Roth vs. Charity vs. Tax—Who Wins?

Roth vs. Charity vs. Tax—Who Wins?

Your fini-flight is in the books and you’re wearing that tiny USAF Retired pin on your lapel. Clearly, the first thing on your mind is, “How do I deal with the tax bomb coming from this pile of Traditional TSP dollars?” If that’s true, you’re weird like me, so keep reading. If not, you’ll eventually have this thought, so keep reading anyway.

Traditional TSP Tax Bomb

At the risk of melodrama, a sizeable Traditional TSP balance really can be a tax bomb. Imagine you’re 45 with a Traditional TSP balance of $350K. If you earn 10% on that pile until Aunt IRS requires you to take RMDs (required minimum distributions) at age 72, your balance could be $4.5 million. Where’s the problem?

If you’re 72 today with a Traditional TSP balance of $4.5M, your first RMD is $175K. If that were your only income as a married couple, you’d be in the 24% federal tax bracket. It’s probably not your only income if you’re reading this because you likely have a military pension of at least $50K and you’re over 70 so you’re claiming Social Security for another say, $25K.

If this combined $250K is your only income, you’re still in the 24% bracket today, but your tax bill is steep and you’re now paying the “phantom” tax of IRMAA (Income-Related Monthly Adjustment Amount) which in 2021 is $386 per spouse per month or an extra $9,264 per year. On an income of $250K, that’s basically an extra 4% tax. Don’t forget about the possibility of the .9% additional Medicare tax and the 3.8% Net Investment Income Tax (NIIT) which could be triggered depending on your actual sources of income.

If you had no Traditional TSP, in this scenario, your income (as seen on your tax return) would be $75K. In 2021, there’s a lot of tax tailwinds at that level: no IRMAA, 0% Long-Term Capital Gains (LTCG) rates (up to $80K) and the 12% tax bracket to name a few.

So yes, an outsized Traditional TSP balance could make something explode—your head, when you read the “what you owe” line of your tax return.

Defusing the Traditional TSP Tax Bomb

The first step in defusing the Traditional TSP Tax bomb is to consider converting Traditional TSP dollars to Roth dollars. You’ll need to roll the money out of the TSP into an IRA and pay tax on the conversion at your current top marginal rate, e.g. 22% or 24%. Once tucked away in your Roth IRA, those dollars grow and remain tax-free until you use them after age 59.5, or up to 10 years after you leave them to your heirs.

If you pull out your handy-dandy 3-1.Money (sorry-it’s still in coord at the 2 Star level…), you’ll find the unfortunate rule that you can’t do a Roth conversion on your TSP dollars until after you retire or separate from the military. The best you can do to manage a sizable Traditional TSP balance while you’re still active/ANG/ARC is to contribute to the Roth TSP instead. Even that decision might not be the best fit based on your combined family income in a given year!

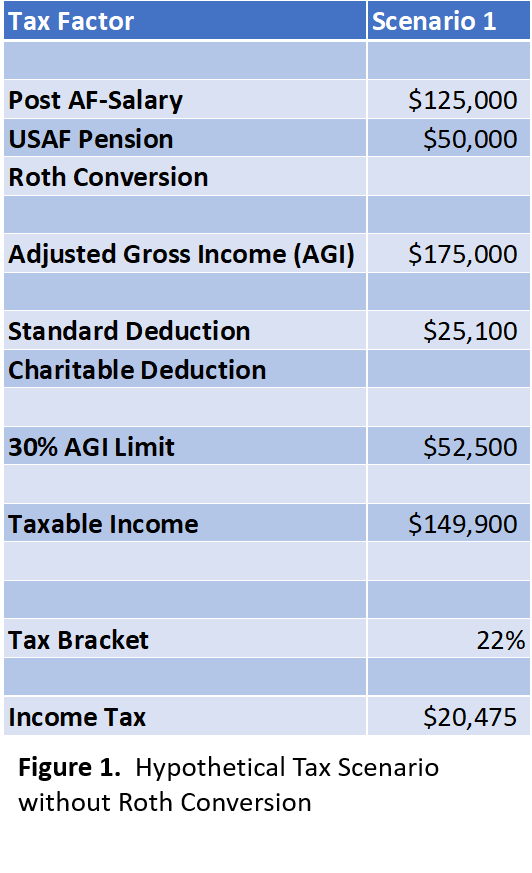

Let’s take a look at a scenario. Assume you’re newly retired/separated from active duty, married with no children, making $125K plus a $50K military pension. Figure 1. shows the highlights of your 2021 tax return: Your AGI is $175K, your tax bracket is 22%, and your bill is $20,475. You’re taking the standard deduction of $25,100 because, like 90% of taxpayers post-2018, you can’t itemize your deductions.

