Bucket Strategies for Fighter Pilots

Oddly enough, cash is a contentious topic among investors, and fighter pilots are no different. Some think cash is trash, others say cash is king. But cash in a bucket is a strategy that every fighter pilot needs to think about before flipping the Paycheck Switch to OFF mode.

Bucket Strategy 101

When you’re no longer earning income to support your needs, typically called: retirement, you need to find a way to support yourself (and your spouse/family). There’s no single correct method among:

- Pensions

- Social Security

- Annuities

- Rental / Royalty Income

- Dividends / Interest

- Passive Business / Partnership Income

- Capital Gains Distributions

- Asset Sales

- Reverse Mortgages

- Debt from sources including Life Insurance

This list isn’t exhaustive, but it does cover the sources most of us will need to consider. If you’ve never been into real estate, life insurance, or business/partnership ownership, then you’re probably looking at living off:

- Pensions

- Social Security

- Returns from and Sales of Assets

If you have a government pension, then it probably attempts to keep up with inflation. For now, you can expect Social Security to do the same. For the rest of your lifestyle needs, you must have a strategy that turns your assets into income such that you don’t outlive your money.

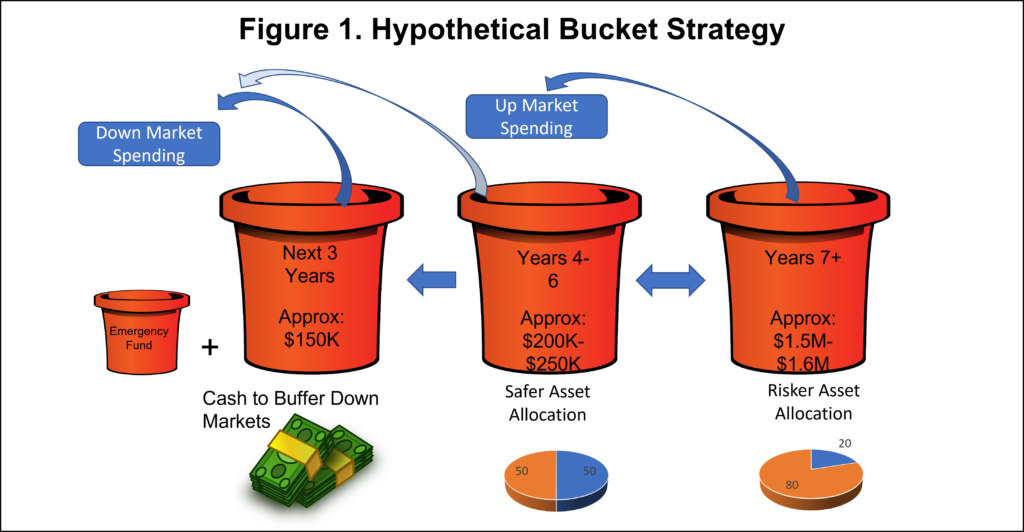

A Bucket Strategy is a technique that breaks up your assets into conceptual “Buckets” to match your assets to your future needs and mitigate risks. For example, you might have one bucket that contains cash and cash equivalents for period of years, another bucket with assets designed to produce income, and a final bucket designed to produce asset growth.

Figure 1 show an example of how buckets might used. Note that the asset allocations in each bucket will be specific to each investor’s risk tolerance, risk capacity, goals, and time horizon.

Key features of these buckets include:

Bucket 1 has enough cash and risk-free assets (e.g., CDs, savings bonds, Treasury Bills, Muti-Year Guaranteed Annuities (MYGA)) to last for say, 3 years. The idea is to match assets (cash) to liabilities—the need to spend for lifestyle support. Bucket 1’s purpose is to inoculate a family against Bear Markets.

When the market is declining, investors might have to sell assets at a loss and risk premature depletion of assets. Additionally, dividend returns might be lower during a Bear Market. If a family has cash/equivalents to spend, there should be no need to sell assets when the market is down.

