Should You Own Bonds?

Some might say stocks are like a fighter jet—sleek, sexy, and high-performing. Does that make bonds a C-130—generally reliable, workhorse, but maybe not as fun play around with? I’ll defer that argument to the crud table and offer some thoughts on bonds that that fighter pilots should consider.

Bonds 101

A quick primer on bonds is the highlight of any party, so I’ll start with that. A bond is a slice of debt from a government or company. You loan the bond issuer some scratch and the issuer pays you interest over a defined period and then returns the principal at the end of the term. Your home mortgage is likely part of a bond that is currently paying interest to an investor out there. Bonds have several features that investors need to understand.

- Default Risk– the issuer might not repay you, or might repay only part of it’s promise. The U.S. government issues bonds that the market considers default risk-free. If a meme-stock company is issuing bonds right now, those might not be default risk-free… state and local governments rarely default on bonds, but it does happen.

- Mutual Funds– bonds can be purchased directly (usually in increments of $1,000) or in a mutual fund that holds a diverse array of bonds. Most of us will purchase bonds in a mutual fund or exchange traded fund (ETF).

- Ordinary Income Tax– Except for bonds issued by your state or a city in your state (called municipal bonds), the interest income from bonds is taxed at your marginal income rate, e.g. 22%, 24%, 32% etc. Owning anything but tax-exempt municipal bonds in a taxable account may not be desirable because of the annual tax-drag.

- Capital Gains Tax– If you own a municipal bond mutual fund or ETF in a taxable account, and the fund creates gains by selling some of its bonds for a premium, you’ll now pay capital gains tax (0%, 15%, or 20%) on those gains. This surprises many investors that purchase municipal bond funds for a tax advantage.

- Interest Rate Risk– If you own a bond paying 4% interest, but interest rates rise to 6%, you’re going to want to get in on some of that 6% action. If you paid $1,000 for that 4% bond, you’re going to have to reduce the sale price to get someone else to take it off your hands. If the tables were turned and you owned a bond paying 6%, but rates drop to 4%, investors will pay you a premium to get your 6% bond.

- Safety? Bonds are often referred to as “fixed income” because they pay a specified rate of interest and aren’t tied to short-term company performance and profits like stocks. Many investors plan their retirement years on the assumption that their bonds will pay out as planned. There are few guarantees in life, but many assume that bond payments are close enough. Thus, bonds are usually considered the safe portion of an investment portfolio. Clearly this isn’t a rule of physics…

- Correlation to Stocks– Historically, when the stock market is in roller coaster mode, some investors sell stocks and buy bonds. When this demand for bonds increases, bond prices rise. Falling stock prices and rising bond prices cushions the effect of stock losses. Falling bond prices and rising stock prices has the opposite effect—drag on the return provided by the stocks. Again… not a rule of physics…

There’s a lot more geekery to bonds, but these concepts are key.

We know that diversification or asset allocation, is one of the 5 pillars of investing because it helps us avoid putting all of our eggs in one basket. As investors, we’d usually like to avoid having our entire portfolio roll inverted and pull at the same time. In the early part of our retirement years, a portfolio that does 45° HARB could result in a diet of Alpo consumed in the back seat of one’s car-turned-residence instead of eating Grey Poupon and rocking a sweet golf cart around The Villages… But the question is how much to diversify?

