What to Know About Tax-Loss Harvesting

Investing and personal finance have lots of clunky, technical vocabulary words to help your eyes glaze over, so you can be forgiven if tax-loss harvesting sounds like a great addition to the list. But, tax-loss harvesting (TLH) can be a powerful weapon in your investing arsenal, so you’ll want to understand the basics and when to deploy it.

What is Tax Loss Harvesting?

Let’s start with the tax part. When you sell an investment or personal asset (stock, mutual fund, car, house, etc.) for more than you paid for it, you have a capital gain and the IRS will tax that gain. When you sell an investment asset for less than you paid for it, you have a capital loss and the IRS will let you subtract your losses from your gains.

It’s important to note the subtle difference—gains on personal use assets like houses and cars can be taxed, but the personal asset losses cannot be deducted. If you make a profit on the sale of a non-investment home, part of the profit could be taxed. If you sell a car for more than its adjusted basis—same-same.

Unfortunately, you cannot deduct a loss on a personal home or car.

Back to investment losses—imagine you purchased stock OLDS for $100 and because of a market correction, it’s now trading at $50. If you sell it for $50, then you can use the $50 loss to offset other gains made throughout the year. If you expect to have capital gains, then capital losses can lower your tax bill by reducing the size of your gains.

Watch Out for the Wash

Adding to the list of geeky investing terms today is “wash sale.” A wash sale occurs when you sell an investment asset for a loss, but make a purchase of a “substantially identical asset” within 30 days before or after the loss. When a wash sale occurs, the loss is “washed away” or disallowed by the IRS.

If you sell OLDS for a $50 loss, but buy it back 29 days later at $55, the IRS just adds your original $50 loss to the new price to give you a basis of $105 in the stock. Future transactions of those shares will be based on a purchase price of $105.

Wash sale rules exist to keep investors from generating sham transactions just to erase gains. Newbie investors frequently shed tears on April 15th when the reality of the wash sale rule comes home to roost.

Currently, wash sales rules apply to stocks, bonds, mutual funds, ETFs, options, futures, and warrants. Conspicuously absent, at least for now, are digital assets. So, while Aunt IRS will tax your gain on PugCoin sales, you get to offset those gains with losses…for now. It’s widely expected that future changes to the tax code will snuff out this loop hole on digital assets.

The “substantially identical” aspect of securities means that you can’t sell OLDS stock at loss and then buy OLD options or warrants within 30 days. That said, you could sell one index fund and then buy a fund tracking a different index—they are not the same.

What to Sell?

Since 2012, brokerages are required to track share purchases individually—by “specific lot,” rather than just calculating the average cost of all of your shares. This is crucial to effective tax-loss harvesting.

