Don’t Close the Backdoor (Roth IRA)

Many active duty officers with working spouses realize that investing, taxes, and retirement planning get pretty complicated as income approaches $200K. Unfortunately, few take advantage of the Backdoor Roth IRA, giving up a serious wealth-building tool and ultimately, over-paying the IRS.

A Backdoor Roth IRA is just a Roth IRA with an administrative penalty lap. Kind of like filling out your medical history for the 369th time before your flight physical. It’s both necessary and unnecessary, but ultimately, you need to do it to get where you want to be.

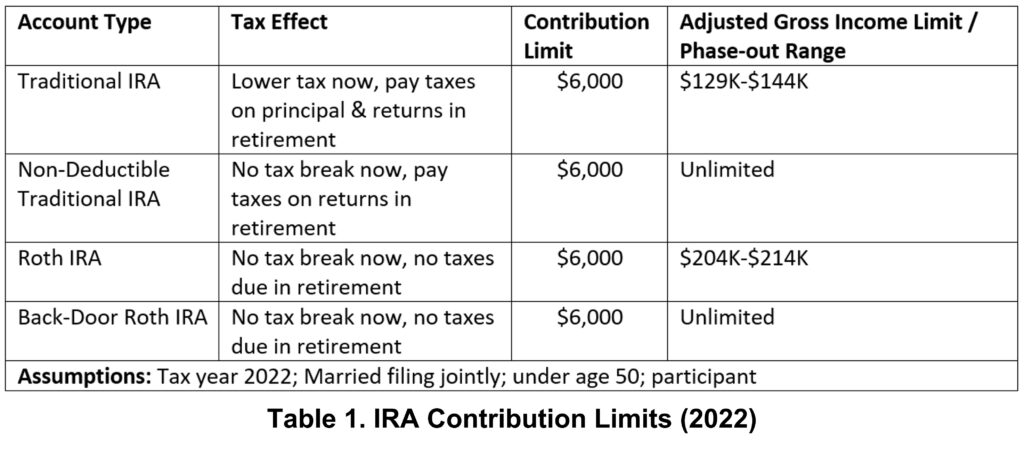

As a refresher, here are the main kinds of IRAs (that you care about):

- Traditional: Deduct the contribution (up to $6K in 2022 under age 50) from your current income, lower your current tax bill, but pay taxes on the principal and the returns when you start to access them in retirement. Often called a “Pre-tax” IRA.

- Non-Deductible Traditional: Same limits, but you can’t deduct the contribution, so you pay taxes at your marginal rate in the year of the contribution. The returns grow tax-deferred, so you pay taxes on the returns only when you access them in retirement. (note: you won’t see an account called “Non-deductible Traditional.” It’s the reality of tax treatment and you’re on the hook for tracking it as such.) Often called an “After-tax” IRA.

- Roth: Same limits, but you can’t deduct the contribution, so you pay taxes at your marginal rate in the year of the contribution. The principal and returns grow tax-free, so when you access them in retirement, you don’t pay taxes on them. Also called an after-tax IRA, but Roth IRA generally has more meaning.

While Uncle Sam wants to incentivize retirement saving, he doesn’t particularly want the rich to get too many tax breaks (well, maybe the really, really rich…). As such, there are inflation-indexed income limits for contributions to Traditional and Roth IRAs to keep the wealthy from getting outsized tax-advantaged savings opportunities.

To complicate matters, the deductibility of a Traditional IRA contribution is pegged to whether or not your employer offers a tax-advantaged retirement plan (the military does). Rather than dry your eyes up with all the details, Table 1 is a summary.

From Table 1, you can see that the Backdoor Roth IRA is basically the offspring of the Non-Deductible Traditional IRA and the Roth IRA. It has the best trait of the Non-Deductible Traditional IRA: unlimited income. It also has the best trait of the Roth IRA: no taxes on the compounded returns in retirement. It’s like being able to Wall and Grind at the same time. The effect is that there is actually no income limit for a Backdoor Roth IRA.

How Do I Contribute to a Backdoor Roth IRA?

Step 1. Open and contribute (ideally) the annual limit to a (Non-Deductible) Traditional IRA at your favorite brokerage (e.g. Fidelity, Vanguard, Schwab, etc.), preferably where you have your Roth IRA from those “lean” years when you could contribute directly. If you already have a Traditional IRA, you can use it if the balance is $0—more on this in a moment.

