Taxes for Teenagers

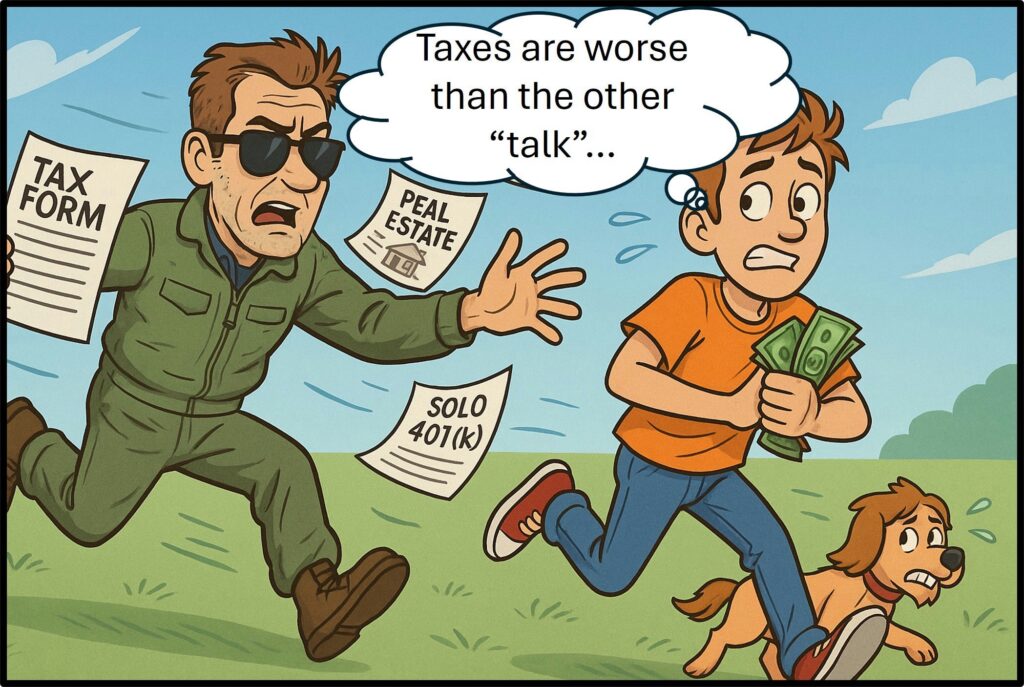

I knew I was off track when my 21-year-old daughter asked me, “Dad, how much do I get in taxes?” She was either being cheeky, pointing out that I’d failed to teach her about taxes, or both. Then a week later, she drove it home with a meme picturing a young woman wondering:

“I don’t get why people think taxes are hard… Step 1: Get your tax forms. Step 2: Give them to your dad.”

This tax season was good for an introspective dad laugh, but it occurs to me that I’m not the first parent who struggled to teach a basic level of tax understanding to his kids.

If you’ve ever tried teaching your teenager anything that doesn’t come with a dopamine rush, you know the challenge. But like certain other facts of life, you probably don’t want your kid to learn all they know about taxes from things they see on their phone… So, here’s a short guide for helping your teen understand taxes without over-g’ing their attention span.

Phase 1: Reassurance

The first thing teens should hear is: “You’re not going to jail and we’ll help you.”

Let them know that you’ll help them navigate taxes until they’re ready to handle it themselves. This removes some of the fear because you’ll fly on their wing until they’re ready to solo.

Phase 2: Tax 101

Uncle Sam requires us to pay what we owe, no more, no less. Some adults take a lot of risk trying to min-run their income reporting. Others run out of time and interest, and they miss legitimate opportunities to suppress their tax bill. The goal should be to pay just the right amount each month to avoid a big bill or big refund at tax filing time (April 15th).

In addition to paying what we owe, we need to pay on time throughout the calendar year. Most of the time, our employers help us with this, but it’s ultimately our responsibility to determine and pay the correct amount. There are great free tools, such as calculators , that can help “pre-game” the tax picture without a PhD in taxes.

