Nothing Says Summer like a Custodial Roth IRA!

Summer 2021 has arrived and it seems to mean that March 2020 is finally over, so I’m sure we’re all thinking the same thing—time for the kids to get a summer job already, right? For so many reasons, this will be a summer like no other, but let’s focus on the nexus of opportunities presented by a labor shortage, sweet tax-advantaged accounts, and your kids needing to get out of the house! And what’s better than getting kids out of the house? Making sure they stay there when they’re not kids anymore, of course. It just so happens that a Roth IRA can help ward off the risk that junior will try to come back and roost after college. But how does this summer-job-Roth-IRA magic work?

Roth Refresher

To demonstrate the power of this idea, let’s recall how a Roth IRA works. A child has to have earned income, such as from babysitting, lawnmowing, busing tables, restaurant hosting, bagging groceries, etc. You can’t contribute to a Roth IRA from birthday gift money or investment income. With earned income in hand, you can open a Roth IRA with the custodian of your choice (e.g., Vanguard, Schwab, E-Trade, etc.) and deposit the money before April 15th (technically tax return due date) of the next year. Each person can contribute the lower of their earned income or $6,000 in 2021.

The special sauce of a Roth IRA is that a taxpayer pays their current tax rate on the contribution, but then the principal and earnings of their investment grow tax-free. Distributions from the Roth IRA are also tax-free in most cases. It’s important to note that your Tax Uncle (Uncle Sam) requires that you leave the money in the account until it’s time to use it for retirement. There are many exceptions to this rule, such as withdrawals of principal at any time, early retirement, up to $10,000 for a first-time home purchase, and even college expenses, so consulting a financial planner or tax professional is always a sound idea before tapping an IRA.

Adults tend to like Roth IRAs because they allow one to perform tax arbitrage. Contributions take advantage of today’s tax rate with the expectation that the tax rates will be higher when the money is needed in retirement. Up to the 24% bracket, that’s likely true for many military families. For kids, it’s hard to imagine a lower tax rate than 0%, so it’s effectively always true.

Why choose a Roth versus Traditional IRA for a child? Remember that a Traditional IRA allows the taxpayer to skip income tax on the dollars earned today in order to pay tax at the future rate in retirement. If a child’s income tax rate is effectively 0% today, it’s only going to be higher in retirement. A Traditional IRA for a child violates one of the cardinal rules of tax planning: “Always pay the IRS what you owe, but never leave a tip!”

Each taxpayer, even a kid with a summer job, is allowed a standard deduction of up to $12,550 (2021). So, if junior works 40 hours a week over an 8-week summer, s/he can contribute $2,143 to a Roth IRA if earning the federal minimum wage of $7.25. If you grabbed an abacus to check this, you’ll note that $7.25 * 40 * 8 = $2,320, but the child will have to pay FICA taxes at 7.65%, even though s/he’ll owe no income tax. The magic is that the child’s income tax rate is probably 0% when the money is earned, which means s/he will never pay income tax on that money, or the earnings on that money, again!

The federal minimum wage isn’t all that common and many employers know they have to entice kids away from cushy babysitting-type jobs, so while not too many kids are going to make the full $6,000 over a summer (it would take $18.75/hr to get there) they do have the whole 12 months of the year to earn, even if they can’t work much during the school year.