Bucket 1 can be thought of as “Bear Market Insurance.” In fact, any investor that’s allergic to market volatility can think of some amount of cash as insurance rather than an investment. We expect investments to earn future purchasing power and we expect cash to preserve current purchasing power.

Bucket 2 typically contains a moderate or balanced stock and bond portfolio. Bucket 2’s purpose to is to generate income versus asset price growth. Bucket 2 provides “padding” between Bucket 1 and Bucket 3 and helps refill Bucket 1 when asset returns are growing.

Bucket 3 has multiple purposes. First, during Bull Markets, investors can pull income and gains from Bucket 3 to meet lifestyle needs. This may come in the form of dividends and capital gain distributions or sales of shares.

Second, Bucket 3 refills Bucket 1 and Bucket 2 after Bear Markets. If a family depletes some or all of Bucket 1 and 2, Bucket 3 stands the best chance of providing portfolio re-growth as markets recover.

Finally, Bucket 3 provides insurance against longevity. While a retired couple might plan on living to 85, fate may have other plans. Bucket 3 should attempt to provide resources as thought the couple will far outlive their planned life expectancy.

Operationalizing the Buckets

It’s one thing to think of Bucket 1 as Bear Market insurance, Bucket 2 as padding on Bucket 1, and Bucket 3 as longevity insurance, but it’s another to put the strategy into practice.

Practical considerations for Bucket 1 include:

How many years of cash to keep? If the average Bear Market is about 10 months, but longer Bear Markets have lasted several years, investors much weigh the tradeoffs. Keeping too much cash in Bucket 1 prevents Buckets 2 & 3 from working as hard. It may ultimately lower spending in retirement, i.e., a reduced standard of living. On the other hand, a puny Bucket 1 could result in Bucket 2 & 3 depletion which means running out of money before running out of life. A common technique is three years of living expenses in Bucket 1. This number hedges against many, but not all historical Bear Markets, so this is a crucial conversation to have before building your buckets.

Where to put Bucket 1? Hopefully we’re not seriously considering putting money in a bucket or even a mattress, but you do need to consider where Bucket 1 belongs. If three years of living expenses exceeds the FDIC insurance limit for your situation, you’ll need to start splitting your Bucket 1 funds among separate accounts/institutions.

Complexity is another crucial factor. Even fighter pilots, used to walking on water and whatnot, are going to experience some level of cognitive decline as we age. Your 50-year-old self may have no problem keeping track of funds spread across multiple accounts and asset types. Your 82-year-old self might find such strategies somewhere between tedious and untenable. Your widow(er) maybe completely lost if you build a Rube Goldberg machine to manage your cash.

What about inflation? Cash is not supposed to earn returns that outpace inflation. If you expect inflation to be 3% and a year’s spending is $100K (in Year 1 dollars) then you need to set aside $100K + $103K + 106.9K = $309.9K.

Ladders. A ladder is a plan to uses time-structured products like CDs, Bonds, or MYGAs based on their maturity. An example might be to build Bucket 1 with the following ladder:

- Year 1 spending: Cash in a checking account

- Year 2 spending: A 1-year CD purchased at the start of Year 1

- Year 3 spending: A 2-year CD purchased at the start of Year 1

As the CDs mature, they fill up the checking account and new CDs are purchased with funds from Bucket 2 and or 3.

Practical Considerations for Buckets 2 & 3

One of the challenges of a Bucket strategy is that you’ll likely start retirement with a portfolio of accounts such as Traditional and Roth IRAs plus TSP and 401(k) accounts for each spouse. Additionally, you’ll probably have at least one taxable brokerage account. The tax-efficient order of depletion of those accounts might not exactly overlay a Bucket 2 “income & padding” and Bucket 3 “long-term growth” structure.

Buckets = Accounts? It may be possible to simplify your accounts such that you literally have an account (IRA, taxable brokerage, etc.) that holds your Bucket 2 investments and another for Bucket 3. While this might be most conceptually simple, consider the following scenario:

Let’s assume you’re 73 and therefore subject to Required Minimum Distributions (RMDs). If Bucket 2 is a Traditional IRA and Bucket 3 is a taxable brokerage account, then you’re required to take your RMD from Bucket 2 even though you might prefer to sell assets from Bucket 3 for tax or other reasons. What’s more, you can’t refill Bucket 2 from Bucket 3 in this situation as you can no longer contribute to your IRA when you’re not earning income.

