When is the Best Time for Roth Conversions?

You’re in the squadron bar on Friday afternoon wondering why the Mayor just can’t keep the mob under control. What’s the fuss? Hat on the bar? Wall versus grind? Number of roles in ACM? Nope. It’s Roth conversions and when is the best time to pay the tax man without leaving a tip? (Clearly this really a dystopian version of what happens in the squadron bar, but read on anyway!)

The Pre-Tax Problem

When you contribute to the Traditional TSP, a 401(k)/403(b), IRA or any other qualified pre-tax account, as long as you meet certain requirements, you get to deduct that contribution from your current income and lower your current tax bill. For single income officer families below the grade of O-8-ish, that usually means skipping paying 22% today in order to hopefully pay a lower rate in the future when you access those dollars in retirement.

What many wealth-minded folks eventually realize is that their tax rate in retirement is likely to be higher than it was in a large part of their earning years, not lower. This is especially true for retired O-6+ types.

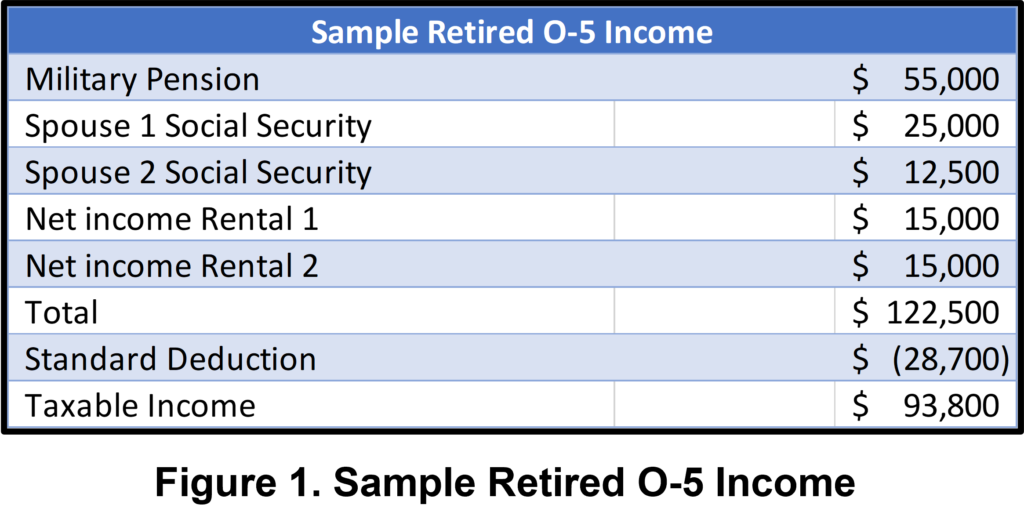

Here’s an easy example: Assume that you’re a 67-year-old retired O-5 with a couple of rental houses and claiming social security for you and your spouse. Your total income might look like figure 1.

There’s a couple of Easter eggs in this chart. First, you’re not withdrawing anything from your pre-tax accounts yet, so income is lower than it will be at age 75+ when you must take required minimum distributions (RMDs) from those accounts. Second, it’s currently 2023 and lower tax brackets are still in effect from the 2017 TCJA law. In 2026, the tax brackets snap back and there’s no longer a 22% bracket—it becomes 25%.

So, if hypothetically you did your earning and saving in pre-tax accounts at a tax rate lower than 25%, then you skipped paying a lower tax rate in order to pay a higher rate later. Ouch!

