Can Fighter Pilots have 401(k)s?

Most of us are briefed into the not-so-special program known as MAX TSP. You contribute either pre-tax or post-tax dollars directly from your paycheck, select some investments, let the compounding go, and then hope to have enough to meet your retirement goals. But what about 401(k)s—are they better and can fighter pilots even have 401(k)s?

TSP vs. 401(k)

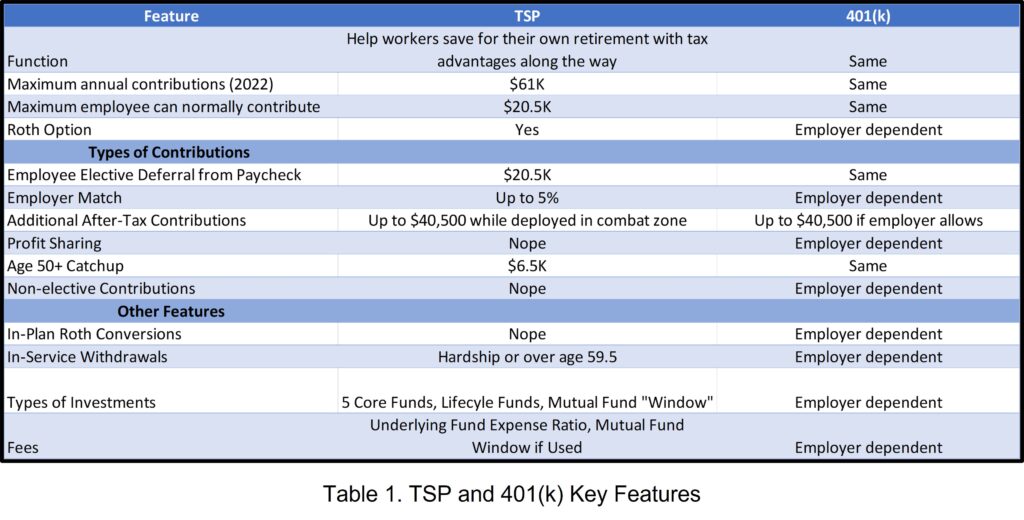

At the root of it, the TSP and 401(k)s are functionally identical, although they have some nuances under the regulatory hood. Here are the key features:

From Table 1, we can see that in the most important ways such as contribution limits, the TSP and 401(k)s are similar. Employer plans aren’t cheap however, and the costs too offer a 401(k) include:

- Plan initiation costs

- Annual tax filing costs

- Ongoing administration cost

- Matching costs

- Potential profit-sharing costs

Because these costs add up quickly, it’s common for employers to skinny-down plan features. Well-funded, larger companies usually offer all the bells and whistles a plan can have such as Mega Backdoor Roth IRA capability and access to most retail mutual funds and ETFs.

Companies on tighter budgets often use templated 401(k)s that have higher fees (passing the costs to the workers) and fewer investment options. Companies do have a fiduciary duty to employees in the management of a 401(k) and it’s not uncommon for workers to push back on a bad 401(k).

Why Would You Want a 401(k)?

If you’re still on active duty maxing out your TSP and IRA(s), being able to put more money into a 401(k) is an appealing technique to signature-manage the tax man. The most common reasons fighter pilots might consider a 401(k) are:

- Working a civilian job that offers a 401(k) while still on active, reserve or guard duty

- Working a 1099 contract job while still on active, reserve, or guard duty

- Spouse works at a company that does not offer a 401(k) and the family wants more tax-advantaged savings vehicles

It’s not common for active duty fighter pilots to have bandwidth (or get approval) to have outside employment… where you’re working enough to enable 401(k) contributions… with an employer that offers a 401(k). It’s more common for guard/reserve pilots to have 401(k) access with their civilian employer.

Whatever the family’s employer configuration, if you’re a super-saver that maxes the TSP and IRA limits ($20.5K & $6K respectively in 2022), it’s appealing to find a way to stash more into a tax-advantaged account.

The Problem with 401(k)s for Fighter Pilots

The main problem is adding a 401(k) to your bulging TSP and IRA is that each employee gets one burst of Employee Elective Deferrals—that initial $20,500 that you put into your TSP account. If you put $20,500 into the TSP, you can’t put $20,500 or even $1 into a 401(k) as an Employee Elective Deferral. To do so would incur:

- 6% excise tax per year on the excess amount contributed

- Ordinary income tax (e.g., 24%) on the earnings removed when the excess contribution is corrected

- 10% penalty tax on the removal of the earnings if under age 59 ½ .

No matter how you slice it, this is not a tip you want to leave for the tax man.

If you do have access to both the TSP and a 401(k), you can contribute to both, but you’re in charge of monitoring the limits so you don’t over-contribute. Employers can’t see each other’s plans to check your six.

The Solutions with 401(k)s for Fighter Pilots

There are two main remedies for fighter pilots that want to contribute to the TSP and a 401(k): an employer with a generous and flexible 401(k) and a Solo 401(k).

