How Military Families Avoid the “No-Plan Estate Plan”

Estate planning is crucial for all Americans, but those who served in uniform have some unique considerations to manage. While estate planning probably won’t make anyone’s list of most-anticipated annual financial planning activities, lack of estate planning will absolutely make everyone’s list of grief-amplifiers. This article helps military families defend territory that often gets forgotten or delayed until it’s too late.

Everyone Has an Estate Plan…

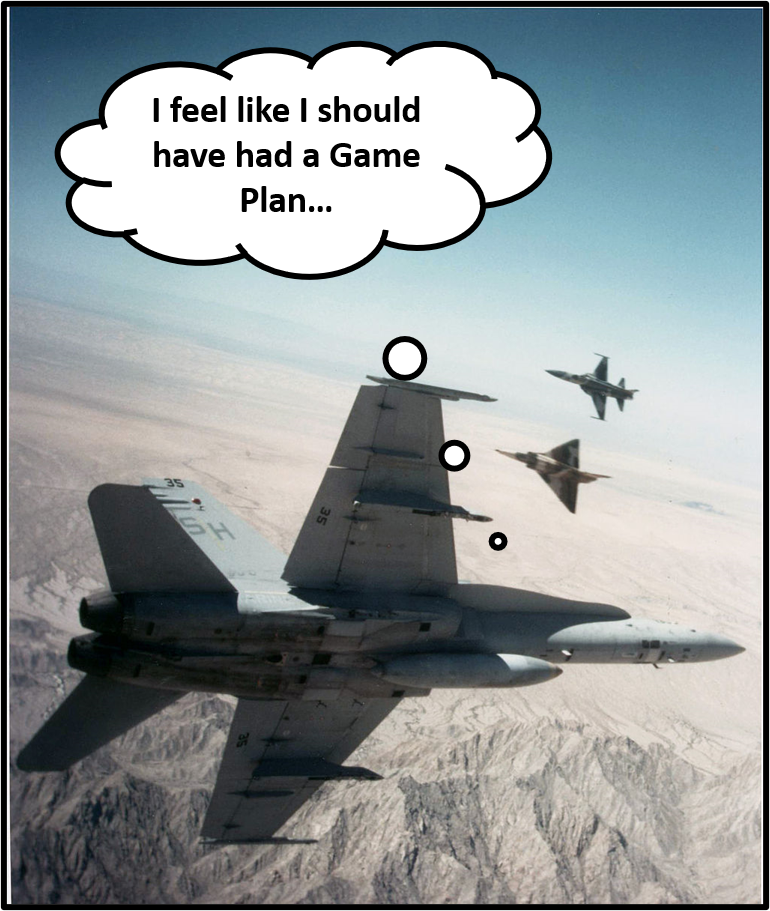

As an instructor pilot, I’d occasionally encounter a student that had what I called “the No-Plan Gameplan.” Whether it was lack of will, skill, knowledge, or preparation, it was pretty obvious when the student didn’t really have a plan to kill the target or survive the threats. Hope was the students apparent tactic, but history has usually demonstrated that hope is a poor substitute for adequate planning and preparation.

The No-Plan Estate Plan is the basic plan that all of us start with—if we die with out plans and documents in place, someone else has to clean up the mess. The state, at a cost of time, frustration, and dollars will impose the law to transfer title of assets and guardianship of minors. Dying without a Will or Trust is called dying intestate. It’s the true No Plan Estate Plan and it’s probably not part of how we’d like our family to remember us.

If you have children, you’ve probably admonished them at some point: “Poor planning on your part does not constitute an emergency on mine.” The No-Plan Estate Plan may not create an emergency, but it will create heartache, expense, delay, and friction at a time when survivors could use some relief from all four.

Free is the Best (Starter) Price

Most military installation Judge Advocate (legal) offices still provide free legal documents to military retirees, but of course you’ll want to check with your local installation to make sure.

Free documents from your installation almost always include the four pillars of basic estate documents:

- Will for each spouse. A Will directs disposition and titling of assets as well as guardianship of minors, disabled adult dependents, and even pets. A Will does not prevent the probate process for transferring assets and titles, but it does streamline it. The No-Plan Estate Plan burdens the courts with determining your intentions.

- Healthcare Power of Attorney (POA) for each spouse. This document expresses your wishes for a trusted agent to make healthcare decisions while you’re incapacitated. The No-Plan Estate Plan invites the courts to do this.

- Living Will / Advanced Directive for each spouse. This document expresses your end-of-life decisions. Again, the No-Plan Estate Plan asks the courts to potentially get involved.

- Power of Attorney for each spouse. A POA can be durable—valid for use at any time, or springing—it springs into validity upon a triggering condition such as incapacity. While none of us plans to become incapacitated, an injury or even the onset of dementia are common causes that both sneak up on us. This document gives your trusted agent the ability to act on your behalf when you cannot.

These four documents can be thought of as the four basic pillars of an estate plan, and when they can be had for free, there’s really no good excuse for delaying action.

If Free isn’t an Option

If your local installation isn’t able to provide free basic estate documents, or you’re a veteran but not a retiree (and not entitled to military legal documents services), you may need to get your basic estate documents “on the market.” Additionally, you might want to consider a Revocable Living Trust which military legal offices won’t provide. Here are some considerations you’ll want to keep in mind.

A Holographic Will is a hand-written basic will. State law will likely determine how courts will interpret a holographic will, but it’s likely better than leaving no will at all—dying intestate.

