Let’s start by skipping the “death and taxes” cliché… whoops. Moving on, let’s assume that you’ve decided to take the bonus. It’s a ton of cash and some serious opportunity to light the blower on your retirement savings. But what about the tax implications? You know you have to pay the tax man, but you don’t want to over-pay or leave a tip, right? How do you know which version of the bonus take? How much, if any, should you take up front?

Unfortunately, the answer is a unique as you and your family, because it’s heavily dependent on your consumption and savings, as well as other sources of income and deductions. While most of us take pride in being a stalwart do-it-yourself type, this is one choice where the modest cost of professional analysis could literally save you tens of thousands of dollars in overpaid taxes. So, before you extrapolate the following analysis to your situation, make sure you understand the assumptions and how they need to be adjusted for your situation. Ultimately, most pilots would benefit from tax planning over the decades, not just the current year. This analysis should highlight that challenge.

Assumptions

As you know from countless hours around the mission planning table, we should only make assumptions when they’re necessary to continue planning. In the case of tax planning, assumptions are critical, but like all models, they’re also flawed. The following assumptions are necessary to answer the question: “What is the most tax-efficient method for taking the aviation bonus over the life of the bonus?”

- Income: This analysis assumes that the only income reported for the pilot (and family) is base military pay and monthly fight pay, with base pay increasing a 1.8% over the bonus and paygrade increasing in line with historical norms. If a working spouse or side hustle is adding income to your household, this analysis won’t hold. This also assume promotion on time through the rank of Colonel.

- Standard Deduction: The household will take the standard deduction, not itemize, and the standard deduction for single filers (S) increases $200 per year, $400 per year for married filing jointly (MFJ).

- TSP: In order to create the best-case tax scenario, we’ll assume that the pilot contributes the maximum to the Traditional TSP every year and that the allowable contribution goes up $500 every 2 years. This is critical, because if you contribute less than the maximum, or contribute to the Roth TSP, your tax bill goes up.

- Spouse IRA: Except when phase-out limits are exceeded, we’ll assume that a MFJ pilot contributes the maximum to a deductible Traditional Spouse IRA and that the limit goes up $500 every two years. Again, this is critical because failing to use this tax-advantaged savings opportunity increases your tax bill.

- Inflation: Assume that inflation of tax brackets is a constant 2.5%.

- Additional Medicare Tax: Assume that the thresholds for the 0.9% additional Medicare Tax do not increase. Currently the limits are $200K for (S) and $250K for (MFJ).

- Tax Brackets and Rates: Assume that the current tax rates do not sunset in 2026. The 2017 tax changes will revert in 2026 unless extended or modified. As my crystal ball remains NMC-S, I will merely remind you that we have a large national debt and exploding entitlement programs to eventually pay for, thus taxes may increase in the future.

- The year 2020. Clearly, a do-over would be a nice option for 2020, and the window for taking the bonus is closed. Therefore, this analysis uses 2020 numbers, but unless the bonus program changes drastically for 2021, the numbers are relevant for analysis.

- The Bonus. Assume that you choose either: $35K for 12 years or $100K up front for 10 years (but remain in the AF for 12 years) or $200K up front which requires 12 years. It’s likely there will be other options, but for simplicity we’ll only look at these three cases. This brings up another difficult choice in analysis. $35K per year for 12 years is $420K, but a 10-year bonus only brings in $350K. More on this below.

- Social Security and Medicare Taxes. Remember that you’ll pay 6.2% up to the Social Security wage base ($137,700 in 2020) and 1.45% on all wage earnings. The future of these taxes is unclear, but our population is aging, so increases are a reasonable expectation.