Money is fungible—any dollar can be swapped for another, but the MK-1 human usually performs “Mental Accounting.” Mental Accounting is when we like to think of funds in one account as reserved for a specific purpose even though in reality, we can move all our funds around to meet any purpose. If we’re beholden to strict Mental Accounting, we might structure our Buckets in a manner that leaves the Tax Man a tip when we’re forced to withdraw from a Traditional IRA because we Mentally Accounted for our Roth IRA to perform a different role in our Bucket Strategy.

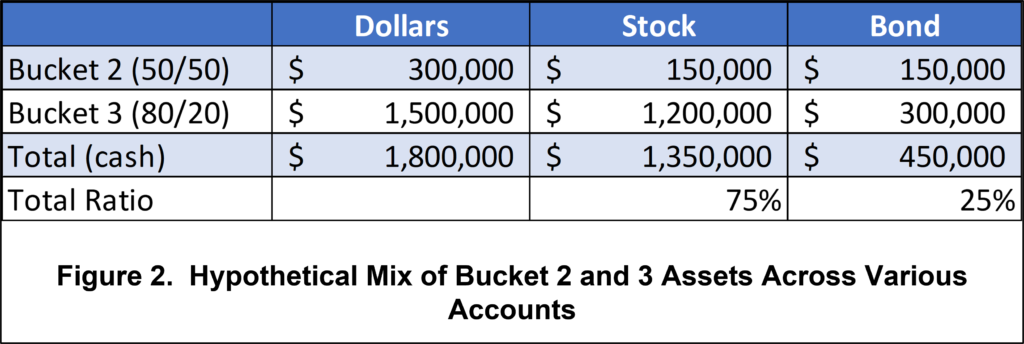

If Buckets are mostly conceptual and only partially an actual account-based method, then Buckets 2 & 3 will probably exist across a combination of accounts. Figure 2 gives an example of a hypothetical Bucket 2 & 3 mixture.

We can see that, regardless of how many and which types of accounts the actual investments are in, the overall mixture is the same. While a 75/25 stock/bond ratio might be aggressive for some retired investors, it’s important to consider that retained cash in Bucket 1 is still part of the overall asset allocation. In this case, $300K of cash in Bucket 1 would make the overall asset allocation 65/35. Clearly, every investor needs to understand his/her risk tolerance and risk capacity in choosing how to allocate each bucket.

Emergency Funds

Assuming a retired family believes in maintaining a cash emergency fund, it’s prudent to continue to maintain such funds as part of a Bucket Strategy. I.e., the emergency fund isn’t a carve-out from Buckets 1, 2, or 3—it’s a separate fund that needs to be available immediately and outside of planned yearly spending.

Alternatives to Bucket Strategies

One of the main drawbacks of a Bucket Strategy is the need to keep a sizeable amount of cash on the sidelines and eroding from inflation. This is more problematic when the portfolio isn’t large to begin with. Buckets 1 and 2 need to be large enough to insulate against prolonged market declines, but Bucket 3 needs to be large enough to provide growth for the whole strategy.

Safe Withdrawal Rate

The term Safe Withdrawal Rate is just that—a term and probably an aspirational one at that. It’s not a rule of physics or math. In 1994, William Bengen conducted a study to try to find a Safe Withdrawal Rate (SWR) that would allow retirees to consume a consistent amount of their nest egg each year with adequate assurance that the portfolio would last.

Key assumptions of Bengen’s research are a 50/50 stock/bond portfolio, adjusting the withdrawal amount up each year for inflation, and a 30-year retirement. Bengen found that 4% withdrawals created a 95% probability of success. Ever since, our collective psyche has been trained that 4% is a magical number.