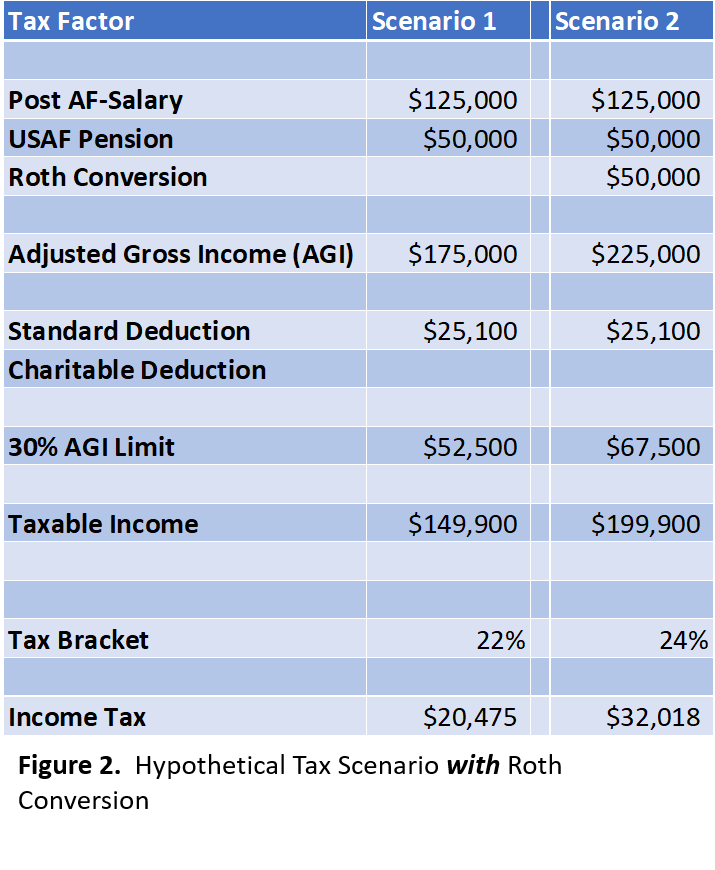

Now let’s assume that you want to avoid the Traditional TSP tax bomb and start converting your Traditional TSP balance to a Roth IRA as seen in Figure 2. Your financial planner runs the numbers and suggests converting $50K per year until the Traditional balance is depleted.

Looking at a side-by-size comparison, your AGI is now $225K, your bracket is 24% and your tax bill is $32,018. You paid $11,543 in extra income tax to convert that $50K to Roth. (23.1% tax for those of you using an abacus at home!)

That extra tax bill is still better than the effects of a sizable Traditional TSP tax bomb in your 70’s, but what if there was a way to get someone else to pay that tax bill for you?

Charity Defuses the Tax Bomb

If you’re charitably inclined, you have an extra tool in your tax bomb kit. Let’s imagine that in addition to your chunky Traditional TSP balance, you’ve also been dabbling in stocks in your taxable brokerage account. If you bought 10,000 shares of (hypothetical) ticker FTR when it IPO’d at $.35 back in March 2009 you spent $3,500, but it’s now worth $35 a share, and you have $350,000 worth of a single stock on your balance sheet.

Let’s assume that your investment thesis for holding FTR has run its course, but you’re not interested in recognizing the punch-in-the-neck tax bill from selling shares at a nearly 100% gain. (If you sell $50K of FTR, your LTCG tax bill is probably $7,500.) Depending on the rest of your tax scenario, you could also be phased out of certain credits and other deductions.

What if you donate some of that FTR stock to your favorite qualified charitable organization in the same year you do a Roth conversion?