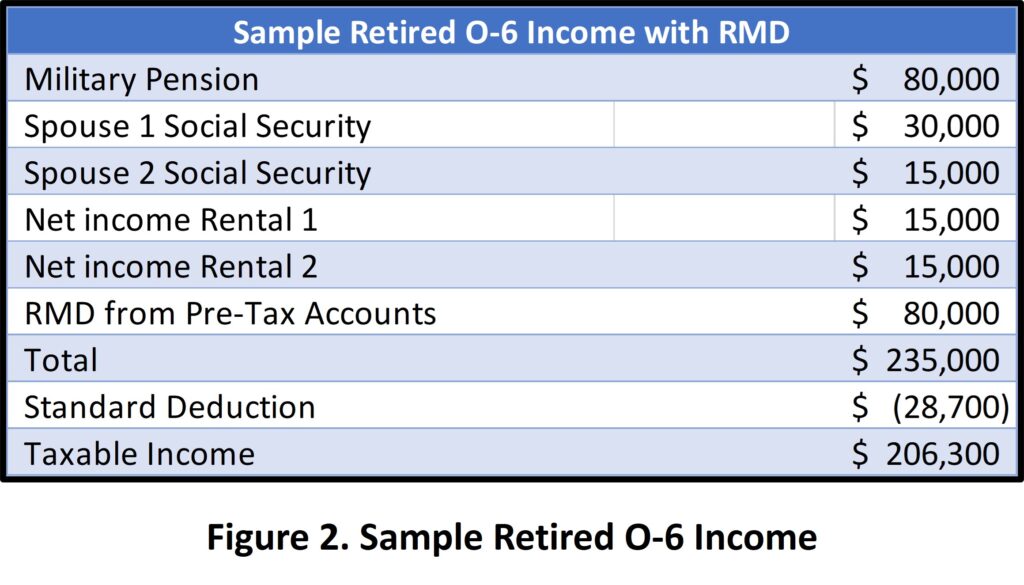

If we look at Figure 2 for a retired O-6 with a little more pension income and a little more Social Security income plus a 4% withdrawal from a $2M pre-tax account, the taxable income gets into the 24% bracket today but would be 28% in 2026 and later—just a few short years from now when the TCJA rates expire. I.e., said O-6 would need to have earned his/her dollars in a bracket higher than 28% to pay a lower tax rate in retirement. That could be true for some post-military years, but probably isn’t true for many active duty years.

The bottom line: you must have a crystal ball to know what your tax rate will be in the future, but you do know what it is now. If you will likely pay a higher rate in the future, skipping pre-tax contributions and going for Roth (and potentially Roth conversions) makes more sense.

Roth Conversion 101

A Roth conversion is simply choosing to pay tax today on pre-tax account balances (partial or in full) in order to move those dollars to a Roth account and receive Roth treatment going forward. Recall that under most conditions, dollars in a Roth account aren’t taxed when you access them in retirement.

For example, if you have $100K in a Traditional TSP account, and you’ve separated/retired such that you’re no longer an active participant, you can rollover those Traditional (pre-tax) dollars to a Roth IRA. You’ll pay your current tax rate (e.g., 22% or 24%) to do so, but then you don’t pay income tax on those dollars (and their future growth) ever again.

What’s more, Roth IRA accounts do not have Required Minimum Distributions at age 75, so your money can compound even longer.

A Roth conversion is simply a tactic to try to pay less in taxes today than you think you will pay tomorrow.

Roth Conversions and the TSP

One problem for many service members, especially O-5’s and higher that only had access to Traditional TSP for many of their early saving years is that you cannot perform Roth conversions on TSP dollars until you retire or separate from service. The is not always true with 401(k)/403(b) accounts as every plan is different.

What’s more, there are many great reasons to stay in the TSP even after you separate/retire. Tax math doesn’t factor in the benefits of the G Fund or the creditor protection of the TSP structure.

It’s best to get professional, fiduciary advice from someone that understands the TSP specifically before considering a Roth conversion from the TSP.

Roth Conversion Timing Factors

Most savers don’t think about Roth conversions until they’re in their 60’s. The driving reason is that once the paycheck switch is in the OFF mode, income tax rates may be lower due to less income, thus there’s more room in a given tax bracket to convert Traditional dollars without tripping into a higher tax bracket. From retirement (meaning: no wage income) to Social Security claiming age (meaning: more taxable income) and then age 75 (meaning: forced RMD income) is often consider “the” Roth conversion window.

