Now, you don’t have to thank me for another cryptic blog title… I’ll keep conjuring those up for fun. But, before we dive into riveting financial planning concepts, let’s clarify what we’re going to talk about. It’s not being part of the top 1% of income-earners or even the top 1% of wealth-holders. Rather, let’s talk about why 4% matters.

In 1994, William Bengen wrote an article that birthed the 4% “safe withdrawal rate” rule-of-thumb. As you can imagine, lots of complex analysis and assumptions underpin financial planning rules-of-thumb, but the gist of this one is, if:

- You have a 30-year retirement

- You’re invested in a diversified portfolio of 50% stocks, 50% bonds

- You withdraw 4% the first year, and then adjust that amount by inflation each subsequent year

Then, you have as high as a 100% chance that you won’t outlive your money in retirement. For an easy example, consider starting retirement at age 65 with $1M in your portfolio. You withdraw $40K (4%) at the beginning of the year, leaving $960K. The market has a decent 5% year so you end up with $1,008,000. At the start of year 2, you withdraw $40K + 3% for inflation, ($41,200) and now you have $966,800 before the market returns 13%. At the start of year 3, you with withdraw $41,200 +3% for inflation, ($42,436) and now you have $1,050,048. At the start of year 4, you withdraw $43,709 and the market hits bear territory closing down 21% and giving you a balance of $795,008.

Unsurprisingly, everything was going fine until that bear year. Now, if the next several years, the market keeps climbing back, you can imagine that you don’t outlive your money. But, if the market stagnates or drops again, you could have a real problem on your hands, right?

Sequence of Returns Risk

There are many risks in the financial world, but the risk that, when you need your money to grow, or at least not shrink, it does just that is called sequence of returns risk. Imagine starting with $1M and the sequence of returns from the market, instead of looking like:

- Year 1: 10% to $1,100,000

- Year 2: 5% to $1,155,000

- Year 3: 12% to $1,293,600

- Year 4: -18% to $1,060752

- Year 5: -13% to $922,854

Looks like:

- Year 1: -20% to $800,000

- Year 2: -7% to $744,000

- Year 3: 3% to 766,320

- Year 4: 8% to $827,625

- Year 5: 20% to $933,150

In the latter sequence, as long as you never take money out, you end up better. But if you’re retired, no longer adding to the portfolio, you’d be forgiven for starting to sweat B-61s that your portfolio won’t recover in time to avoid residing in your car and eating store-brand dog food.

While we certainly can’t control sequence of returns, we need to keep the concept in mind every time we think about retirement. Right now, the financial news media is printing lots of stories about people retiring early because the sequence of returns since 2009 has rocketed their portfolio to a figure that suggests an adequately-funded retirement. You can imagine that someone planning to retire in 2009 felt a bit different.

Monte Carlo Analysis

Monte Carlo Analysis is a less-nerdy way of talking about using a computer to model varying sequences of returns on a portfolio. Generally, Monte Carlo Analysis generates a range of outcomes based on 1,000 or more sequences of market returns. Inputs to Monte Carlo Analysis include:

- Starting balance- e.g., $1M

- Number of years in retirement-e.g., 30

- Historical Returns or Random Returns

- Withdrawals or additions to the portfolio-withdraw 4%, adjusting for inflation annually

