Backdoor Roth IRA Club

TLDR up front… skip this article if:

- Your income is below about $200K (married), $135K (single)

- You like paying more tax than you have to pay

- You don’t have concerns about enough income in retirement

Just kidding. Read the article either way.

I spend a great deal of time helping families and individuals navigate the Backdoor Roth IRA process in order to optimize retirement savings and taxes. I’ve written quite a bit about Backdoor Roth IRA basics here and in the Fighter Pilot Finance group on Facebook. While many readers feel familiar with Backdoor Roth IRAs, few people have heard of Backdoor Roth Club.

What is Backdoor Roth Club? Well… it’s like Fight Club in that it has pretty specific rules and norms, but it’s a lot less violent than Fight Club. You’ll keep your teeth in Backdoor Roth Club.

Backdoor Roth Club is the club you can join when you meet certain criteria:

- Your income is too high for Front Door Roth Club

- You don’t like overpaying your lifetime tax bill

- You want to make sure your diet limits the amount of cat food in retirement

Cheekiness aside, thinking about the transition from “I’ve always just saved in a Roth IRA” to “What is with this Backdoor IRA nonsense?” can really cause a lot of confusion. To clear up the confusion, a new mental model might be helpful. Try this on for size:

“Because I have the fortune to earn a high income, I’ll need to do what other high-income people do. I’m in their club now. I’ll need to figure out what people in this club do.”

If you’ve ever joined any new organization whether it’s a military unit, sports team, country club, pickleball club, gun club, knitting club… you noticed that the club has both rules and norms. If you adapt successfully to both, you probably do just fine in the club.

Backdoor Roth Club Rules

Let’s start with the rules. If you don’t follow these, you’ll probably get a love letter from Aunt IRS, a plus-sized tax bill, and a few new gray hairs from tax stress.

The First Rule of Backdoor Roth Club: Talk about Backdoor Roth Club.

Remember, this isn’t Fight Club, we’re not trying to keep secrets. Backdoor Roth IRAs are easy to mess up and painful to clean up. Get help early and often in the process until you’re fully proficient. Whether it’s from your financial planner, fellow steely-eyed killers in the squadron bar, ChatGPT (kidding… sort of…), or pretty much anyone but an insurance salesperson… get help!

The other rules of Backdoor Roth Club:

- Make sure you don’t have a pre-tax balance in a Traditional IRA, SEP IRA, or SIMPLE IRA. This doesn’t stop you from doing a Backdoor Roth IRA. It just usually stops a Backdoor Roth IRA from making sense. If you have a pre-tax or even after-tax balance in a Traditional, SEP, or SIMPLE IRA, it may pay dividends to get help doing your Backdoor Roth IRA. Note that we’re looking both ways before we cross the street at IRAs—not TSP or 401(k), 403(b), and other employer plans. It’s fine to have a balance in your Roth IRA—those are after-tax dollars. We care about pre-tax dollars and after-tax dollars in pre-tax accounts. (Non-Roth accounts).

- Assuming you have a $0.00 balance in your pre-tax IRAs, you’re cleared hot to deposit the annual maximum for each spouse into each spouse’s Traditional IRA. That’s $6,500 (under age 50) in 2023. Ideally, now each spouse has an after-tax balance of $6,500 ($7,500 over age 50) in their Traditional IRA. If you don’t have a Traditional IRA, you’ll just open one for each spouse to comply with Rule 2.

- Use your brokerage’s process (usually an online “Move Money” or “Transfer between accounts” option) to move the money directly from your Traditional IRA to your Roth IRA. As you can imagine, this is vastly easier if your Traditional IRA and Roth IRA are at the same brokerage.

- Show your homework. Especially if you self-prepare taxes, you’ll need to make sure you account for the Backdoor Roth process, primarily on form 8606 of your tax return. (Form 8606 is the official tax form of Backdoor Roth Club.) Each tax software seems to ask questions differently, and I’ve yet to find one that uses the terminology “Backdoor Roth IRA.” So, we need to tell the software that we made a contribution of $6,500 and a Roth conversion of the same $6,500. The form 1099R that you receive from your brokerage is crucial to the process, but so is telling the software that you did a contribution followed by a Roth conversion.