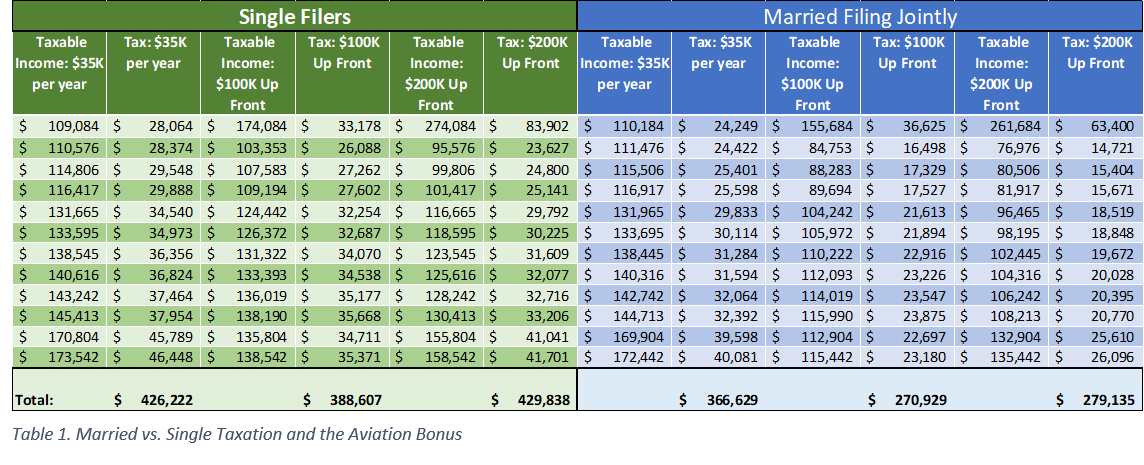

Okay, I get it– “JUDY” on the assumptions. Hopefully this paints a picture of how complex the tax decisions around the bonus can be. So, what’s the bottom line? All things being equal, Table 1 shows that for both Single and Married Filing Jointly pilots, taking $100K up front is the most tax efficient over the 12 years of the potential bonus since the pilot pays a total of $388,607 (S) and $270,929 (MFJ) in income, Social Security, and Medicare taxes. For Single pilots, this is $37,615 less than the tax bill from taking $35K per year with nothing up front and $41,231 less than taking $200K up front. For married pilots, the differences are $95,700 and $8,206 respectively. Before taking the plunge on the $100K up front, remember that it is a 10-year bonus and only $350K in compensation, vs. the $420K total compensation from a 12-year bonus. Put another way, a single pilot pays around $40K more in taxes to earn get the extra $70K of a 12-year bonus. A married pilot pays between about $8K and whopping $95K more for the extra $70K of the 12-year bonus. There’s a lot more to consider though…

Observations

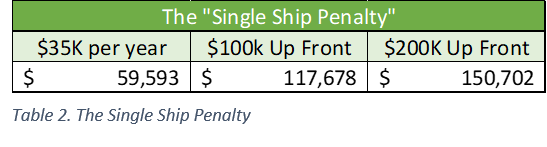

Table 1 offers a great deal of food for thought. The disparity in taxation for Single Pilots is stark. This comes from several tax headwinds. First, Single filers get half the standard deduction. This means that Single pilots eligible for the bonus are most likely tree’d in at least the 24% Marginal Tax Bracket. What’s more is that, because the military offers a retirement plan, single pilots cannot make a tax-deductible contribution to a Traditional IRA in order to further reduce their current tax bill. Finally, our tax brackets effectively penalize a single pilot compared to her married counterpart. Both earn the same compensation, but the tax brackets climb much faster for the single pilot such that when taking $200K up front, a single pilot gets whacked with the 35% tax bracket. A married pilot would have to earn over $414K to touch the 35% bracket. Table 2 – “The Single Ship Penalty” lays out the difference in married versus single tax bills in each bonus scenario. I wouldn’t rush out for a mail-order spouse to avoid the Single-Ship Penalty, but I would consider hitting a Justice of the Peace before December 31st of my first bonus year if a marriage was on short final… Finally, if you’re planning on staying in for 12 years, there’s less than $4,000 difference between total taxation for the $200K Up Front option. This could be very beneficial if the single pilot gets married some during the course of the bonus years.

