Merges that Fighter Pilots Blow Through

You’ve read the books. You’ve read the blogs. You’ve listened to the podcasts. You’ve essentially gone to Financial Weapons School by correspondence. You know about the arsenal of financial weapons available to help you, your family, and your squadron mates max perform money. But, let’s face it—the landscape of financial merges you might encounter is at best…dizzying. Is there any topic in the financial world you can skip knowing about, at least for now, and not put your family’s future at risk? Well, what’s the first thing you learned in Financial WIC by correspondence…it depends!

Getting out of the Chocks

Let’s start with some assumptions. Let’s assume you’re still a few years from military retirement or separation, but not looking to actually stop working for an income in the next few years.

You desire to max-perform your money, but not necessarily go full F.I.R.E.

For the most part, let’s limit this discussion to either military-specific financial issues or those that are commonly discussed in the personal finance domain.

Finally, to avoid repeating the entire internet in an article, we’re just going to hit the wavetops of your financial merge options:

- Buy the merge – take advantage now

- Blow through—sig manage and move on to more important targets

- Clean up off target—get back to this in a different phase of the mission

- Handoff to adjacent formation—if you have a spouse, then maybe

Buy the Merge or Blow Through?

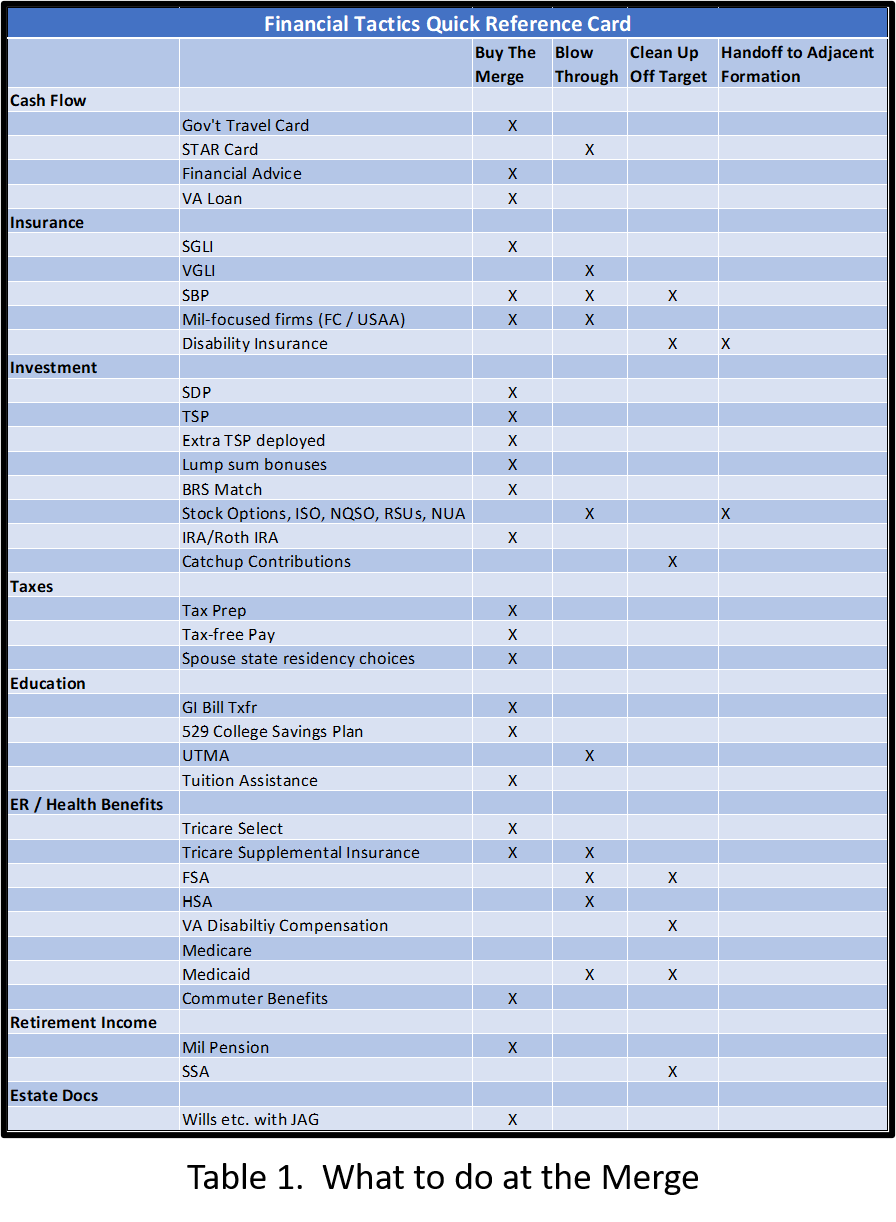

Table 1. can, but probably shouldn’t be shrunk down, laminated, and distributed at your next financial weapons academics class held at the end of the squadron bar. It’s organized essentially in line with the domains of financial planning.