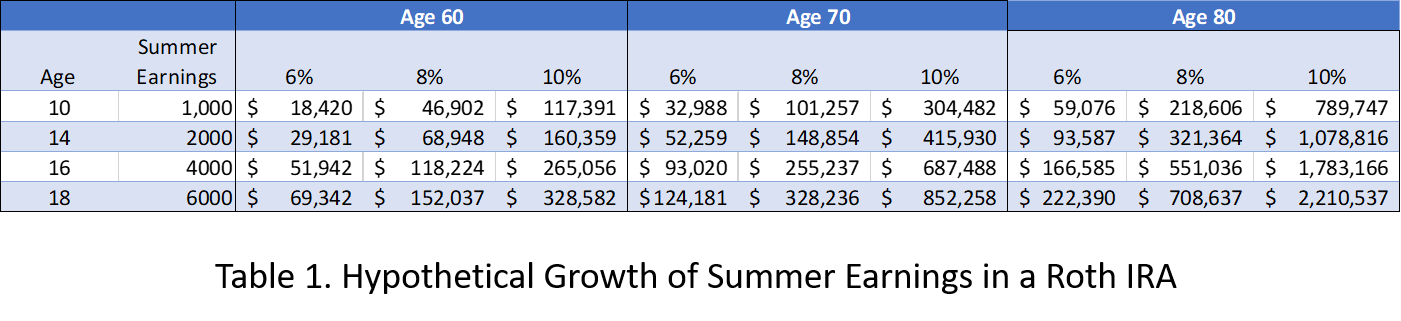

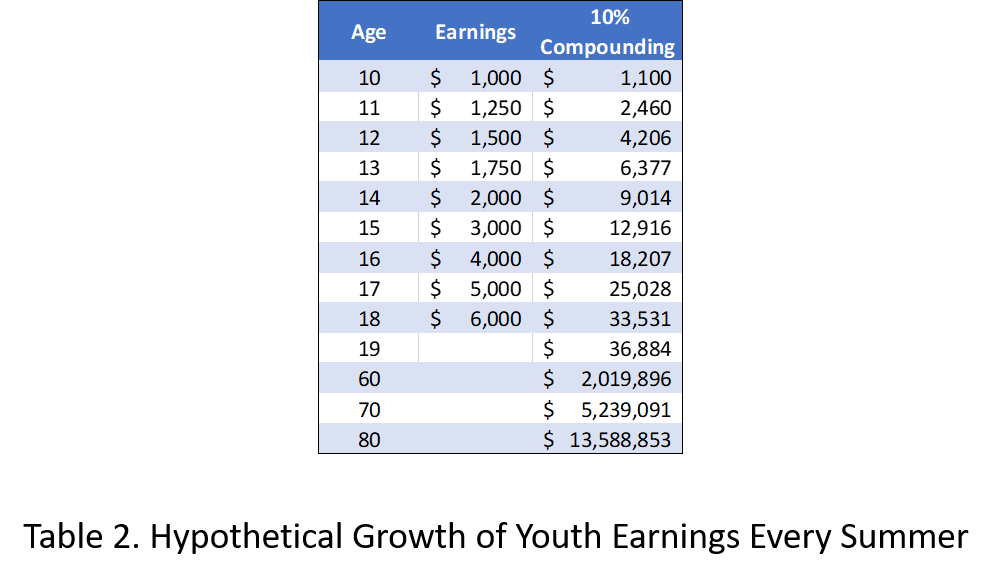

Let’s take a look at some scenarios to see what could happen when a kid gets started with retirement saving in their teens. Table 1 shows hypothetical earnings over youth summer-earning years from age 10 through 18, compounded at rates of 6%, 8%, or 10% at ages 60, 70, and 80. This table assumes that junior only works and saves in that one year. But what if junior works and saves every summer/year? Table 2 shows the effect of investing at 10% each year from age 10 through 18, but then never investing another penny. At age 60, the Roth IRA could have over $2M! (Don’t tell junior that 3% inflation would make that worth only about $583K of today’s dollars…)

What’s a Custodial Roth IRA?

Now that your kiddo is salivating at the prospect of being a multi-millionaire having only saved during teenage years, it’s time to talk accounts. Legally, minors can’t own their own Roth IRA. Their parent/guardian must open a custodial Roth IRA. Over the years, most of the major brokerages have begun offering this service with varying levels of ease. Some brokerages will allow you to open a custodial account completely online, while others require the arcane use of paper, ink, and snail mail. As with any account, you’ll want to consider the investment options available, the account costs (you shouldn’t pay any), underlying expense ratios of investments, and the ease of managing your account through online tools. This is definitely in the realm of DIY, but it never hurts to consult your financial planner when considering such a move.

When your child turns 18, it’s time to contact the custodian and transfer ownership of the account to your adult child. Ideally, having taught him/her the value of hard work and saving at such a young age, you can convince your kiddo that the Roth IRA magic works best if you leave it alone until retirement rather than cashing it in, paying taxes and penalties, and buying a shiny depreciation-mobile after college…

What about Child Labor Laws?

The Department of Labor sets minimum standards for child labor, and in most cases the minimum age is 14. State laws can be more restrictive and many jurisdictions set specific hour limits for the summer and school year so it’s important to determine what’s legal in your area before sending the kiddos off to the salt mines.

Rules are different when children work in a family business, but one of the questions parents frequently ask is, “how much can I pay my kids in the family business?” The answer is that you have to pay them market wages for the work performed. If they do janitorial work in the office, you can’t pay them $200K per year—the IRS has figured out that business-owning parents like to try to transfer wealth this way.

