Roth is Dead—Long Live Roth!

Buried in all of the good, fact-based, and opinion-free news this past week is that the House Ways and Means Committee produced its proposed changes to tax law. While not guaranteed to become law, many experts agree that these changes are a high Pk shot, so this particular glimpse into the crystal ball may be more useful than others.

Relevant to the steely-eyed killer crowd are two major changes to Roth accounts. Roth is not dead, but some of his friends probably are… for now.

Remind Me What a Roth Is?

A Roth account, be it an IRA, TSP, or 401(k), allows you to pay you income tax on the dollars you contribute today, then the money grows tax-free until you start to use it, nominally after age 59 ½. Assuming you meet the (easily-met) requirements, the growth and principal are available to you tax-free.

Roth accounts are the prized pig of tax-advantaged accounts because they lock in what the saver believes is a lower tax rate today and eliminate the risk of a higher tax rate in the future.

Many savers have been worried that Roth accounts were too good to be true, and it looks like Congress might agree. While changes to the Roth might have been inevitable, we can probably thank Peter Thiel for making sure Roth got plenty of attention this year.

Proposed Roth Changes

Keep in mind that these changes are proposed. That said, depending on your situation, they may warrant action for tax year 2021 and could change your options for future tax years if signed into law.

The Bad News

Goodbye Roth Conversions. Sort of. The proposed law eliminates Roth conversions (paying tax on untaxed retirement contributions to an IRA/TSP/401(k), then receiving Roth treatment thereafter), but only for high income earners.

The new tax law looks to define high income earners for most purposes as over $400K for single taxpayers, and $450K for married filing jointly taxpayers. Marriage penalty anyone?

So, if your taxable income is under $400K/$450K, convert away (after talking to your financial/tax advisor please!).

The Good(ish) News

This particular part of the law would take effect in 10 years, starting with tax year 2032. This helps revenue because Congress expects lots of wealthy families to convert pre-tax dollars to Roth like there’s no tomorrow…because there sort of isn’t.

Additionally, if your household income is below the $400K/$450K thresholds (likely indexed for inflation) then Roth Conversions will still be available to you.

Goodbye Backdoor Roth. This one hurts. The proposed law eliminates the option to convert after-tax dollars to Roth for all income levels. This effectively closes a loophole that many taxpayers use to maximize their Roth balance over the decades.

Goodbye Mega Backdoor Roth. While not available to many taxpayers, the Mega Backdoor Roth strategy also gets the axe. The legislation not only kills conversions of after-tax contributions, but in the case of employer plans, the after-tax contributions themselves.

To Panic or not to Panic?

The loss of the Backdoor Roth IRA is a serious bummer, but it does appear that taxpayers will still be able to contribute to a non-deductible traditional IRA when they exceed Roth income limits ($140K/$208K for single/married in 2021). That should still allow tax-deferred growth on the earnings.

Possible Strategies

Acting off of proposed legislation can be a big leap. Electoral outcomes and tax policies follow a bit of a sine wave over the decades, so tomorrow’s changes could be more favorable to savers than today’s. As always, the crystal ball is Code 3.

Since it’s not unheard of for Congress to act at the 11th hour in December as the tax year closes, many taxpayers will need to posture their strategy before the law is signed. If the law doesn’t come to be, it’s possible to leave the IRS a tip by paying more than necessary in 2021.

Strategy 1: Backdoor Roth now! If you’ve been waiting to contribute and convert your annual IRA dollars because you like to wrap that up closer to the April 15th filing deadline… don’t. Depending on how the tax law verbiage finalizes, you could miss the opportunity to do one last backdoor Roth IRA.

As always, you should talk to your financial or tax advisor if you’re not certain how this might impact you.