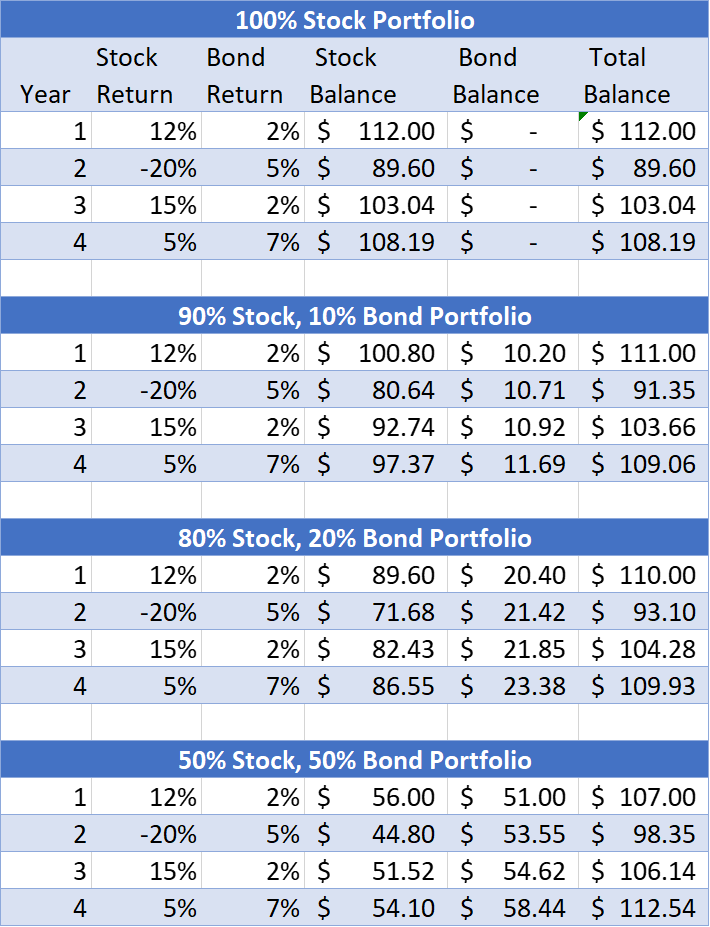

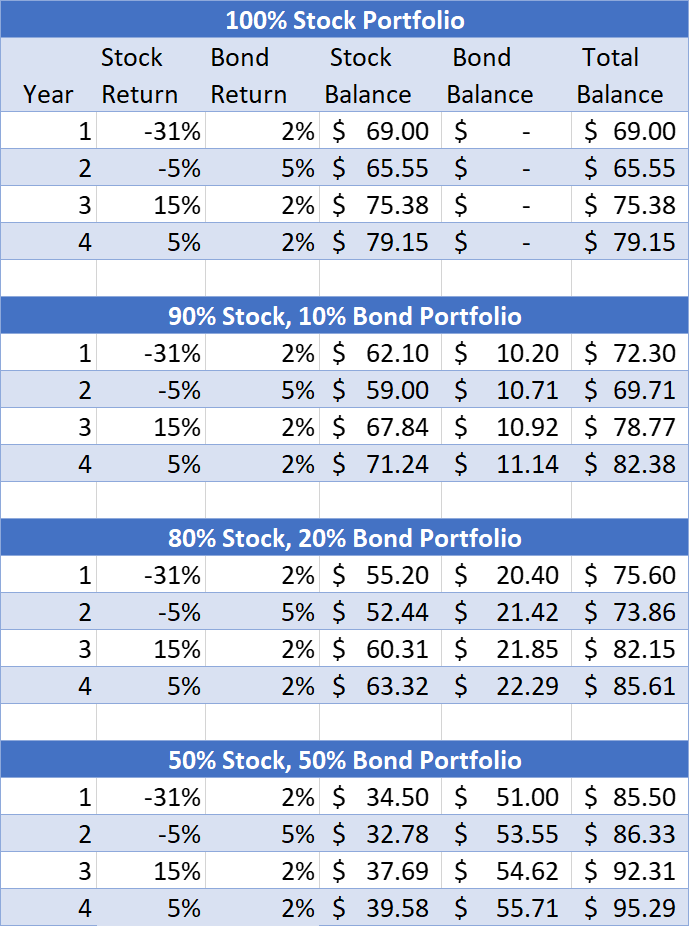

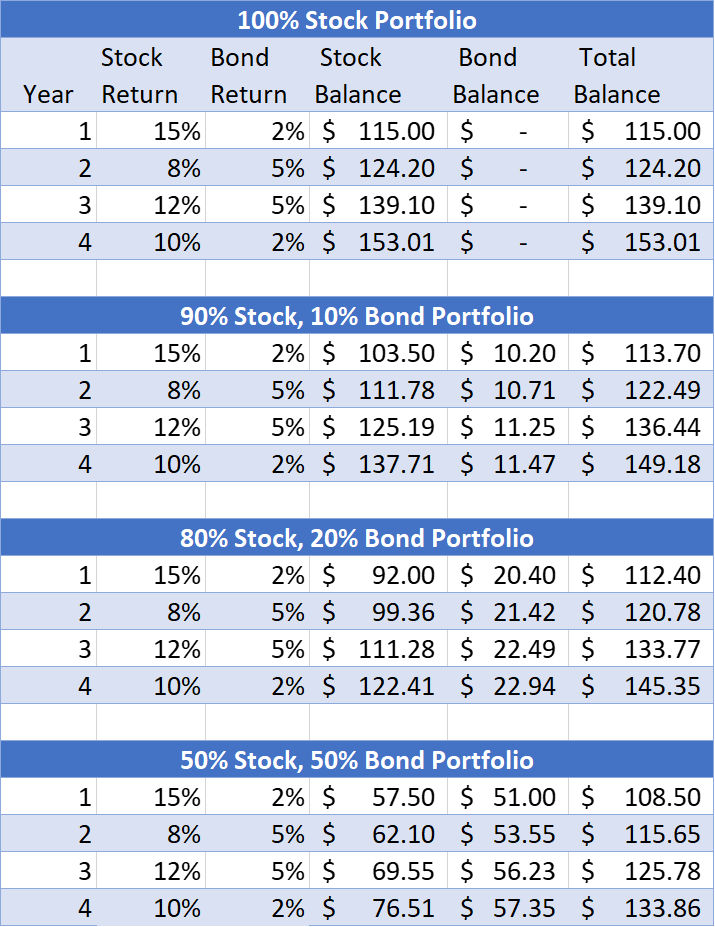

Since the great depression, stocks have generally returned a nominal (not adjusted for inflation) return of just about 10%. Bonds have nominally earned about 5%. The following three tables illustrate various hypothetical sequences of returns over model portfolios consisting of:

- 100% Stocks

- 90% Stocks / 10% Bonds

- 80% Stocks / 20% Bonds

- 50% Stocks / 50% Bonds

Table 1. Hypothetical sequence of returns on a stock and bond portfolio.

Table 2. Different hypothetical sequence of returns on a stock and bond portfolio.

Table 3. Yet another hypothetical sequence of returns on a stock and bond portfolio.

If you don’t naturally enjoy sifting through tables representing model portfolios and returns, you’d probably expect that Portfolio A would generally produce the best returns since it has no drag from lower-performing bonds. Likewise, you’d also expect that as more bonds are added to a portfolio, the overall performance would decrease. The truth? It depends on the sequence of returns.

The sequence of returns in Table 1 results in improving performance as more bonds are added, but not by much. The 50/50 portfolio ending balance is only 4% larger than the 100% stock portfolio. Table 2 starts off with a lousy first year for stocks at -31%. In this case, even though the bond returns are “meh,” the 50/50 portfolio has an ending balance that’s 20% higher than the 100% stock portfolio. Finally, Table 3 illustrates a scenario where stocks never have an amazing year or a particularly bad year. In this case, 100% stock portfolio ends up 14% higher demonstrating that under some conditions bonds truly cause drag on portfolio performance.

UNCLE!!! Just tell me if I should invest in bonds already!

Sorry- no can do. Choosing an asset allocation is as unique as these snowflakes I hear everyone griping about. But here are some thoughts on why bonds might or might not belong in your portfolio.

When Bonds Can be Appropriate

- Leading up to retirement and in the first few years of retirement—these years are generally the most sensitive to sequence of returns risk. For my fellow geezers, remember October 2007 through March 2009? Stocks lost over 50%. Millions of people lost the vast portion of their retirement savings. What’s worse is that the remedy for a battered nest egg is usually to work a few extra years. That may not be an option if employers are thinning the herd to handle a recession.