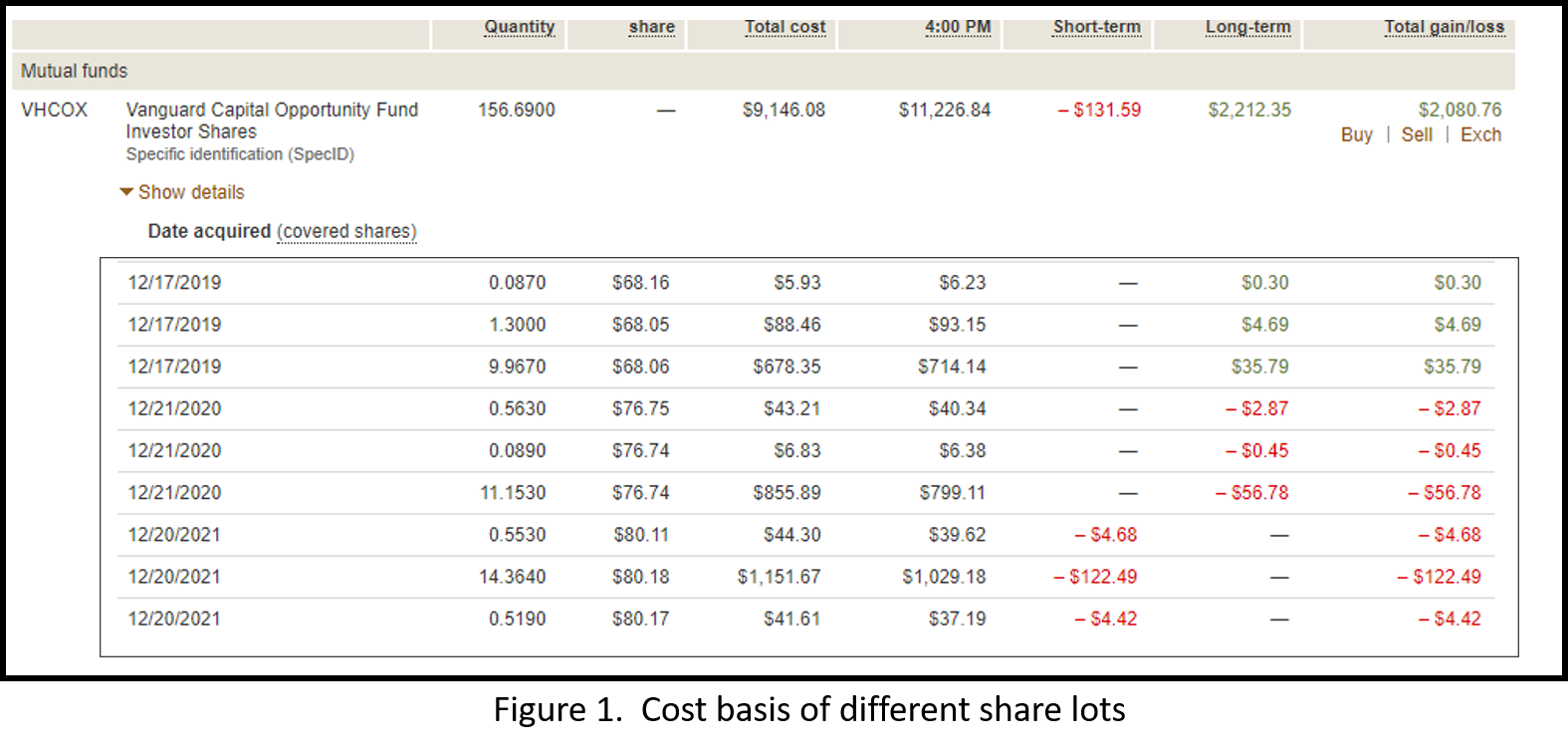

Figure 1. shows a series of transactions in a mutual fund. We can see that shares were purchased over the years, but the most recent purchase “lots” since December 2020 all reflect a loss. Some are short-term and some are long-term.

The short-term losses only stem from purchases of shares (or fractions of shares) within the past 365 days. The long-term losses come from purchases greater than one year ago.

If the investor sells these shares that are currently trading at a loss, the sum of the losses will be available to offset capital gains the rest of the year.

Everyone is Above Average, Right?

If your currently only tracking shares of your mutual funds, ETFs, or stocks by average price, then it is much more difficult to tax-loss harvest. In fact, if you own shares purchased over a significant period, say, 2010 through late 2021, there’s a good chance that any losses are so outweighed by gains that they won’t show up at all.

So, if you haven’t switched to tracking shares by specific lot and you want to add tax-loss harvesting to your tool kit, it’s time to login to your taxable accounts and make the switch.

When to Harvest

The first requirement for TLH is that you actually have to have shares trading at a loss—i.e., the market is probably in a correction. There haven’t been many periods of correction since March 2009, but December 2018, March 2020, and the period since January 2022 do stand out.

The entire market doesn’t need to be down, but it’s usually a good signal to check your various share lots to see if any losses can be harvested.

A common question is, “if I like the investment, why sell if I believe the price will come back?” The answer is simple—if you believe it’ll come back, buy some more 31 days later but snatch the losses while you can. Your future self will thank you on April 15th.

Beyond the Taxes

While harvesting tax losses is the core reason for TLH, shaping your portfolio is another great reason to sell off losers.

It’s not uncommon that our current self doesn’t like what our younger self bought. Maybe you got hornswoggled by the brokerage lurking outside the base gate when you were a lieutenant. Now you realize those class-A shares of active funds don’t fit into your investment plans. Tax-loss harvesting is the perfect way to prune them out of your portfolio.

Every time you tax-loss harvest, you’ll have cash to purchase other assets that you really want. Chances are, the assets that you purchase with loss proceeds will be trading at a discount too, so you can at least feel good about that!

Cleared to Rejoin

Tax-loss harvesting is one of the most powerful tools in your investing arsenal. Savvy investors routinely look for losses to offset gains and shape their portfolio. Tax-loss harvesting can lower your tax bill, potentially for years while giving you a second chance to purchase the right investments for your needs. Action steps you can take to today:

- Switch to tracking share prices by specific lot at your brokerage

- Calculate the amount of any available losses

- Talk to your financial planner about how best to use the proceeds from loss sales

Fight’s On!

Winged Wealth Management and Financial Planning LLC (WWMFP) is a registered investment advisor offering advisory services in the State of Florida and in other jurisdictions where exempted. Registration does not imply a certain level of skill or training.

This communication is for informational purposes only and is not intended as tax, accounting or legal advice, as an offer or solicitation of an offer to buy or sell, or as an endorsement of any company, security, fund, or other securities or non-securities offering. This communication should not be relied upon as the sole factor in an investment making decision.

Past performance is no indication of future results. Investment in securities involves significant risk and has the potential for partial or complete loss of funds invested. It should not be assumed that any recommendations made will be profitable or equal the performance noted in this publication.

The information herein is provided “AS IS” and without warranties of any kind either express or implied. To the fullest extent permissible pursuant to applicable laws, Winged Wealth Management and Financial Planning (referred to as “WWMFP”) disclaims all warranties, express or implied, including, but not limited to, implied warranties of merchantability, non-infringement, and suitability for a particular purpose.

All opinions and estimates constitute WWMFP’s judgement as of the date of this communication and are subject to change without notice. WWMFP does not warrant that the information will be free from error. The information should not be relied upon for purposes of transacting securities or other investments. Your use of the information is at your sole risk. Under no circumstances shall WWMFP be liable for any direct, indirect, special or consequential damages that result from the use of, or the inability to use, the information provided herein, even if WWMFP or a WWMFP authorized representative has been advised of the possibility of such damages. Information contained herein should not be considered a solicitation to buy, an offer to sell, or a recommendation of any security in any jurisdiction where such offer, solicitation, or recommendation would be unlawful or unauthorized.