The internet age has birthed many online legal document companies. Some are completely DIY (do it yourself), but others will include a call or video call with an attorney licensed in your state—”DIY-plus” if you will. You’ll probably still carry the burden of getting documents notarized and witnessed, but you’ll be more assured that your intentions will be carried out because of the professional design of the documents.

A live, local estate attorney may carry the highest price upfront for document preparation, but has many advantages over DIY or DIY-plus methods. An experienced attorney should know the nuances of your state’s laws and be able to walk you through the whole process. This is especially important if your state has complicated homestead laws that could be affected by how you title a home that you put into a Trust. Additionally, if you have properties in multiple states, you’ll likely need professional help to navigate the laws of various jurisdictions.

Free probably isn’t an option for any sort of Trust, such as a Revocable Living Trust. But a Trust has many advantages over a stand-alone Will. If properly established, with appropriate assets titled to the Trust, then a Trust avoids the probate process entirely.

Probate avoidance is a key reason to establish a Trust. Probate has three main problems:

- Cost – Attorney, court, and other fees

- Time—Courts don’t move at lightning speed and heirs may be waiting on inheritances

- Public—Probate is a process open to the public

Another great reason to work with a local attorney is “the last mile” problem. Getting a Trust drawn up, signed, notarized, and witnessed is important, but getting assets titled to the Trust is crucial. A Trust with no assets titled to it doesn’t put your estate plan into action. The last mile, titling assets to the Trust, can be confusing and require professional assistance. Most attorneys will offer this as part of their services, but an online company may have a harder time getting you through that last mile to an effective, in-force plan.

When do you Want to Pay?

Military families often build very toned frugality muscles over a career of service. Cost sensitivity can be the difference between building wealth and just getting by for some families. However, there are times to consider more than just the sticker price.

The probate process can be expected to cost a percentage of an estate’s assets. If you assume that probate, including attorney fees, court costs, re-titling costs, and potential executor costs equal 5% of the estate, then even a modest $100K estate could be expected to cost $5K through probate.

A holographic will is free, but if it creates a snarl in probate court, then it might cost several thousand dollars to remedy. If the public nature of probate invites a contest, the costs will likely grow.

A DIY or DIY-plus Will probably costs a few hundred dollars, but a Will doesn’t prevent probate or its minimum costs. A professionally prepared Will may be less likely to invite a contest, but it will still be exposed to the public through probate.

A properly built estate plan, including a Revocable Living Trust and pour-over Will may cost a few thousand dollars. (A pour-over Will is just a Will that “plays goalie” to catch assets not titled to the Trust and put them into the Trust after you die.)

This is a bargain compared to the expected price of probate for even modest estates! Combined with the avoidance of probate’s public aspect and time drag, the initial cost of a Trust might pay for itself many times over in the actual administration of your estate.

If spare cashflow is scarce right now, then suppressing estate planning costs may be prudent. But if your estate will have assets after you pass, it’s worth considering how probate costs might compete with any goals you have to leave a legacy to your heirs. Afterall, the cost of probate is coming directly out of their inheritance.

Cleared to Rejoin

The No-Plan Estate plan is a bad plan. Military retirees can often get the basic four pillar documents for free through military legal offices. Non-retiree veteran families may have to pay out-of-pocket costs, but the minimum threshold of a Will can be had for free and is probably better than the No-Plan Estate Plan.

A Revocable Living Trust is an excellent tool that allows families to trade a few thousand dollars today, for the peace of mind that higher future time, dollar, and public transparency costs will be avoided later.

You’ve spent a lifetime building your wealth—your estate. You spent a large portion of that lifetime serving your country. Now it’s time to serve your family with at least a basic estate plan, so why not start by contacting your local military installation’s legal office today?

Fight’s On!

Winged Wealth Management and Financial Planning LLC (WWMFP) is a registered investment advisor offering advisory services in the State of Florida and in other jurisdictions where exempted. Registration does not imply a certain level of skill or training.

This communication is for informational purposes only and is not intended as tax, accounting or legal advice, as an offer or solicitation of an offer to buy or sell, or as an endorsement of any company, security, fund, or other securities or non-securities offering. This communication should not be relied upon as the sole factor in an investment making decision.

Past performance is no indication of future results. Investment in securities involves significant risk and has the potential for partial or complete loss of funds invested. It should not be assumed that any recommendations made will be profitable or equal the performance noted in this publication.

The information herein is provided “AS IS” and without warranties of any kind either express or implied. To the fullest extent permissible pursuant to applicable laws, Winged Wealth Management and Financial Planning (referred to as “WWMFP”) disclaims all warranties, express or implied, including, but not limited to, implied warranties of merchantability, non-infringement, and suitability for a particular purpose.

All opinions and estimates constitute WWMFP’s judgement as of the date of this communication and are subject to change without notice. WWMFP does not warrant that the information will be free from error. The information should not be relied upon for purposes of transacting securities or other investments. Your use of the information is at your sole risk. Under no circumstances shall WWMFP be liable for any direct, indirect, special or consequential damages that result from the use of, or the inability to use, the information provided herein, even if WWMFP or a WWMFP authorized representative has been advised of the possibility of such damages. Information contained herein should not be considered a solicitation to buy, an offer to sell, or a recommendation of any security in any jurisdiction where such offer, solicitation, or recommendation would be unlawful or unauthorized.