- In 529 plans as college nears– The start of college is similar to the start of retirement—the need for funds is now and there isn’t time to wait for the market to recover. The relative safety of bonds can help protect the ability to attend college as fragged.

- Rebalancing is the core strategy– for most investors in order to force “buy low, sell high” behavior over the decades of dollar-cost-averaging. Since bonds tend to be less correlated to stocks, there’s a good chance that when stocks go on sale, your bond portfolio will be a nice chunk of dry powder allowing you to purchase stocks at lower prices. Rebalancing by selling bonds (relatively high) and buying stocks (relatively low) is harder to do when you don’t have any bonds in your portfolio.

- It’s hard to sleep when you’re worried about the effects of the next bear market. Choosing an asset mix that aligns with both your risk tolerance and risk capacity can help your peace of mind and improve the chances that you’ll stay with the plan during market volatility.

- High Income– If you’re in the 35% bracket and you’ve maxed your other tax advantaged savings accounts (IRA, 401k, etc.) then a municipal bond paying 4% is the same as a taxable investment paying 6.15%.

When Bonds Might Not be Appropriate

- You don’t ever rebalance between asset classes, look at your portfolio, or even care how much risk you’re taking for the returns your getting. Sound like you? I didn’t think so.

- You can stomach the risk of an all stock or all (other asset class) portfolio and you have decades to ride out volatility (remember stocks have averaged about 10%, bonds only 5%). Additionally, you don’t like the idea of drag from low-performing asset classes.

- You’ve already won the game, face virtually no risk of outliving your money, and want to leave a MOAB-sized inheritance to your heirs.

- You have other sources of guaranteed income that replace the income one might expect from a bond portfolio. (More on this in Part 2).

Cleared to Rejoin

Remember earlier this month when day traders were using a slick smartphone app to drive up the price of 20-year municipal bonds issued by the town of Horse Barnacle, Wyoming? Me neither. Bonds just aren’t that interesting in a world where we follow the performance of stocks like the stats of marquee pro athletes. But bonds are an important arrow in the quiver of most investors at one stage or another. It’s important to consider the risk and return effects of bonds an you design and nurture your portfolio for the decades. In Part 2 of this series, we’ll take a look at why some fighter pilots might hold bonds until they retire, but skip them in retirement.

Fight’s On!

Winged Wealth Management and Financial Planning LLC (WWMFP) is a registered investment advisor offering advisory services in the State of Florida and in other jurisdictions where exempted. Registration does not imply a certain level of skill or training.

This communication is for informational purposes only and is not intended as tax, accounting or legal advice, as an offer or solicitation of an offer to buy or sell, or as an endorsement of any company, security, fund, or other securities or non-securities offering. This communication should not be relied upon as the sole factor in an investment making decision.

Past performance is no indication of future results. Investment in securities involves significant risk and has the potential for partial or complete loss of funds invested. It should not be assumed that any recommendations made will be profitable or equal the performance noted in this publication.

The information herein is provided “AS IS” and without warranties of any kind either express or implied. To the fullest extent permissible pursuant to applicable laws, Winged Wealth Management and Financial Planning (referred to as “WWMFP”) disclaims all warranties, express or implied, including, but not limited to, implied warranties of merchantability, non-infringement, and suitability for a particular purpose.

All opinions and estimates constitute WWMFP’s judgement as of the date of this communication and are subject to change without notice. WWMFP does not warrant that the information will be free from error. The information should not be relied upon for purposes of transacting securities or other investments. Your use of the information is at your sole risk. Under no circumstances shall WWMFP be liable for any direct, indirect, special or consequential damages that result from the use of, or the inability to use, the information provided herein, even if WWMFP or a WWMFP authorized representative has been advised of the possibility of such damages. Information contained herein should not be considered a solicitation to buy, an offer to sell, or a recommendation of any security in any jurisdiction where such offer, solicitation, or recommendation would be unlawful or unauthorized.