackets revert to 2017 levels, the dollar cutoffs are hypothetical, but reasonable estimates for comparison. The asterisks indicate that a tax rate is not in effect for that year.

Let’s assume you want to try to only do Roth Conversions if you can pay 12% or less. If you can suppress all other income sources (pensions, capital gains, dividends, rental income, etc.) then you could plan to convert $117,450 from 2023 to 2025 (as seen above, the standard deduction will take Adjusted Gross Income down to $89,450 of taxable income), per year for 3 years for a total of $352,350.

Certainly, paying only 12% on money that was probably earned at 22% or higher is a great deal, but it doesn’t meet the goal of converting a full $400K. Time to smile at the market decline!

During a market decline, the size of your pre-tax nest egg shrinks. You expect this to be temporary, but the reality is, it’s easier to Roth Convert a larger proportion of your pre-tax balance when a Bear Market has shrunk the size of that balance.

A 20% decline in the market turns $400K to $320K on paper. While we wouldn’t hope for a market decline to last a lot of years, any period of market decline is an opportunity to move a larger slice of a (temporarily) smaller pie from Traditional to Roth.

Can I Actually do Roth Conversions?

The biggest problem for most of us is that we’re not just still working, but we might still be a participant in the TSP. The TSP does not allow conversions to an IRA while you’re still a participant including Active Duty, National Guard, or Reserves. To convert Traditional TSP dollars to a Roth IRA, you’ll need to be separated or retired. Then it’s green-light-go.

Traditional IRAs, as well as SIMPLE and SEP IRAs have no such limits. If you have pre-tax money in a Traditional, SIMPLE, or SEP IRA, you can effectively do Roth Conversions whenever you want. (SIMPLE IRAs must wait 2 years from the first contribution.)

If you’re separating or retiring from military service soon and perhaps getting ready to suck up first-year First Officer pay, you might be staring at a trifecta:

- Access to your Traditional TSP dollars

- Temporarily low-income window during historically low tax rate environment

- Market decline

If you have the cash to pay the taxes, these conditions create a great opportunity to do some heavy lifting from the Traditional pile of dollars to the Roth pile of dollars.

Should I do Roth Conversions?

You know the answer to this one—it depends! The basic speculation of Roth Conversion is that you or your heirs will pay a higher tax rate when pulling dollars out of the Roth account than when you earned the dollars. Skip paying 32% today in hopes of paying 25% or less later, etc.

If your crystal ball is like mine, it’s a Cat III Hangar Queen without good prospects. That said, current tax rates are historically low and the future need for government revenue seems likely to be high, so it’s not unreasonable to expect higher tax rates in retirement.

In addition to expecting higher tax rates later, some other common reasons to do Roth Conversions might be:

- A preference for knowing retirement income will be tax-free

- Avoiding Shadow Taxes like IRMAA

- Avoiding taxation of Social Security

- Avoiding the Widow(er) tax

- Pre-paying taxes for heirs (or preventing a 10-year tax bomb for them)

- The feeling of having “Insurance” against higher tax rates

- Avoiding Required Minimum Distributions (Traditional IRAs have them, Roth’s don’t)

Cleared to Rejoin

Roth Conversions are one of the most powerful tools in Financial Planning. When the stock market is down, Roth Conversions are on steroids because they lift a greater proportion of your wealth from the pre-tax pile to the tax-free pile. The most important thing to remember is that you need to forecast the impact not just on your current-year tax bill, but your lifetime tax bill as well.

If the people we never should have elected are putting on a clown show that gives your nest egg some temporary shrinkage, Roth Conversions are a great way silver lining!

Fight’s On!

Winged Wealth Management and Financial Planning LLC (WWMFP) is a registered investment advisor offering advisory services in the State of Florida and in other jurisdictions where exempted. Registration does not imply a certain level of skill or training.

This communication is for informational purposes only and is not intended as tax, accounting or legal advice, as an offer or solicitation of an offer to buy or sell, or as an endorsement of any company, security, fund, or other securities or non-securities offering. This communication should not be relied upon as the sole factor in an investment making decision.

Past performance is no indication of future results. Investment in securities involves significant risk and has the potential for partial or complete loss of funds invested. It should not be assumed that any recommendations made will be profitable or equal the performance noted in this publication.

The information herein is provided “AS IS” and without warranties of any kind either express or implied. To the fullest extent permissible pursuant to applicable laws, Winged Wealth Management and Financial Planning (referred to as “WWMFP”) disclaims all warranties, express or implied, including, but not limited to, implied warranties of merchantability, non-infringement, and suitability for a particular purpose.

All opinions and estimates constitute WWMFP’s judgement as of the date of this communication and are subject to change without notice. WWMFP does not warrant that the information will be free from error. The information should not be relied upon for purposes of transacting securities or other investments. Your use of the information is at your sole risk. Under no circumstances shall WWMFP be liable for any direct, indirect, special or consequential damages that result from the use of, or the inability to use, the information provided herein, even if WWMFP or a WWMFP authorized representative has been advised of the possibility of such damages. Information contained herein should not be considered a solicitation to buy, an offer to sell, or a recommendation of any security in any jurisdiction where such offer, solicitation, or recommendation would be unlawful or unauthorized.