Smooth Income, Lumpy Expenses

When the 2008 financial crisis paid a visit to my household, I finally learned to take some advice from my mother. Growing up, she had stretched our family’s modest income as far as anyone could. Her technique was to withdraw most of my dad’s paycheck in cash on the 1st and 15th of each month. She and my father used a yellow legal pad to write out a budget, and they put the budgeted amount of cash went into an envelope for groceries, gasoline, clothing, etc. Throughout the month, she only paid for those expenses from their specific envelopes in order to avoid overspending.

Dave Ramsey has popularized this method with his radio show and books, but it’s nothing new. Money is a resource just like time and calories. Just like those resources, without a flight plan, money will generally get off course. But in the 21st century, lugging around envelopes of cash is at best inconvenient. More likely, it’s a deal-breaker for busy families. If two spouses each spend money at the grocery store, does each have to carry half of the budget around in an envelope? It doesn’t take much imagination to forecast the frustration and problems coming from such an arrangement.

Money on a Mission

I’m a firm believer that we need to give our money a mission, but I also believe that the best systems for cash flow are the ones that we’ll actually use. Cash in envelopes works great for some families, but not so much for others. While there are many systems for managing cash flow, I’ll detail the one that works best for our family. We ops checked quite a few before settling on this one—electronic envelopes.

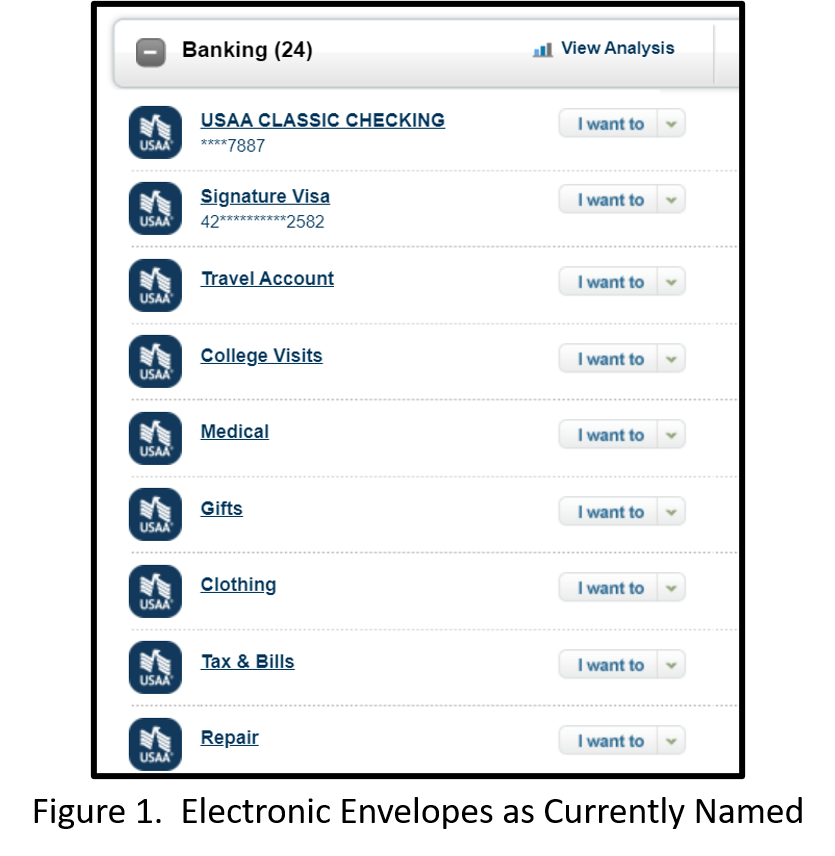

The bank we use (hint: it rhymes with Who SA A?) offers what, for my purposes, is a practically unlimited number of free checking and savings accounts. Opening them online takes 5.8 minutes. The website allows you to nickname each account, so that they’re visually meaningful—e.g., travel, car repair. While we have one main spending account for debit card, ATM, and check transactions, we can make transfers as needed throughout the month from any of the accounts. Over the years, as we’ve determined new short, medium, and long-term savings goals, we’ve accumulated about a dozen of these electronic envelopes. Figure 1 shows a subset of the current accounts. We’ve retired some names (e.g., house down payment) and added others (e.g., purchase bougie dog that I got out-voted on…).

There are a few devils in the details, but it basically works like this:

- Determine our monthly budget by category (I use Excel with a new tab for each month.)

- Determine amounts for non-monthly categories (e.g., travel, car repair)

- Transfer amounts to named accounts as determined in Step 2.

- Spend through the month in main account.

- When non-monthly expenses arise, transfer that amount from named account to the main account.