Here’s the logic on financial merge tactics:

Cash Flow

- Government Travel Card: You really don’t have a choice but to have one. Don’t “be that guy” that get’s in trouble with it. It’s not the one you play credit card roulette with in Vegas.

- STAR Card: Skip it. Credit cards don’t help build wealth. They encourage us to spend more than we need to per transaction because we don’t feel the literal discomfort of separating with cash.

- Financial Advisor: The Air Force contracts for a highly qualified personal financial counselor at most installations. S/he is a great resource for helping you sort through both simple and complex topics with personalized advice.

- VA Home Loan: If you decide to buy a home while still vulnerable to PCS’s, the VA loan is hard to beat. Rates are usually lower, you can put 0% down (usually ill-advised), and you can refinance without an appraisal.

Insurance

- SGLI & FSGLI: Max it out. Keep the beneficiaries up to date. It’s only $400K, you almost certainly need to supplement it with additional Term Life insurance.

- VGLI: VGLI replaces SGLI after retirement. It’s expensive and the coverage isn’t as good as what most of us can get in the marketplace.

- SBP (Survivor Benefit Plan): This one is not one-size-fits-most. It’s a complex decision to balance the math, the unknown future, and our emotions. It’s a great topic to talk to that base financial counselor about. Consider reading Forrest Baumhover’s short, but excellent book about it.

- Military–Focused Financial/Insurance Companies: While some products from these companies are truly a deal, others… not so much. Shop around for car/home insurance and cancel the intercept if they start talking about Whole, Variable, or Universal life insurance.

- Disability Insurance: No company will write a policy on you while you’re on active duty, but Uncle Sam will effectively give you a policy with a medical retirement. If you rely on your civilian spouse’s income, strongly consider a policy for him/her. After separation/retirement, this is crucial insurance until you’re financially independent.

Investing

- SDP (Savings Deposit Plan): Unless you have a time machine back to the 1980s, you’re not getting 10% guaranteed interest anywhere else. If you deploy, you’re turning away a free $1,000 bonus if you skip this.

- TSP (Thrift Savings Plan): You’d be surprised how many fairly senior and really senior officers don’t take advantage of this. This article is a good review of all of the benefits. Don’t let another sun set before starting your contributions!

- Extra TSP while Deployed: Deployments are about creating a better future for someone—why not include your family by making additional after-tax contributions while you’re deployed?

- Lump Sum Bonus: If you take the bonus and you’re going to invest it, generally the math works out to get as much up front as you can rather that peanut-butter spreading the payments over your service commitment.

- BRS Match: The Blended Retirement System for FNGs starting after 2018 offers a 5% free-money match. If you don’t contribute at least 5%, you’re intentionally taking a pay cut.

- Stock Options: Unless you have a spouse that works in a tech start up or large company, you can probably skip learning about NQSOs, ISOs, RSUs, and NUA. Too many acronyms anyway!

- IRA/Roth IRA: Yup, even if you contribute to the TSP, your older self needs to you max out these accounts for both spouses every year!

- Catchup Contributions: Once you turn 50, it’s time to light the blower. TSP and IRA catchup contributions give you an extra 33% and 16% chance to fund your retirement years.

Taxes

- Tax Preparation: The base legal office usually sponsors a free tax preparation service. Even if you do your own taxes, you could consider a checkup with this service—especially if you have a complex year like converting a home to a rental.

- Tax-free pay: BAH and BAS are tax free, as is (most) of your basic pay while deployed. Every financial topic has tax implications, which is another reason to talk to that installation financial counselor.

- Spouse State Residency: If you PCS to a state that has an income tax, it’s usually optional to pay it—i.e., you may not have to file and pay. Military spouses no longer have to change residency just because of PCS. It’s worthwhile to signature manage your family’s state residency—you won’t have the option after you get that retirement pin.

Education

- I. Bill Transfer: It’s hard to understate the value of a scholarship that paces inflation and generally transfers to the family member that needs it the most. The initial transfer choice should be made early to buy the most options.

- Tuition Assistance: If you’re considering an advanced degree, take advantage of this program as soon as you can. Service-level budget realities cause funding to ebb and flow, especially for officers, so get while the getting is good!

- UTMA/UGMA: These accounts cause financial aid drag in the college process. A parent-owned 529 account helps you signature-manage the college funding process better. UTMA vs. 529 vs. Taxable account is a complex decision and worthy of some disinterested 3rd party advice.

- 529 Plan: Even if you have a transferred G.I. Bill, 18 years’ worth of tax-deferred compounding and flexible tax-free distributions make a 529 too good to pass up. If you happen to pay state income taxes, your state might even offer a tax deduction.

Healthcare and Employer Benefits

- Tricare Select: This is a great option if your family wants flexibility in choosing providers and skipping a trip to the primary doctor just to get a referral that you know you need. But the out-of-pocket costs can add up, so…

- Tricare Supplemental Insurance: While not necessarily cheap, a supplemental policy can help tamp down the out-of-pocket costs.