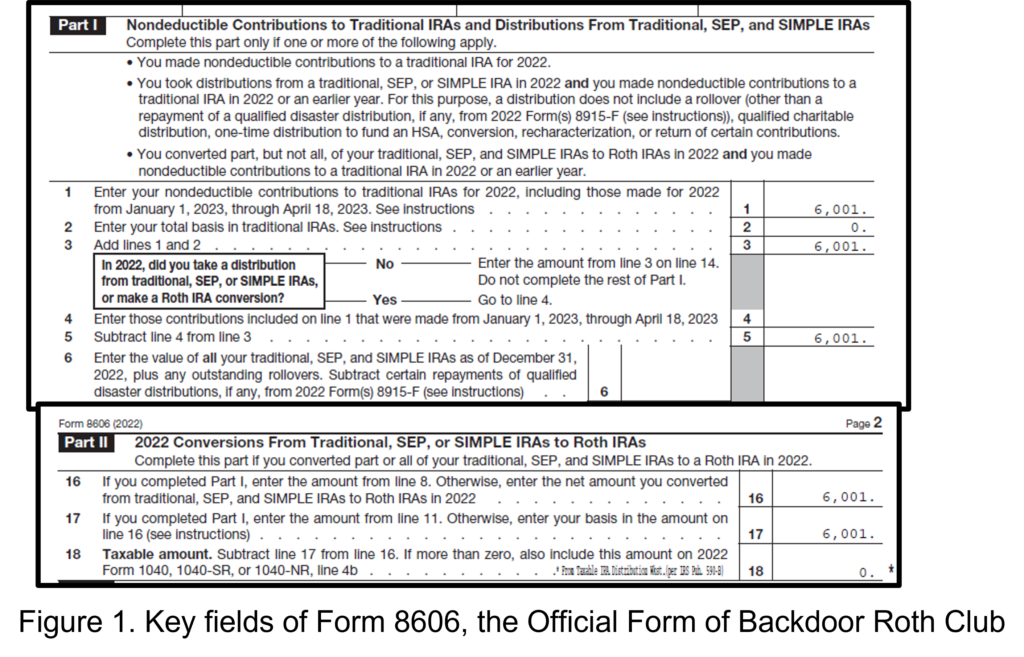

Figure 1. Shows part of form 8606. The lines that are crucial to successfully showing your Backdoor Roth homework are:

- Line 1. The amount you contributed for the tax year.

- Line 2. The after-tax basis you had in your Traditional IRA (including SEP and SIMPLE IRA) prior to the contribution. For most years, this will be $0.00.

- Line 13. The amount of the contribution that is non-taxable. Since you earn too much to deduct this IRA contribution, it should be the whole $6,500.

- Line 16. The amount you converted to a Roth IRA. Again, it should be the whole contribution amount.

- Line 18. Taxable amount of the conversion. Usually this will be $0.00 and that’s certainly the goal. If it’s a small number… a few dollars, that’s not uncommon due to earnings in the Traditional IRA.

That’s it. Those are the hard and fast rules of Backdoor Roth Club.

- Talk about Backdoor Roth Club.

- Put money in a Traditional IRA.

- Convert it to a Roth IRA.

- Show your work on form 8606 with your tax return.

Backdoor Roth Club Norms

You usually don’t need to write down that one ought keep a hat or cell phone off the squadron bar. Everyone knows it. It is a behavior norm. You probably don’t show up to MAML Club (aka Middle-Aged Man in Lycra, aka cycling) club with baggy shorts and flip flops. You wear Lycra and reveal what Lycra reveals. That’s normal in MAML clubs.

Backdoor Roth Club has norms too. You don’t have to follow them, but if you do, you’ll enjoy Backdoor Roth Club a lot more.

Norm 1. Lump Sum, not Dollar-Cost Average. When you were in “Front door” or “Regular” Roth Club, you likely used DCA (dollar-cost averaging) to fund your Roth IRA throughout the year. By depositing 1/12th of the annual limit each month, you not only smooth out your family’s cash flow, but you get to take advantage of market volatility to bring down your average purchase price of investments in your Roth IRA.

Backdoor Roth Club skews to Lump Sum investing rather than DCA for several reasons:

- 2-Step Process. A Backdoor Roth is a 2-step process. First you contribute, then you convert. To keep the process simple and avoid building up pre-tax earnings while the money is temporarily in the Traditional IRA, we don’t want the money sitting in the Traditional IRA very long. Somewhere between 24-48 hours is typical.

If you build up earnings because you forgot to do step 2, the conversion, then you’ll pay tax as you convert those earnings. That’s an unforced tax bill, a tip to Aunt IRS if you will. What are the chances that if you must do a series of 12 contributions and conversions throughout the year… you won’t pork it up and miss the timing a couple of times?

- Is a small amount of pre-tax earnings a big deal? Not really. But you make a lot of money and your time is valuable. Do you really need to be constantly doing contribution then conversion laps around the year? Simplicity is elegance.

- Time in the Market. The second reason for Lump Summing your Backdoor Roth all at once is that, if you do so early in the year, your dollars get a lot of extra compounding time. They’re present on all of the really volatile days, some of which will swing up. You don’t want to miss those.

Norm 2. As early as you can. If you buy the reasons for Lump Sum, then you’ll understand that most folks in Backdoor Roth Club are eager to get their dollars to work as soon as possible. They’re also eager to not have “Do I still need to mess with IRAs for the year?” hanging over their heads for the year. They cross this off the financial to-do list as early as possible.