- Rebalancing

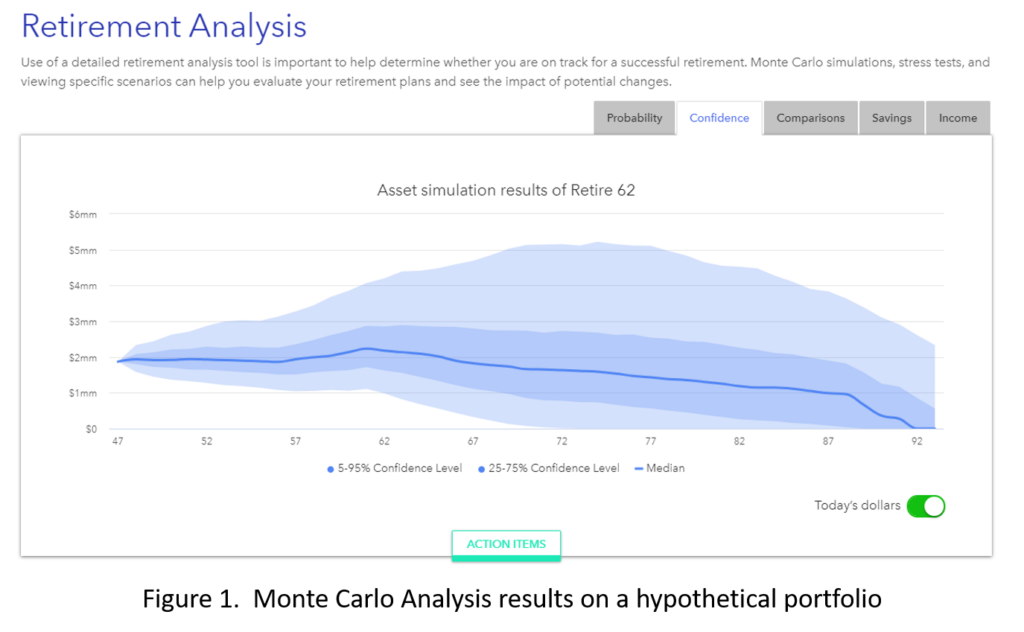

The outputs look might look like Figure 1. The dark blue line is the median balance of the portfolio after, say over the period of analysis. The darker shaded blue area represents the range of returns that fall within 25%-75% probability. Finally, the lighter shaded blue area represents the 5%-95% range. The worst case shows this family potentially running out of money at age 72 and the best case implies an ending portfolio value about where it started.

Monte Carlo Analysis is by no means perfect. But it does represent one way to stress-test the size of the portfolio that you think you might need when you start retirement. If the Monte Carlo Analysis indicates a 70% chance of success, but you’re 20 years from retirement, then you have time to continue to both build your nest egg and refine your assumptions heading towards retirement. At the same time, a 70% chance of success doesn’t automatically mean a 30% chance of failure (car, dog food, etc.). More likely, it means a 30% probability that you’ll need to make some consumption changes over your retirement years. I’d wager that it’s certain that for one reason or another, all of us will make decisions to change consumption over our retirement years.

If, however, you work until age 70 and your Monte Carlo Analysis suggests a 99% chance of success, you may want to consider whether or not you’ve not only left some “YOLO” on the table during your working years… and whether you’re poised to do the same in your retirement years.

Back to 4%

If you haven’t heard of the 4% rule (of thumb), you may have heard “save 25x your income.” They’re mathematically the same. 4% of $1M is $40K and if that’s your income need, then 25 * $40K is $1M. Unless you’re retiring today, we need to go a bit further with this math.

Let’s say you’re an O-5 comfortably living on $120K per year now. Your pension should be an inflation-adjusted $50K per year. You get $10K, also with COLA, from the VA. You expect your Social Security to be another $20K. $80K of your retirement need is inflation-protected (although you may want to ask your grandparents if they feel like these types of payments really keep up with inflation). You need $40K in today’s dollars, inflation-adjusted, in order to meet your $120K annual consumption requirement. If you’re retiring today, then $1M should work. What if you’re 25 years from retirement?

Historical inflation is 3%, so your $1M today only purchases $466, 975 worth of lifestyle at retirement in 25 years. So, to count on today’s purchasing power of $40K, we need to inflate our $1M by 3% over 25 years. I.e., at retirement 25 years from now, the portfolio balance needs to be $2,093,773. To get $40K worth of today’s purchasing power, you’ll actually be withdrawing $83,751…which is still 4% of $2,093,773. My apologies, as this type of discussion always feels like a disorienting combination of both math and time travel.