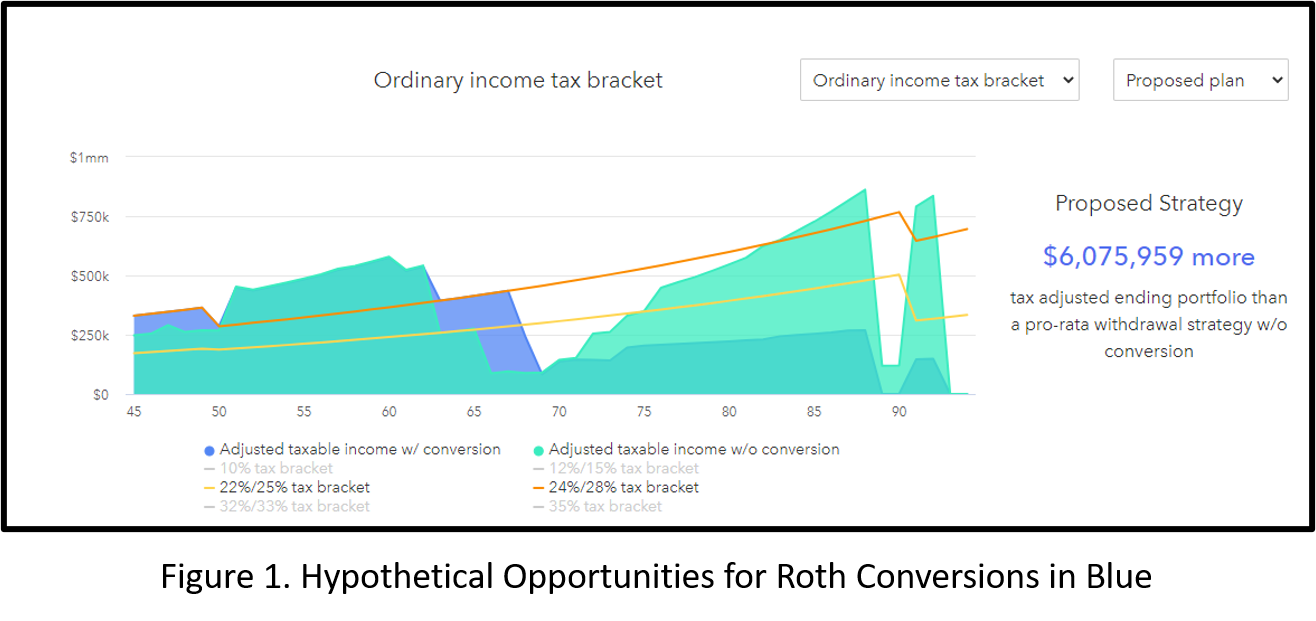

Strategy 2: Convert now! Keeping in mind that even high-income families can Roth convert until tax year 2031, you may want to lean forward on your Roth conversions. Figure 1 below shows in the blue-shaded areas of the graph where this hypothetical family can Roth convert to the top of the 24% bracket (which becomes 28% again in 2026).

If the family takes advantage of the maximum available Roth conversion opportunity, it has serious seven-figure impact on their terminal net worth.

Heads up though… the Roth conversion strategy means paying more taxes today in order to avoid decades of higher tax bills. When you talk to your tax professional, you usually ask, “How can I lower my taxes this year?” The answer won’t likely involve Roth conversions.

When you ask your financial planner, “How can I pay the least taxes over my lifetime?” The answer may involve Roth conversions this year. Since these are at odds, make sure you’re doing diligent planning with your team to choose the best strategy for your overall plan.

What’s not Impacted

The proposed tax legislation doesn’t seem to affect a lot of mainstays of tax-advantaged saving. I.e., high-earners should still be able to contribute to their Roth TSP/401(k). If you’re below the IRS limits, you can invest directly into a Roth IRA. Roth conversions are largely allowed and will be for most taxpayers. Traditional IRAs are still available for those under the income limits too.

Cleared to Rejoin

The proposed tax law changes are just that—proposed. No need to panic, but definitely time to plan and prepare to take action. Here are action steps you can take now to optimize your tax bill over the decades:

- If a Backdoor Roth was part of your 2021 plan. Get ‘er dun, all the way, comfortably before December 31st

- If you’re considering Roth conversions this year, it’s time to evaluate whether or not your conversion window might narrow or close in the out-years so you can optimize this year.

- If you’ve been planning to open a Solo 401(k) to enable future Mega Backdoor Roth IRAs, perhaps verify that you’d open the same one even if you can’t do Mega Backdoor Roth IRAs.

- If you do have after-tax dollars in an IRA, and have been meaning to Roth convert those dollars, you may be able to flush the earnings into your TSP/401(k) and only Roth convert the contribution dollars (that you’ve already paid taxes on).

- Keep an eye on the news and keep in touch with your financial and tax professionals to max-perform your 2021 and future opportunities.

Fight’s On!

Winged Wealth Management and Financial Planning LLC (WWMFP) is a registered investment advisor offering advisory services in the State of Florida and in other jurisdictions where exempted. Registration does not imply a certain level of skill or training.

This communication is for informational purposes only and is not intended as tax, accounting or legal advice, as an offer or solicitation of an offer to buy or sell, or as an endorsement of any company, security, fund, or other securities or non-securities offering. This communication should not be relied upon as the sole factor in an investment making decision.

Past performance is no indication of future results. Investment in securities involves significant risk and has the potential for partial or complete loss of funds invested. It should not be assumed that any recommendations made will be profitable or equal the performance noted in this publication.

The information herein is provided “AS IS” and without warranties of any kind either express or implied. To the fullest extent permissible pursuant to applicable laws, Winged Wealth Management and Financial Planning (referred to as “WWMFP”) disclaims all warranties, express or implied, including, but not limited to, implied warranties of merchantability, non-infringement, and suitability for a particular purpose.

All opinions and estimates constitute WWMFP’s judgement as of the date of this communication and are subject to change without notice. WWMFP does not warrant that the information will be free from error. The information should not be relied upon for purposes of transacting securities or other investments. Your use of the information is at your sole risk. Under no circumstances shall WWMFP be liable for any direct, indirect, special or consequential damages that result from the use of, or the inability to use, the information provided herein, even if WWMFP or a WWMFP authorized representative has been advised of the possibility of such damages. Information contained herein should not be considered a solicitation to buy, an offer to sell, or a recommendation of any security in any jurisdiction where such offer, solicitation, or recommendation would be unlawful or unauthorized.