Phase 3: Name That Tax

Teens already know about sales tax from their purchases. But once they start working, they’ll see new taxes come out of their paycheck. Here are the big ones:

Income Tax: Pays for things like roads, schools, and fighter jets.

FICA Tax: This includes Social Security and Medicare taxes. You might call it a “geezer tax” because it pays (some) income and (some) medical expenses for the aged. (It also pays these to the poor and disabled.)

Self-Employment Tax: This is really just FICA tax times 2 since you need to pay both the employer share and your own share when you earn money from things like babysitting, lawn mowing and dog walking.

You don’t need to overwhelm them with all the obscure taxes—like excise taxes or the details of inheritance taxes—but they should understand the ones that show up on their pay stub.

Phase 4: Tax Filing

Taxes tend to be in the background most of the year, then we start to get forms from our employers in January-February. We need to either use a software tool (free to cheap) for DIY’ers, a free service (often available to the military and low-income taxpayers), or a paid professional.

Generally, taxes need to be filed by 15 April each year. You can always file a simple form to get a 6-month extension, but you’re still supposed pay what you owe by 15 April. “But Dad… how do I know what I owe?”

Teens and young adults often don’t earn above the standard deduction, so it’s common that they don’t need to file, or they just get a refund of any income tax (not FICA) withholding.

Phase 5: Don’t Embrace the Refund

Tax refund culture might as well be payday loan and credit-score-worship culture. Each tax season, advertisers glorify all the spending you can do with your tax refund. This teaches our kids that they should give Uncle Sam a negative-interest loan so they can splurge on widgets with a tax refund.

We’re better off teaching them that while we don’t want to stroke a big check on April 15th, hoping for a refund is mismanagement. Writing Uncle Sam a check (or sending him an ACH… since our kids may not know what checks are) for one dollar is the best-case scenario.

Cleared to Rejoin

Taxes scare most adults. While our tax situations are often more complicated than our kids, our kids need us to teach this fact of life too. As soon as they start earning, it’s time to help them understand their pay stub and file their first return. If you work with a financial planner, s/he would probably be happy to help with some intro to taxes for your kids. Tax-savvy kids are on their way to being financially healthy adults!

Fight’s On!

Winged Wealth Management and Financial Planning LLC (WWMFP) is a registered investment advisor offering advisory services in the State of Florida and in other jurisdictions where exempted. Registration does not imply a certain level of skill or training.

This communication is for informational purposes only and is not intended as tax, accounting or legal advice, as an offer or solicitation of an offer to buy or sell, or as an endorsement of any company, security, fund, or other securities or non-securities offering. This communication should not be relied upon as the sole factor in an investment making decision.

Past performance is no indication of future results. Investment in securities involves significant risk and has the potential for partial or complete loss of funds invested. It should not be assumed that any recommendations made will be profitable or equal the performance noted in this publication.

The information herein is provided “AS IS” and without warranties of any kind either express or implied. To the fullest extent permissible pursuant to applicable laws, Winged Wealth Management and Financial Planning (referred to as “WWMFP”) disclaims all warranties, express or implied, including, but not limited to, implied warranties of merchantability, non-infringement, and suitability for a particular purpose.

All opinions and estimates constitute WWMFP’s judgement as of the date of this communication and are subject to change without notice. WWMFP does not warrant that the information will be free from error. The information should not be relied upon for purposes of transacting securities or other investments. Your use of the information is at your sole risk. Under no circumstances shall WWMFP be liable for any direct, indirect, special or consequential damages that result from the use of, or the inability to use, the information provided herein, even if WWMFP or a WWMFP authorized representative has been advised of the possibility of such damages. Information contained herein should not be considered a solicitation to buy, an offer to sell, or a recommendation of any security in any jurisdiction where such offer, solicitation, or recommendation would be unlawful or unauthorized.