Do Retirees Really Use the 4% Rule?

Recently, William Bengen revised his model and suggested that 4% was probably too conservative, noting that 4.5% is a better number. I haven’t polled all American retirees just yet, but I suspect that those who’ve had the luxury to consider the 4% rule use it as a starting place for planning, both in their accumulation years and retirement/decumulation years.

If the market is up most years for the first 10 years of retired life, sticking to 4% could result in some lost “YOLO.” If the market is down most years for the first 10 years of retired life, sticking to 4%… well, that whole car and dog food scenario comes back into play.

The 4% rule isn’t the only method for planning and (perhaps) executing a decumulation plan in retirement. The “safety first approach” is a method whereby you ensure your minimum income needs are matched to guaranteed income sources such as pensions, social security, and annuities. Thus, the portfolio and its returns provide the discretionary income you’ll want for fun or perhaps legacy goals.

Another option is “asset-liability matching” where you partition your near, mid-, and long-term income needs in retirement, and then partition your savings in a like manner. Sometimes called a bucket strategy, this might look like putting several years of cash aside for the next few years of income needs, followed by conservative a mid-term portfolio that focuses on income rather than growth. The last “bucket” would be a growth portfolio that seeks to outpace inflation in order to provide for the extended years of retirement.

A popular modification to the 4% rule uses a “guardrails” strategy. An upper guardrail allows you to give yourself a “raise” after years when portfolio growth exceeds projections. A lower guardrail tells you when you need to reduce spending in order to avoid early depletion risk. The guardrail strategy helps add an adaptive component to avoid both missed “YOLO” and car/dog food scenarios.

Cleared to Rejoin

The 4% rule and other decumulation strategies quickly fall apart if you don’t know what your spending numbers truly look like, so it’s crucial to monitor that number during both your accumulation and decumulation years. The 4% “safe withdrawal rate” may not be the strategy that you choose to use in retirement, but it can be very helpful in giving you a target to aim at. As you build your strategy, it’s critical to consider the effects of inflation so you can get today’s spending power out of tomorrow’s dollars. Finally, if the 4% doesn’t resonate with you, no problem. But you should pick a target for your retirement number, lest you fall victim to the adage— “if you aim at nothing, you’ll hit it every time.”

Fight’s On!

Winged Wealth Management and Financial Planning LLC (WWMFP) is a registered investment advisor offering advisory services in the State of Florida and in other jurisdictions where exempted. Registration does not imply a certain level of skill or training.

This communication is for informational purposes only and is not intended as tax, accounting or legal advice, as an offer or solicitation of an offer to buy or sell, or as an endorsement of any company, security, fund, or other securities or non-securities offering. This communication should not be relied upon as the sole factor in an investment making decision.

Past performance is no indication of future results. Investment in securities involves significant risk and has the potential for partial or complete loss of funds invested. It should not be assumed that any recommendations made will be profitable or equal the performance noted in this publication.

The information herein is provided “AS IS” and without warranties of any kind either express or implied. To the fullest extent permissible pursuant to applicable laws, Winged Wealth Management and Financial Planning (referred to as “WWMFP”) disclaims all warranties, express or implied, including, but not limited to, implied warranties of merchantability, non-infringement, and suitability for a particular purpose.

All opinions and estimates constitute WWMFP’s judgement as of the date of this communication and are subject to change without notice. WWMFP does not warrant that the information will be free from error. The information should not be relied upon for purposes of transacting securities or other investments. Your use of the information is at your sole risk. Under no circumstances shall WWMFP be liable for any direct, indirect, special or consequential damages that result from the use of, or the inability to use, the information provided herein, even if WWMFP or a WWMFP authorized representative has been advised of the possibility of such damages. Information contained herein should not be considered a solicitation to buy, an offer to sell, or a recommendation of any security in any jurisdiction where such offer, solicitation, or recommendation would be unlawful or unauthorized.