Further exploration of the pros and cons of treating 4% as a Safe Withdrawal Rate are beyond the scope of this article, but now that we have the concept down, let’s look at modifications to SWR.

Guardrails

When we drive on winding roads, physical guardrails line the shoulders. If we stray too far to a side, the guardrails should bump us back towards the middle of the road. Guardrails as a retirement income strategy work the same way.

A Guardrail Strategy typically starts with a probability-based withdrawal number, perhaps even 4%. Like a SWR strategy, actual withdrawals increase with inflation each year. However, if market conditions are exceedingly good for a period, a Guardrail Strategy bumps spending up to a higher level. The inverse is true as well. If the portfolio declines towards a lower guardrail, retirees must cut spending to keep from depleting the portfolio.

Guardrail Strategies can enable retirees to spend higher overall amounts if their sequence of market returns is positive. Likewise, since a single number like 4% isn’t blindly followed through an extended Bear Market, a Guardrail Strategy also offers more protection against depletion.

Another advantage of a Guardrail Strategy is that it doesn’t inherently require multiple years of cash sitting on the sidelines. That said, if you’ve lived through a few Bear Markets, you know that selling shares when the market is down 50% isn’t fun.

Thus, retirees might consider a hybrid of Buckets and Guardrails. If the portfolio is large enough to begin with, then a cash/equivalent Bucket 1 alongside a Guardrail-managed Bucket 2 & 3 (really just a single other bucket) could create inoculation against Bear Markets, the option to spend more from Bull Markets, and some lead time before deciding to reduce spending based on the size of the cash cushion in Bucket 1.

Cleared to Rejoin

If you’re still in your accumulation years, you certainly don’t need to pick a retirement income strategy. You should know about retirement income strategies, but it’s probably too early to commit to one.

If you’re within five years of flipping the Paycheck Switch to OFF mode, it’s high time to pick a method that will translate your nest egg into a simulated paycheck during your retirement years. A Bucket Strategy can be an excellent way to inoculate against Bear Markets while tactically deploying your dollars to last as long as you do.

Whether you choose a Bucket Strategy or another technique such as Guardrails, you need to have a plan. If your nest egg is more quail than ostrich, you could be at risk of running out of dollars before you run out of years. If your nest egg is more ostrich than quail, poor retirement income planning could result in dying with a big pile of money and a small pile of memories—also not a winning strategy.

Next time you speak with your Financial Planner, Bucket and other retirement income strategies would be a great topic for the agenda. Until then…

Fight’s On!

Winged Wealth Management and Financial Planning LLC (WWMFP) is a registered investment advisor offering advisory services in the State of Florida and in other jurisdictions where exempted. Registration does not imply a certain level of skill or training.

This communication is for informational purposes only and is not intended as tax, accounting or legal advice, as an offer or solicitation of an offer to buy or sell, or as an endorsement of any company, security, fund, or other securities or non-securities offering. This communication should not be relied upon as the sole factor in an investment making decision.

Past performance is no indication of future results. Investment in securities involves significant risk and has the potential for partial or complete loss of funds invested. It should not be assumed that any recommendations made will be profitable or equal the performance noted in this publication.

The information herein is provided “AS IS” and without warranties of any kind either express or implied. To the fullest extent permissible pursuant to applicable laws, Winged Wealth Management and Financial Planning (referred to as “WWMFP”) disclaims all warranties, express or implied, including, but not limited to, implied warranties of merchantability, non-infringement, and suitability for a particular purpose.

All opinions and estimates constitute WWMFP’s judgement as of the date of this communication and are subject to change without notice. WWMFP does not warrant that the information will be free from error. The information should not be relied upon for purposes of transacting securities or other investments. Your use of the information is at your sole risk. Under no circumstances shall WWMFP be liable for any direct, indirect, special or consequential damages that result from the use of, or the inability to use, the information provided herein, even if WWMFP or a WWMFP authorized representative has been advised of the possibility of such damages. Information contained herein should not be considered a solicitation to buy, an offer to sell, or a recommendation of any security in any jurisdiction where such offer, solicitation, or recommendation would be unlawful or unauthorized.