If your family has excess cash on January 2nd, you’ll be in good company with other Backdoor Roth Club members doing your contributions on the first business day of the year. If it takes a few pay checks to build up the funds for a Lump Sum, no problem. But you’ll find few Backdoor Roth Club members waiting until April 15th of the following year. Time in the market beats timing the market.

Norm 3. Assume you’re in Backdoor Roth Club. If your income could be lumpy and unpredictable some years, especially the year you transition from the military, you’re better off assuming you’ll be in Backdoor Roth Club. See Backdoor Roth Club Fails below.

Rules are rules. Break them and you might not be in the club. Norms are norms. Break them and you won’t enjoy the club.

Backdoor Roth Club Fails

Pretty much all the Backdoor Roth Club Fails come from Rule 1 violations. If you don’t know what you’re doing, and you don’t get competent help, it’s pretty easy to mess up the rules. Here are common Backdoor Roth Club Fails to avoid:

Started the year in a “Front door” or “Regular” Roth IRA… See Norm #3 above. If you make direct Roth contributions only to realize later that you needed to join Backdoor Roth Club, you’re headed to the admin penalty box. You must remove the Roth IRA contributions, potentially pay tax on gains, and then restart the Backdoor Roth process.

“Removing my excess Roth IRA Contributions was a blast.”

–No one ever

“I feel like I deserved 6 hours on hold with my brokerage to fix that Roth IRA mess.”

–No one ever’s friend

If you’re not sure if your income will buy entry into Backdoor Roth Club, find out.

Didn’t know I was in the club. Many families earn too much for “Front door” Roth IRA contributions but do them anyway. What’s worse, they don’t remove the contributions in a timely manner. Aunt IRS has some sweet penalty taxes and interest to say about that. If you suspect you should have joined Backdoor Roth Club a few years back, it’s time to come in from the cold. Talk to a financial planner, Enrolled Agent, Tax Attorney, or CPA. Bad news doesn’t age well. Bad news that compounds ages worse.

Tax Return Shenanigans. I’ll lump these fails all together. Every year, I see:

- Didn’t enter Backdoor Roth data correctly. Paid tax twice on the contributed amount. Paid tax filling fees twice to fix with an amended tax return.

- Didn’t tell tax professional that I did a Backdoor Roth IRA. Paid tax twice on the contributed amount. OR,

- Didn’t tell tax professional that I did a Backdoor Roth IRA. Paid tax twice on the contributed amount. Paid tax filing fees twice to fix with an amended tax return.

- Thought I did Backdoor Roth, but no form 8606. You guessed it… Paid tax twice… paid more filing fees!

- Contributed $6,000… converted $9,000. If you contributed to your Backdoor Roth in early-to-mid March 2020 and then converted in December 2020, it’s quite possible you earned an impressive return due to market conditions that year. But because you delayed the conversion, you paid tax on the earnings. If you convert right after the contribution, all the Roth benefits begin. No tax on the earnings!

Cleared to Rejoin

Backdoor Roth Club is a good club to join. You earn a lot of money and unfortunately, pay a lot of taxes. Following the rules and norms of Backdoor Roth Club keeps you from overpaying your taxes. To get the most out of Backdoor Roth Club, follow the rules, mind the norms, and let someone else do the fails! A good financial planner can help initiate you into Backdoor Roth Club, so if in doubt–See the first rule of Backdoor Roth Club—Talk about Backdoor Roth Club!

Fight’s On!

Winged Wealth Management and Financial Planning LLC (WWMFP) is a registered investment advisor offering advisory services in the State of Florida and in other jurisdictions where exempted. Registration does not imply a certain level of skill or training.

This communication is for informational purposes only and is not intended as tax, accounting or legal advice, as an offer or solicitation of an offer to buy or sell, or as an endorsement of any company, security, fund, or other securities or non-securities offering. This communication should not be relied upon as the sole factor in an investment making decision.

Past performance is no indication of future results. Investment in securities involves significant risk and has the potential for partial or complete loss of funds invested. It should not be assumed that any recommendations made will be profitable or equal the performance noted in this publication.

The information herein is provided “AS IS” and without warranties of any kind either express or implied. To the fullest extent permissible pursuant to applicable laws, Winged Wealth Management and Financial Planning (referred to as “WWMFP”) disclaims all warranties, express or implied, including, but not limited to, implied warranties of merchantability, non-infringement, and suitability for a particular purpose.

All opinions and estimates constitute WWMFP’s judgement as of the date of this communication and are subject to change without notice. WWMFP does not warrant that the information will be free from error. The information should not be relied upon for purposes of transacting securities or other investments. Your use of the information is at your sole risk. Under no circumstances shall WWMFP be liable for any direct, indirect, special or consequential damages that result from the use of, or the inability to use, the information provided herein, even if WWMFP or a WWMFP authorized representative has been advised of the possibility of such damages. Information contained herein should not be considered a solicitation to buy, an offer to sell, or a recommendation of any security in any jurisdiction where such offer, solicitation, or recommendation would be unlawful or unauthorized.