Married pilots fare way better when choosing bonus options. Twelve-year tax projections are better in every case ($0, $100K, or $200K Up Front) for married pilots. Married pilots climb the tax brackets slower with the same income. As such, they pay significantly less in taxes over the years and only pay total of $8,207 more when taking $200K up front versus $100K up front. Married pilots can also contribute to a deductible Traditional IRA for their spouse in most years since their Adjusted Gross Income (AGI) won’t exceed the phaseout range.

Savings Rate is a key driver of this analysis. Recall from the litany of assumptions above, we assume that bonus-takers max out their tax-advantaged opportunities. In 2020 and 2021, that means $19,500 into the TSP and another $6,000 into a Spousal IRA if married. There are some among us who save $25,500 for retirement as a newly bonus-eligible major, and they’re going to be very wealthy one day. I’ll wager that most pilots haven’t leaned in on retirement savings to this level. If you’re going to consume your bonus payments rather than sock away the maximum for your Tax-Advantaged Accounts (TAAs), you’ll pay even more. (Hope you like the matching Teslas, but be careful not to have to live in them when you’re 65.) If you’re read this far, I’m betting you’re keen to use the bonus to solidify your future by saving in your TAAs, and you can always learn more by reviewing 4-I-4-T. (Hyperlink)

Tax planning isn’t as sexy as investment planning and most of us don’t get further than looking for deductions and using TAAs. But for major money muscle-movements like an income spike, tax planning is critical. As a sneak peak, if you’re an O-5 or higher, you’ve probably got most or all of your money in the Traditional TSP. There will likely come a time when you realize that converting some of that money to Roth dollars is critical wealth-building strategy. That’s likely to be another income spike, and you’ll have limited options of which years you can do it while controlling your other income sources. Early upgrade to wide-body Captain? Probably another income spike. It couldn’t hurt to consult your tax professional or financial planner to make sure that you’re planning taxes over the decades, not just April 15th.

Summary

I have to foot-stomp again, this analysis is exquisitely sensitive to the plethora of assumptions I laid out. You definitely shouldn’t use it as a sole source for your Aviation Bonus plans. Glaringly absent is any consideration of the time value of money of the taxes you pay today or the growth from a well-invested upfront bonus check. Ideally, you’ll consider that anytime you could have a significant change in your family’s income, you might be getting ready to leave the tax-man a tip. You’re better off to incorporate tax planning for your decades into those decisions as it could save far more than you’d ever pay a professional for analysis. Finally, we all like to sport-gripe about things like taxes and most of us know not only our marginal tax rate, but our effective rate as well. What’s your savings rate? Chances are that will be the wealth thrust that far out-strips tax drag.

Winged Wealth Management and Financial Planning LLC (WWMFP) is a registered investment advisor offering advisory services in the State of Florida and in other jurisdictions where exempted. Registration does not imply a certain level of skill or training.

This communication is for informational purposes only and is not intended as tax, accounting or legal advice, as an offer or solicitation of an offer to buy or sell, or as an endorsement of any company, security, fund, or other securities or non-securities offering. This communication should not be relied upon as the sole factor in an investment making decision.

Past performance is no indication of future results. Investment in securities involves significant risk and has the potential for partial or complete loss of funds invested. It should not be assumed that any recommendations made will be profitable or equal the performance noted in this publication.

The information herein is provided “AS IS” and without warranties of any kind either express or implied. To the fullest extent permissible pursuant to applicable laws, Winged Wealth Management and Financial Planning (referred to as “WWMFP”) disclaims all warranties, express or implied, including, but not limited to, implied warranties of merchantability, non-infringement, and suitability for a particular purpose.

All opinions and estimates constitute WWMFP’s judgement as of the date of this communication and are subject to change without notice. WWMFP does not warrant that the information will be free from error. The information should not be relied upon for purposes of transacting securities or other investments. Your use of the information is at your sole risk. Under no circumstances shall WWMFP be liable for any direct, indirect, special or consequential damages that result from the use of, or the inability to use, the information provided herein, even if WWMFP or a WWMFP authorized representative has been advised of the possibility of such damages. Information contained herein should not be considered a solicitation to buy, an offer to sell, or a recommendation of any security in any jurisdiction where such offer, solicitation, or recommendation would be unlawful or unauthorized.