You save yourself a lot of work if you fund the account at one time versus dollar-cost-averaging over the year, but more to follow on this later. I recommend selecting a money market fund or cash so that you generate as close to zero earnings as possible during your money’s short stay in this Non-deductible Traditional IRA account (but you don’t want it to lose value either). You can use the same account each year, it will just have a zero balance when you’re not doing your Backdoor gymnastics.

Step 2. Wait a day. Seriously, no need to wait any longer. Log in and transfer the money from the (Non-Deductible) Traditional IRA to your Roth IRA. Your brokerage may warn that this could be a taxable event, but that’s unlikely since you paid taxes on the funds prior to funding the (Non-Deductible) Traditional IRA and there haven’t been any earnings in the last 24 hours. Yes, it’s a taxable event, but the tax bill is $0 on $0 earnings.

Step 3. Fill out IRS Form 8606 (or have your tax preparer do it). This is critical and could generate a penalty if skipped. This form tracks money flowing in and out of Non-Deductible IRAs. (If a Non-deductible balance carries from year to year, Form 8606 is often the only place where that balance gets tracked, if at all.) Boom! Backdoor Roth IRA!

For most of us, this is as complicated as the process gets. You can earn a gazillion dollars and still contribute to a Roth IRA with a quick administrative penalty lap through a Non-Deductible Traditional IRA and form 8606.

The Pro-Rata Problem

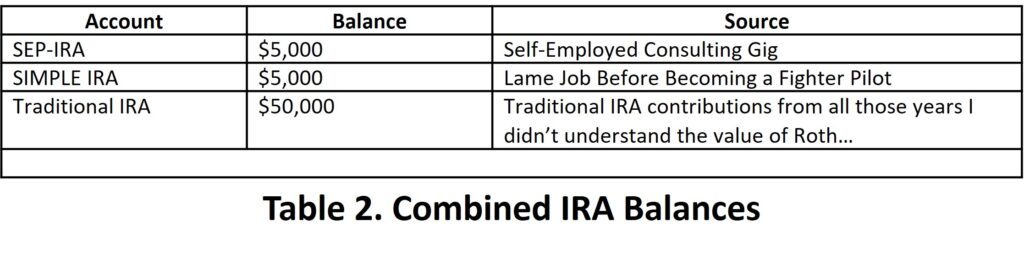

Unfortunately, if you already had money in a Traditional IRA, SIMPLE IRA, or SEP IRA, you may not be able to contribute to a Backdoor Roth IRA, or at least not without some extra work or taxes due. First, the IRS considers all three of those IRAs to have the same tax character—they are made up of pre-tax dollars, so let’s just think of them as pre-tax IRAs for a moment. Second, even if you have several different pre-tax IRA accounts in your name as in Table 2., the IRS considers them to be a single balance of pre-tax IRA dollars- in this case $60,000.

Imagine that you’re trying to create a Backdoor Roth IRA. You’re on Step 3 filling out form 8606 and you realize that you must account for pre-tax IRA dollars. I’ll skip to the punchline: because you have pre-tax IRA dollars, the IRS considers any transfer from a Non-Deductible Traditional IRA to be a pro-rata distribution of the pre-tax dollars you have in your pre-tax IRA accounts and the amount you just deposited into the Non-Deductible T-IRA.

Assuming the $60,000 balance in the Table 2. accounts and a $6,000 contribution to the Non-Deductible Traditional IRA, the ratio is $6,000 ÷ $66,000 = 9.1%. That means that when you try to transfer $6,000 from the Non-Deductible Traditional IRA, the IRS is going to look at it as 90.9% pre-tax dollars being converted into a Roth IRA and 9.1% after-tax dollars being transferred into the Roth IRA.

You’ll pay your marginal tax rate on 90.9% of the $6,000 because the IRS views it as Roth Conversion. In the 24% bracket this looks like $5,454 * .24 = $1,308 of ouch! You already paid 24% tax on the $6,000 when you earned it, and you didn’t actually move money out of any of the pre-tax accounts, but you’ll pay tax as though you moved 90.9% of your attempted Backdoor Roth from a pre-tax account.

Here’s the worst part: unless you keep immaculate records (typically via a series of form 8606’s) on the portion of your Traditional IRA dollars that are pre-tax and after-tax, you’re at high risk of inadvertently paying tax twice on the after-tax contributions down the road because it’s easy to forget how much of your Traditional IRA balance is pre-tax versus after-tax.

Solving the Pro-Rata Problem

You have a couple of choices when solving the pro-rata rule problem.

- Get your money out of pre-tax IRA accounts. The easiest is probably to rollover the money into the TSP (or your 401k/403b).