Devilish Details

Step 1. Our family basically uses Dave Ramsey’s technique. We list our expected income for the month, then prioritize our giving/savings, mandatory expenditures, and then discretionary expenditures in that order. Savings comes up front to make sure we “pay ourselves first.”

Step 2. This is tough if you don’t have reasonable records/estimates of what you spend, so it takes a while to dial in the amounts. But if you use an aggregator like Mint.com, it’s pretty easy to see what you spend on categories like car repair or veterinary bills. Each month, we plan to set aside 1/12th of the annual amount for these non-monthly budget categories.

Step 3. Our bank’s website and smart phone app make transfers between accounts a 33-second affair. The monthly process takes about 5 minutes to set up. Automatic transfers are available at most banks too.

Step 4. We spend from a single checking account for all routine purchases. It’s just simpler for us that way. We keep a floor in that account such that we’re not at risk of an overdraft for the types of purchases that we call routine.

Step 5. When vet bills, car repair bills, and other periodic expenses arise, we execute them from the main account and then transfer the amount from the appropriate named account to the main account.

While there’s nothing magic about this process, it’s has solved the problem of “smooth income, lumpy expenses” for our family. We don’t pull money out of the travel fund for car repair or current month groceries. Clearly, we could, but for us, the simple life-hack of putting dollars in an account with a named purpose creates a commitment device— “Hands off, that money is for the Disney Trip!”

Views of Others

Just because electronic envelopes work well for some families doesn’t mean they’re a good fit for all. Here’s some reasons why you should think twice:

- Commitment to budgeting: This process… is a process and it’s meant to make budgeting easier and more effective. If you’re not committed to budgeting each month, the juice may not be worth the squeeze.

- Upfront planning: To get started with electronic envelopes, you’ll not only need to determine your areas of lumpy spending, but reasonable estimates of the annual amounts you’ll spend. You won’t get this perfect, but budgeting is a journey not a destination.

- Flight following: Executing electronic envelopes takes both a batch of transfers at the beginning of the month and multiple quick discrete transfers throughout the month. It’s not a fire-and-forget process. At the same time, you’ve read this far into an article about budgeting, so you probably have at least a passing interest in getting your dollars to behave better. If you’re currently struggling to keep dollars on task, how much effort are you putting into your current processes? Electronic envelopes might be a workload reduction for you.

- Complicating the simple: I’ve advocated that simplicity supports wealth building, so adding extra accounts seems to violate that principle. The problem is that it’s very difficult to track where dollars flow to in order to avoid over-spending or under-saving without tools. Electronic envelopes are actually a pretty simple toolset for the complicated task of keeping dollars on task.

Cleared to Rejoin

There is likely a level of income for most families where budgeting isn’t crucial to achieving financial goals. However, since some ultra-wealthy folks seems cognizant of their income enough to want to avoid overspending it on taxes, I think it’s a safe bet that flight following dollars is a habit that’s highly correlated with wealth building and maintenance. If budgeting, even in select categories, has been elusive for your family, electronic envelopes might be an easy way to smooth out the lumpiness of expenses throughout the year. There’s no need to open a bunch of new accounts all at once, but starting with one or two of your most thorny categories can go a long way. Why not give it a try?

Fight’s On!

Winged Wealth Management and Financial Planning LLC (WWMFP) is a registered investment advisor offering advisory services in the State of Florida and in other jurisdictions where exempted. Registration does not imply a certain level of skill or training.

This communication is for informational purposes only and is not intended as tax, accounting or legal advice, as an offer or solicitation of an offer to buy or sell, or as an endorsement of any company, security, fund, or other securities or non-securities offering. This communication should not be relied upon as the sole factor in an investment making decision.

Past performance is no indication of future results. Investment in securities involves significant risk and has the potential for partial or complete loss of funds invested. It should not be assumed that any recommendations made will be profitable or equal the performance noted in this publication.

The information herein is provided “AS IS” and without warranties of any kind either express or implied. To the fullest extent permissible pursuant to applicable laws, Winged Wealth Management and Financial Planning (referred to as “WWMFP”) disclaims all warranties, express or implied, including, but not limited to, implied warranties of merchantability, non-infringement, and suitability for a particular purpose.

All opinions and estimates constitute WWMFP’s judgement as of the date of this communication and are subject to change without notice. WWMFP does not warrant that the information will be free from error. The information should not be relied upon for purposes of transacting securities or other investments. Your use of the information is at your sole risk. Under no circumstances shall WWMFP be liable for any direct, indirect, special or consequential damages that result from the use of, or the inability to use, the information provided herein, even if WWMFP or a WWMFP authorized representative has been advised of the possibility of such damages. Information contained herein should not be considered a solicitation to buy, an offer to sell, or a recommendation of any security in any jurisdiction where such offer, solicitation, or recommendation would be unlawful or unauthorized.