Unfortunately, delaying until one’s 60’s can cause problems:

- Tax rates may be higher tomorrow than they are today. Make no mistake—there is a tax bracket increase scheduled for 2026. Many experts believe that the government will have to raise taxes to manage interest on the national debt and increasing Medicare costs.

- Age 63 is when your first Medicare “IRMAA” surtax is calculated such that Roth conversions in ones early 60’s can induce a Medicare fee increase which is essentially a tax increase. (Medicare Income Related Monthly Adjustment Amount, or IRMAA is also a “cliff tax” such that if you’re $1 over the limit, you pay the higher rate.)

- You know what state you live in today. Do you know what state you’ll live in when you’re retired? Does that state have an income tax? If so, that usually adds to your Roth conversion tax bill.

- Pay the tax when you can pay the tax. When you no longer have a paycheck, you might be loathe to separate with cash just to “pre-pay” taxes even if it makes superb mathematical sense. If you’re still working, you’re likely to feel better about greasing the IRS’s pockets because you can still earn more.

- The tax code is written in pencil. The 2021 proposed tax legislation that did not pass had quite a few changes that would affect Roth accounts, primarily for high income earners ($400K+) and the ultra-high net worth set ($10M+). Congress is likely to keep basic Roth features around because it increases current-year income, but how’s your crystal ball doing at predicting what Congress will do with future tax legislation?

- Widow(er)s get taxed hard. If one spouse passes early, the surviving spouse often has a very similar retirement income level, but the tax brackets accelerate faster on that income for a single person. It will be much more expensive to do Roth conversions for a surviving spouse.

- The tax on $1M is higher than the tax on $250K. Whether it’s because of the progressive tax brackets or simple raw dollars, if you wait until your pre-tax account has compounded to $1M versus sucking up the pain when it’s at $250K, you’ll pay more in tax regardless of the tax rate. Now, due to inflation, you might part with the same spending power, but you’re probably going to be very allergic to a higher tax bill regardless of the spending power of the dollars.

This list isn’t exhaustive (TLDR is real…) but you get the idea, it’s important to think through traditional “wisdom” about when to do Roth conversions before just putting it off until your 60’s.

Roth Conversions can Hurt the Young Too

The next tax bracket up isn’t the only consideration for Roth conversions. There are many tax credits, deductions, and decisions that look at versions of your income too. (Versions meaning your taxable income, or Adjusted Gross Income, or Modified Adjusted Gross Income.)

The IRMAA tax affects you after age 63, but you may be trying to “look poor” for the college financial aid process in your 40’s and 50’s, so those might not be good years to recognize additional income for Roth conversions.

Here’s a list of other taxes, credits, opportunities, and deductions that could be affected by recognizing additional income in a year:

- Net Investment Income Tax starts above $250K (married)

- Coverdell Education Savings Account

- Lifetime Learning Credit

- American Opportunity Credit

- Student Loan Interest Deduction

- Child Tax Credit

- Adoption Expense Credit

Does the Time of Year Matter?

Let’s assume that you’re convinced that Roth conversions might be worth doing, does it matter when during the year you pull the trigger? Absolutely.

The most common approach to Roth conversions is to choose the tax bracket target and “fill up the bracket.” I.e., if your taxable income in 2023 would be $150K as a married couple, then you have $40,750 of “headroom” in the 22% bracket before any Roth conversion dollars would start to be taxed at the next highest bracket of 24%.

If your only source of family income is wages, then it’s pretty easy to predict/calculate your taxable income. However, many families have interest income, dividend income (some of which is taxed at ordinary versus capital gain rates), short-term capital gain income, and potentially side-hustle income. Many of these types of income won’t be fully known until late in the year—often the lasts weeks of December.

Roth conversions must be completed by 31 December to count for the tax year. (Imagine the frenzy coming in December 2025…) Investment institutions that help you do the conversion not only have to deal with lots of federal holidays in the later part of the year, but hordes of people are clogging up the workflow with Roth conversions, charitable contributions, tax-loss harvesting and other investment-tax maneuvers. Time runs short at the key time of year!