Even if you don’t operate a business, or have kids that model, you might have industrious young babysitters and lawn-mowers. Their earned income can open the door to a Roth IRA too.

Self-Employment Income for Kiddos

If your aspiring entrepreneurs are legitimately bringing in the dough, the IRS doesn’t care about their age for a Roth IRA. The tax man does care that workers pay their required taxes. As I mentioned above, it’s not easy for youth workers to earn enough to pay income tax because of the $12,550 standard deduction. But $400 is the magic number that triggers self-employment tax.

When kids work as an employee for a business, the employer withholds income tax, Social Security tax and Medicare tax, and possibly state income tax. Thus, as far as taxes go, the only residual issue after a summer job is filing taxes to get a refund of income taxes, assuming income is below the standard deduction.

Kids working in jobs like babysitting and lawnmowing are self-employed sole proprietor businesses in the eyes of the IRS. While they won’t (likely) need to pay income tax, they’re on the hook for both the employer and employee portions of Social Security and Medicare tax (a.k.a. FICA tax), a total of 15.3% (6.2% each for Social Security and 1.45% each for Medicare).

Since no one is withholding taxes on this income, the child (or more realistically the parent) needs to pay them. To add a bit of complexity, just like income tax, self-employment taxes are “pay-as-you-go” and you should to file and pay quarterly estimated taxes to avoid a late payment penalty. Super fun… However, the late payment penalty only kicks in if the taxpayer owes more than $1,000 in taxes, so for a simple summer job, you can probably save the trouble until tax season. Consult your tax professional to be sure in your situation.

The idea of a 10-year-old paying taxes on lawnmowing income is definitely a wet blanket, but putting it in a bit of perspective, the self-employment tax on $1,180.64 is $180.64—leaving $1,000 left to put in a Roth IRA for 50+ years. As we saw in Table 1, that $1,000 can become hundreds of thousands of dollars of tax-free retirement cash, so paying $180 in FICA taxes for the opportunity is a pretty decent tradeoff.

Cleared to Rejoin

Whether it’s a summer job bagging groceries, or a year-round babysitting gig, our kids are likely to have a sizeable chunk of earned income flowing through their young lives. Not too many kids are going to have the foresight to lead turn their retirement savings by starting before their late 20’s or even 30’s. Savvy parents can use custodial Roth IRAs to give their kids a great head start, teaching them about investing and the value of hard work along the way. Because of the standard deduction, earned income as a minor receives the rare 0% income tax rate… forever. Yes, Social Security and Medicare taxes take a nibble, but they’re a small price to pay for an extra decade of compound returns. While it’s no guarantee, a nicely-building retirement account might even be the kind of financial foundation that helps ensure that kids achieve escape velocity from your basement, and I’m pretty sure we’d all pay a little FICA tax for that!

Fight’s On!

Winged Wealth Management and Financial Planning LLC (WWMFP) is a registered investment advisor offering advisory services in the State of Florida and in other jurisdictions where exempted. Registration does not imply a certain level of skill or training.

This communication is for informational purposes only and is not intended as tax, accounting or legal advice, as an offer or solicitation of an offer to buy or sell, or as an endorsement of any company, security, fund, or other securities or non-securities offering. This communication should not be relied upon as the sole factor in an investment making decision.

Past performance is no indication of future results. Investment in securities involves significant risk and has the potential for partial or complete loss of funds invested. It should not be assumed that any recommendations made will be profitable or equal the performance noted in this publication.

The information herein is provided “AS IS” and without warranties of any kind either express or implied. To the fullest extent permissible pursuant to applicable laws, Winged Wealth Management and Financial Planning (referred to as “WWMFP”) disclaims all warranties, express or implied, including, but not limited to, implied warranties of merchantability, non-infringement, and suitability for a particular purpose.

All opinions and estimates constitute WWMFP’s judgement as of the date of this communication and are subject to change without notice. WWMFP does not warrant that the information will be free from error. The information should not be relied upon for purposes of transacting securities or other investments. Your use of the information is at your sole risk. Under no circumstances shall WWMFP be liable for any direct, indirect, special or consequential damages that result from the use of, or the inability to use, the information provided herein, even if WWMFP or a WWMFP authorized representative has been advised of the possibility of such damages. Information contained herein should not be considered a solicitation to buy, an offer to sell, or a recommendation of any security in any jurisdiction where such offer, solicitation, or recommendation would be unlawful or unauthorized.