Many airlines contribute a flat percentage of salary into the 401(k). This can really run up the scoreboard on the account size without much in the way of employee contributions. If you’re under the Blended Retirement System in the guard/reserves and receiving a 5% match, you probably don’t want to skip TSP contributions as it’s like giving yourself a pay cut. Thus, you can contribute 5% to the TSP and the remainder of your annual limit ($20.5K in 2022) to the civilian employer plan.

Depending on the features the employer offers, you may be able to make Additional Employee After Tax contributions to your 401(k). It’s most likely that your civilian employer’s plan will require that you contribute your annual limit to the plan before beginning this type of contribution, so diligence is necessary to avoid an excess contribution by putting money into the TSP too.

If you don’t receive a TSP match, then it may be best to go all in on the 401(k) if the fees and investment choices won’t cause excess drag on your investment performance. Not only would it be simpler to only worry about contributions to one plan, but it will likely make it easier to do Mega Backdoor Roth IRA maneuvers if the 401(k) plan allows it.

What about Solo 401(k)s for Fighter Pilots?

A Solo 401(k) is an employer plan that you start for yourself with income from self-employment. I’ll foot-stomp that it has to be from self-employment. You can’t open a Solo 401(k) just because you don’t like your employer’s plan or the employer doesn’t offer a plan.

Being self-employed as a 1099 consultant, is pretty common for fighter pilots, so a Solo 401(k) may be within reach.

Solo 410(k)s have all the same contribution limits as larger employer 401(k)s. Solo 401(k)s can also be tailored to your specifications. Want to do Mega Backdoor Roth? You can build a Solo 401(k) for that. Want a cheap and easy plan? There’s an app for that too.

Other than the self-employment requirement, you need to know a few other Solo 401(k) ops limits:

- It’s Solo. If you hire non-spouse employees it’s time to close the plan or convert to a regular 401(k).

- A spouse that works in your business can contribute the same as you. S/he gets her own limits, so if the company makes enough, you can stash away quite a bit.

The limit for employer contributions (profit sharing) to a Solo 401(k) is 25% of net profit minus half your self-employment tax and the contributions you made for yourself (which really means 20% of income). That said, if you build a plan that allows Additional After-Tax Employee contributions, then you don’t have to worry about the 25% limit… but you do need to be making some serious money to throw off that kind of cash.

A Solo 401(k) creates a lot of flexibility, especially if your spouse can work in the business too. Keep in mind that the business must produce “earned income” not “passive income.” I.e., consulting with a defense firm as a 1099 contractor produces earned income, but rental income from the slums you own is passive income.

Cleared to Rejoin

Can Fighter Pilots have 401(k)s? It depends of course. Does it matter if you don’t already max your TSP and IRA? Probably not too much. But if you do have access to a 401(k) alongside your TSP, you may have some complexity and opportunity to jam away a lot of tax-advantaged dollars for your future self. If you have a side hustle as a 1099 contractor, a Solo 401(k) with bells and whistles can help you light the afterburner on your retirement savings.

Action Steps you can take today:

- Verify your current contributions to IRAs, TSP, and any 401(k) options you have.

- If you have access to a 401(k), review the Summary Plan Document to see what features it offers.

- Talk to your financial planner about how to optimize your retirement savings without leaving the tax man a tip.

Fight’s On!

Winged Wealth Management and Financial Planning LLC (WWMFP) is a registered investment advisor offering advisory services in the State of Florida and in other jurisdictions where exempted. Registration does not imply a certain level of skill or training.

This communication is for informational purposes only and is not intended as tax, accounting or legal advice, as an offer or solicitation of an offer to buy or sell, or as an endorsement of any company, security, fund, or other securities or non-securities offering. This communication should not be relied upon as the sole factor in an investment making decision.

Past performance is no indication of future results. Investment in securities involves significant risk and has the potential for partial or complete loss of funds invested. It should not be assumed that any recommendations made will be profitable or equal the performance noted in this publication.

The information herein is provided “AS IS” and without warranties of any kind either express or implied. To the fullest extent permissible pursuant to applicable laws, Winged Wealth Management and Financial Planning (referred to as “WWMFP”) disclaims all warranties, express or implied, including, but not limited to, implied warranties of merchantability, non-infringement, and suitability for a particular purpose.

All opinions and estimates constitute WWMFP’s judgement as of the date of this communication and are subject to change without notice. WWMFP does not warrant that the information will be free from error. The information should not be relied upon for purposes of transacting securities or other investments. Your use of the information is at your sole risk. Under no circumstances shall WWMFP be liable for any direct, indirect, special or consequential damages that result from the use of, or the inability to use, the information provided herein, even if WWMFP or a WWMFP authorized representative has been advised of the possibility of such damages. Information contained herein should not be considered a solicitation to buy, an offer to sell, or a recommendation of any security in any jurisdiction where such offer, solicitation, or recommendation would be unlawful or unauthorized.