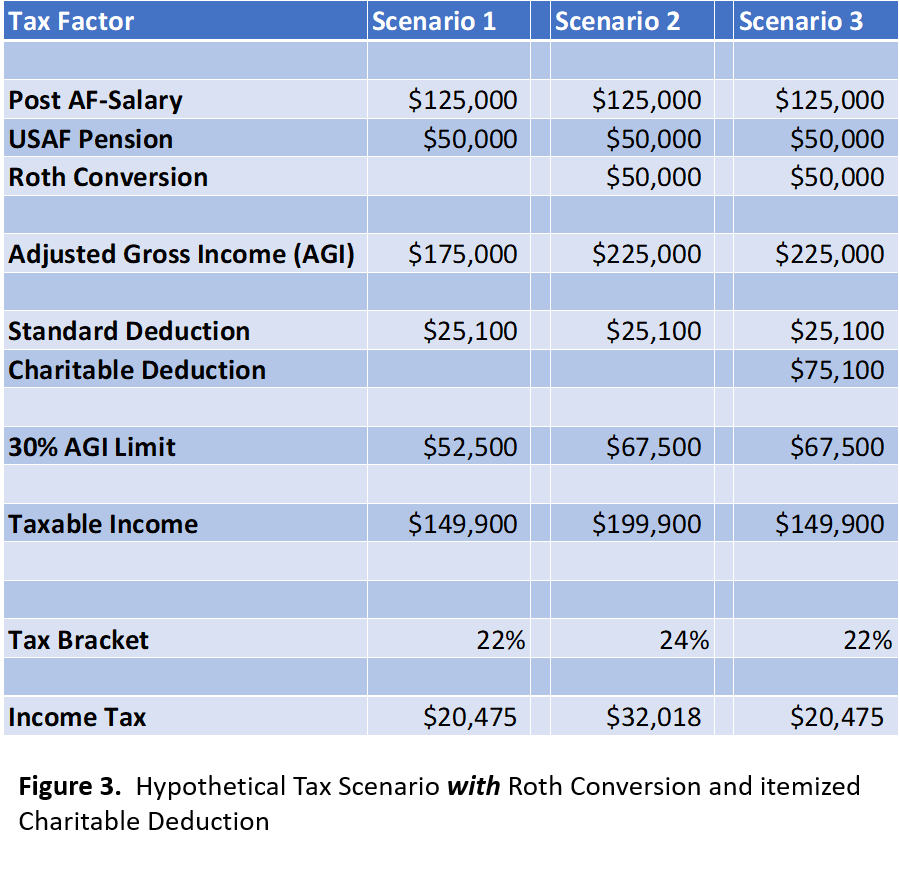

Figure 3. shows the effect. Assuming the same facts as earlier, your tax bracket is back down to 22% and your tax bill is back down to $20,475. That charitable donation has a triple-whammy effect:

- Skip paying LTCG tax (and potential .9% Medicare and 3.8% NIIT)

- Offset the Roth conversion income and reduce income tax

- Erase from your balance sheet taxable gain from a stock that you no longer want to own

Now, for those of you at home plugging this into your own favorite tax projection software, you may notice some trickery going on. There is a limit for deducting capital gain assets—30% of your AGI. In this scenario, you’d have to donate $75,100 to make up for the $25,100 standard deduction and $50K Roth conversion, but the 30% limit is $67,500. You wouldn’t actually get to deduct all $75,100 of the FTR stock donation this year. You would have to carry the extra $7,600 forward to the next tax year.

While this could be the case for some taxpayers, once you’re able to itemize, i.e., you have deductions over the current standard deduction of $25,100 for married couples, then you can itemize things like your state and local taxes (SALT) up to $10,000 and your mortgage interest (up to $750K of a mortgage).

So, while you couldn’t get to $75,100 of itemized deductions with a charitable donation alone in this scenario, you probably could with your SALT and mortgage interest. I skipped this for simplicity in the original scenarios.

Cleared to Rejoin

If you’re a fellow silverback, you probably have some Traditional TSP dollars. The TSP didn’t accept Roth contributions until 2012. Lots of steely-eyed killers put their TSP contributions in fire-and-forget mode, so a Traditional TSP balance is pretty common.

To Roth-convert or not Roth-convert is an annual tax projection exercise, but sooner or later, most of us will need to stare down this issue. If your Traditional TSP is starting to make a ticking noise, you might want to look at how to offset the tax bomb.

Charitable donations don’t have to be cash, but that broken Ikea Glubenförkên that you dropped off at Goodwill isn’t going to nudge your tax bill much if you can’t itemize. If you’ve got appreciated assets that make sense to offload, you might as well offset some income with them.

The title of this article suggests a 3-way fight between Roth conversions, charities, and your tax bill. Who wins? If you do it right—everyone.

Fight’s On!

Winged Wealth Management and Financial Planning LLC (WWMFP) is a registered investment advisor offering advisory services in the State of Florida and in other jurisdictions where exempted. Registration does not imply a certain level of skill or training.

This communication is for informational purposes only and is not intended as tax, accounting or legal advice, as an offer or solicitation of an offer to buy or sell, or as an endorsement of any company, security, fund, or other securities or non-securities offering. This communication should not be relied upon as the sole factor in an investment making decision.

Past performance is no indication of future results. Investment in securities involves significant risk and has the potential for partial or complete loss of funds invested. It should not be assumed that any recommendations made will be profitable or equal the performance noted in this publication.

The information herein is provided “AS IS” and without warranties of any kind either express or implied. To the fullest extent permissible pursuant to applicable laws, Winged Wealth Management and Financial Planning (referred to as “WWMFP”) disclaims all warranties, express or implied, including, but not limited to, implied warranties of merchantability, non-infringement, and suitability for a particular purpose.

All opinions and estimates constitute WWMFP’s judgement as of the date of this communication and are subject to change without notice. WWMFP does not warrant that the information will be free from error. The information should not be relied upon for purposes of transacting securities or other investments. Your use of the information is at your sole risk. Under no circumstances shall WWMFP be liable for any direct, indirect, special or consequential damages that result from the use of, or the inability to use, the information provided herein, even if WWMFP or a WWMFP authorized representative has been advised of the possibility of such damages. Information contained herein should not be considered a solicitation to buy, an offer to sell, or a recommendation of any security in any jurisdiction where such offer, solicitation, or recommendation would be unlawful or unauthorized.

Roth vs. Charity vs. Tax—Who Wins?

Roth vs. Charity vs. Tax—Who Wins?