- FSA: Flexible Spending Accounts aren’t part of Tricare, but your spouse’s job may offer one and you might have one in your post-military job. They offer tax-deferred savings for annual expenses, but it’s use or lose cash, so you can’t fire and forget with an FSA.

- HSA: A Health Savings Account is the holy grail of investment accounts. No income limits, pre-tax contributions, tax-deferred growth, and tax-free distributions for qualified health care expenses… and you can skip it! You have to have a high-deductible health plan which Tricare is not! Unless you don’t take Tricare in retirement, you’ll never be eligible for one of these. (under current law)

- VA Disability Compensation: When you separate or retire, you’re likely as healthy as you’re going to be. That MK-1 human body is going to deteriorate over time and your neck and back aren’t likely to improve. This is worth learning about for lots of reasons, not the least of which is the tax-free nature.

- Medicare: The main thing to know here is that Medicare has a “shadow tax” called IRMAA (income related monthly adjustment amount). The more taxable income you have post-age 65, the more IRMAA you might pay. Roth anyone?

- Medicaid: The reason you might want to know anything about Medicaid is that your parents or grandparents might be forced to use it for nursing home care. You’ll want to avoid this for yourself…

- Commuter Benefits: If you get stationed at the five-sided well of lost souls, you can get a free Metro Card out of the deal. Small consolation to the years that place will steal from your life!

Retirement Income

- Military Pension: It’s no surprise that an inflation-adjusted check every month for lifetime is a good deal, even under the BRS. A pension is like having a multi-million-dollar bond portfolio that can’t lose value. I’m aware of one airline that still offers a defined benefit pension, and it’s not inflation adjusted, so $100K at age 62 only feels like $67K at age 75…

- Social Security: The main thing to know is that it’s taxable. When you start taking it between age 62-70, it adds to your pension and any other taxable income (e.g., Traditional IRA/TSP). Social Security bumps some of us into higher tax brackets.

Estate Planning

- Will: If you don’t have a Will, please stop reading and click here. Your installation’s JA will provide a will or new will free. Not having a will is a bit of a middle finger from the grave… poor form to say the least. The JA will quickly set you up with these additional crucial estate planning tools too:

- Living Will: Also called an Advanced Directive, this is your instructions about “pulling the plug.” Again, expressing your intent can save your loved ones a massive amount of heartache at a time when they are already redlined with grief.

- Health Care Power of Attorney (POA): This document ensures your designated appointee can make decisions on your behalf if you’re incapacitated. You need this alongside the Living Will.

- Power of Attorney: The last member of the basic estate planning 4-Ship is a POA. These get a bad rap because your designated Attorney-in-fact can wreak havoc if s/he is untrustworthy. A sound technique is a “Springing POA” that only comes into effect when you’re incapacitated, not just deployed or otherwise unavailable. There is an immense amount of nuance to POAs, so have a good talk with your legal advisor to understand the capabilities and limitations.

Cleared to Rejoin

It would be nice if this list was all you ever needed to know in order to max-perform your money while serving your country. Unfortunately, fighter tactics and financial tactics will both continue to evolve long past your time in uniform so you have to keep your head in the books. There are definitely financial topics that aren’t worth knowing much about, at least for now. Blow through those merges and get to the targets that are critical for your current mission!

Fight’s On!

Winged Wealth Management and Financial Planning LLC (WWMFP) is a registered investment advisor offering advisory services in the State of Florida and in other jurisdictions where exempted. Registration does not imply a certain level of skill or training.

This communication is for informational purposes only and is not intended as tax, accounting or legal advice, as an offer or solicitation of an offer to buy or sell, or as an endorsement of any company, security, fund, or other securities or non-securities offering. This communication should not be relied upon as the sole factor in an investment making decision.

Past performance is no indication of future results. Investment in securities involves significant risk and has the potential for partial or complete loss of funds invested. It should not be assumed that any recommendations made will be profitable or equal the performance noted in this publication.

The information herein is provided “AS IS” and without warranties of any kind either express or implied. To the fullest extent permissible pursuant to applicable laws, Winged Wealth Management and Financial Planning (referred to as “WWMFP”) disclaims all warranties, express or implied, including, but not limited to, implied warranties of merchantability, non-infringement, and suitability for a particular purpose.

All opinions and estimates constitute WWMFP’s judgement as of the date of this communication and are subject to change without notice. WWMFP does not warrant that the information will be free from error. The information should not be relied upon for purposes of transacting securities or other investments. Your use of the information is at your sole risk. Under no circumstances shall WWMFP be liable for any direct, indirect, special or consequential damages that result from the use of, or the inability to use, the information provided herein, even if WWMFP or a WWMFP authorized representative has been advised of the possibility of such damages. Information contained herein should not be considered a solicitation to buy, an offer to sell, or a recommendation of any security in any jurisdiction where such offer, solicitation, or recommendation would be unlawful or unauthorized.