- If it makes sense for your tax planning, bite the bullet by converting pre-tax dollars to your Roth IRA and paying the taxes on them at your current marginal rate. WARNING: Not only are you going pay at your current marginal rate, you could actually bump up your tax bill by tripping into the next bracket or triggering the 3.8% Net Investment Income Tax or .9% Additional Medicare Tax! If you pay state income taxes too, factor those in.

- If you can’t clear out your pre-tax IRA accounts, don’t attempt a Back-Door Roth IRA yet. Invest your money in another tax-efficient manner in accordance with your investment policy statement.

Avoiding the Pro-Rata Problem

The best way to manage the Pro-Rata Problem is to avoid it by never putting money into pre-tax IRAs. To be clear, the TSP or a 401k / 403b are not IRAs. You can have money in the Traditional TSP (or 401k/403b) and still execute Back-Door Roth IRAs. Here are some other avoidance maneuvers:

- Choose a solo 401k rather than a SEP-IRA for your side-hustle gig. If you have a small business and want to invest some of that income into a tax-advantaged retirement account, a solo 401k might have modest costs compared to a SEP-IRA, but it provides much greater flexibility.

- Make sure you’re maxing out your TSP / 401k / 403b contributions before putting money into IRAs. No need to create the Pro-Rata problem if you haven’t reached the limit in your TSP / 401k / 403b.

- Friends don’t let friends choose SIMPLE IRAs. The SIMPLE IRA is a popular, inexpensive, and easy tax-advantaged retirement plan for small businesses. But it’s a pre-tax IRA and it has a 25% penalty if you remove funds within 2 years of account opening. If you’re operating a small business or know someone who is, spread the word that SIMPLE IRAs prevent Back-Door Roth IRAs for at least 2 years.

- If you’re only temporarily blocked from a Backdoor Roth IRA (e.g., SIMPLE IRA 2-year lockout) perhaps stash your money in another tax-efficient investment such as real estate or a low-cost Exchange Traded Fund until you can put it into a Backdoor Roth IRA.

Cleared to Rejoin

The Backdoor Roth IRA is a phenomenal tool for building wealth and securing the retirement choices that pilots deserve. The Backdoor maneuver legally circumvents the income limits on Roth IRA contributions and secures the tax-free growth and retirement distributions that Roth accounts provide.

If you don’t have money in any pre-tax IRAs (Traditional IRA, SIMPLE IRA, SEP IRA), a Backdoor Roth IRA is a simple 3-step process. If you do have money in pre-tax IRAs, you need to tread carefully to avoid overpaying that tax man, but a Backdoor Roth IRA may still be an option. Even if you’re in the 24% bracket today, there’s a great chance you’ll be in a higher tax-bracket as your earnings grow so it’s worth doing the homework to try to max-perform the size of your Roth nest egg.

Fight’s On!

Winged Wealth Management and Financial Planning LLC (WWMFP) is a registered investment advisor offering advisory services in the State of Florida and in other jurisdictions where exempted. Registration does not imply a certain level of skill or training.

This communication is for informational purposes only and is not intended as tax, accounting or legal advice, as an offer or solicitation of an offer to buy or sell, or as an endorsement of any company, security, fund, or other securities or non-securities offering. This communication should not be relied upon as the sole factor in an investment making decision.

Past performance is no indication of future results. Investment in securities involves significant risk and has the potential for partial or complete loss of funds invested. It should not be assumed that any recommendations made will be profitable or equal the performance noted in this publication.

The information herein is provided “AS IS” and without warranties of any kind either express or implied. To the fullest extent permissible pursuant to applicable laws, Winged Wealth Management and Financial Planning (referred to as “WWMFP”) disclaims all warranties, express or implied, including, but not limited to, implied warranties of merchantability, non-infringement, and suitability for a particular purpose.

All opinions and estimates constitute WWMFP’s judgement as of the date of this communication and are subject to change without notice. WWMFP does not warrant that the information will be free from error. The information should not be relied upon for purposes of transacting securities or other investments. Your use of the information is at your sole risk. Under no circumstances shall WWMFP be liable for any direct, indirect, special or consequential damages that result from the use of, or the inability to use, the information provided herein, even if WWMFP or a WWMFP authorized representative has been advised of the possibility of such damages. Information contained herein should not be considered a solicitation to buy, an offer to sell, or a recommendation of any security in any jurisdiction where such offer, solicitation, or recommendation would be unlawful or unauthorized.