So, while you can do Roth conversions early in the calendar year, you need to be certain what tax bracket you’re targeting and how much headroom you’ll have in that bracket. Roth conversions cannot be “undone” or re-characterized. If you overshoot, you’ll pay the higher tax rate for the dollars that get orphaned into the next bracket (e.g., 24% or 32%). You’ll also deal with any lost credits and deductions

Another crucial issue is market performance. Imagine that you’ve met all other criteria for doing a Roth conversion of your $100K pre-tax balance and it’s January 2020. Then COVID hits and you decide do your Roth conversion on March 23, 2020. You convert 100% of your pre-tax balance, but instead of paying taxes on $100K, you’d pay taxes on say, $60K to $70K. Assuming you reinvested the funds right away, you get a huge discount on your tax bill and yet your dollars recovered through the rest of the year with their tax-fighting Roth force field in place!

Roth Conversion Timing Tactics

This topic gets confusing quick, so let’s look at a planning checklist you can use for timing your Roth Conversions.

- Can I even get access to my pre-tax dollars yet, or are they locked in the TSP/401(k) until I’m no longer in service?

- What is my combined federal and state top rate today? What is my best guess on what it will be when I stop earning wages?

- Are there any known tax hikes coming my way such as the expiration of a current law (e.g., 2017 TCJA) or the loss of a desired credit or deduction if I have more income?

- Do I have extra cash to pay the taxes now? Would I have to sell taxable investments to raise that cash?

- At what point in the year will I be pretty certain that I know my income for the year so I know how much headroom I’ll have in the desired bracket?

- If my income is unsure, is there a safe number that I can convert early in the year and then follow up with a top-off amount late in the year?

- Do I think the market is at a temporary low such that converting now moves a higher proportion of my pre-tax dollars for a lower tax bill?

- If I think I might leave some IRA balance for my heirs, what do I expect their tax rate to be? Do I want to pre-pay their taxes?

Cleared to Rejoin

If you’re still reading, you’re eyes are probably watering at how awesome Roth conversions can be, right? But timing does matter. Roth conversions early in life create can drastically lower your lifetime tax bill even if they increase it this year. But there are a lot of twists and turns in the tax code, so it’s important to map out all of the ripple effects of a Roth conversion in a given year. Market performance plays into the equation as well, so talk to your financial planner before moving out on any Roth conversion.

Fight’s On!

Winged Wealth Management and Financial Planning LLC (WWMFP) is a registered investment advisor offering advisory services in the State of Florida and in other jurisdictions where exempted. Registration does not imply a certain level of skill or training.

This communication is for informational purposes only and is not intended as tax, accounting or legal advice, as an offer or solicitation of an offer to buy or sell, or as an endorsement of any company, security, fund, or other securities or non-securities offering. This communication should not be relied upon as the sole factor in an investment making decision.

Past performance is no indication of future results. Investment in securities involves significant risk and has the potential for partial or complete loss of funds invested. It should not be assumed that any recommendations made will be profitable or equal the performance noted in this publication.

The information herein is provided “AS IS” and without warranties of any kind either express or implied. To the fullest extent permissible pursuant to applicable laws, Winged Wealth Management and Financial Planning (referred to as “WWMFP”) disclaims all warranties, express or implied, including, but not limited to, implied warranties of merchantability, non-infringement, and suitability for a particular purpose.

All opinions and estimates constitute WWMFP’s judgement as of the date of this communication and are subject to change without notice. WWMFP does not warrant that the information will be free from error. The information should not be relied upon for purposes of transacting securities or other investments. Your use of the information is at your sole risk. Under no circumstances shall WWMFP be liable for any direct, indirect, special or consequential damages that result from the use of, or the inability to use, the information provided herein, even if WWMFP or a WWMFP authorized representative has been advised of the possibility of such damages. Information contained herein should not be considered a solicitation to buy, an offer to sell, or a recommendation of any security in any jurisdiction where such offer, solicitation, or recommendation would be unlawful or unauthorized.