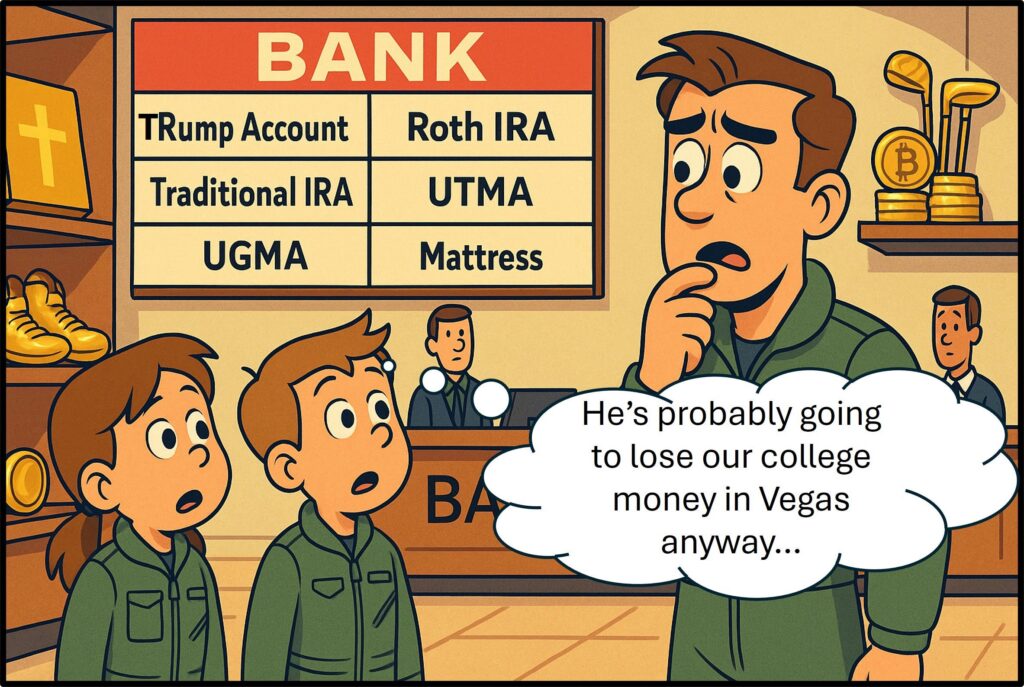

Should Military Families Open a Trump Account?

For my friends who live under a rock as far as tax law goes, the recent passage of the OBBBA spending bill creates a new type of child-focused investment account, literally named a “Trump” account. It might have been possible to come up with a more polarizing name for a savings vehicle, but I’ll leave that musing for another time. Let’s focus on what these accounts are and whether you should consider them or not.

Trump Account 101

These accounts won’t be available until mid-2026, so cancel panic and anxiety about them for now. They are essentially non-deductible Traditional IRA accounts, but the list of known unknowns regarding them is long and distinguished. Here are the basic known features:

- $5K Annual contribution limit, until age 18, starting in 2026, with inflation increases starting in 2027.

- $1K one-time government contribution (tax-free) for children born between 2025 and 2028.

- No tax deduction for contributions, but the contributions are not taxable when distributed.

- Earnings are taxed at ordinary income rates: 10% to 37%.

- Distributions are not allowed prior to age 18, but after that, there is no 10% penalty like with other IRAs.

At face value, these accounts seem like a good way for military families to stash away additional savings to help their kids get ahead. Grandparents could help with the funding, too.

But let’s take a look at some of the pros and cons of these new savings vehicles.

Trump Account Pros and Cons

Any tax-advantaged savings vehicle is worth exploring, but there’s no free lunch. Pros of these new accounts include:

- $5K more of tax-advantaged savings per kiddo is on the table.

- IRA/Roth IRA contributions are still allowed.

- UTMA/UGMA contributions are still allowed.

- 529 contributions still allowed.

- Free $1K for kids born in one 4-year period of time…

- Accounts must invest in low-cost, US-focused index funds.

We’ll look at tradeoffs in a minute, but let’s consider the Trump account cons, acknowledging the triple-entendre there…

- The tax treatment is the same as a non-deductible Traditional IRA, which means:

- You must track the basis until the account is emptied, or you could pay tax twice on the contributions. (Remember how much fun it’s been tracking basis in your Traditional IRA?)

- Earnings will be taxed as ordinary income, which could be much higher than capital gains rates or the potential 0% rate of a Roth IRA, UTMA, or 529.

- Lack of diversification. While I’m a fan of US equities as a core holding of young retirement savers, and this rule is meant to keep insurance-sales-foxes out of the hen house, it’s a bit “big government.” What’s more, being forced into US equities during certain periods (2000-2010) was pretty toxic to returns. Hopefully, this will get a re-look.

- Uncertain financial aid and other government aid treatment. It’s likely that these accounts will look like an IRA for the education financial aid process, but it’s also possible these accounts will weigh against low-income families for other aid programs.

- Uncertain Roth Conversion. Usually, we want to Roth convert non-deductible Traditional IRAs as soon as practical to get tax-free earnings going. It’s uncertain if this will be allowed for these accounts.

- The $5K contribution would compete with the $19K gift limit, thus lowering what could be contributed to a 529 account or UTMA/UGMA. (Gift splitting from a couple would mitigate this.)

- Naming… Trump tends to be a love him or hate him personality. You can probably call it a Section 408f account (like a 529 account) you aren’t a fan.

Now that we know the ins and outs, let’s take a look at alternatives and potential COAs.

Trump Account Options and Alternatives

An entry into this merge starts with answering some of the following questions:

- Do we/I actually have extra money to save after taking care of retirement, college, and other savings? If not, no need to consider these accounts. Put your own mask on before helping others…

- Are we hoping to help Junior with lifetime wealth transfer? “Twenty’s Money” to start a business, buy a home, or dodge debt? Are we trying to run up the scoreboard on what accounts can be in Junior’s name? Is education funding our priority?

- Will we proactively manage the tax consequences of the account?

Alternative accounts to consider include:

- UTMA/UGMA: The contribution limits are essentially $19K per parent, the first $1,350 of income is tax free and the next $1,350 taxed at the child’s rate, often 0%. Tax-gain harvesting can whittle away at a potential tax bill. Earnings are at capital gain rates, which are usually lower than ordinary income rates. There are no penalties for early withdrawal nor RMDs.

As a child-owned asset, they “harm” education financial aid considerations. The main downside of a UTMA/UGMA is that it must be turned over to the child at the state’s age of majority, usually about 21, but ranging from 18 to 25. Also, while a high enough balance to cause a “kiddie tax” is somewhat uncommon for middle-class families, the income above $2,700 is taxed at the parents’ capital gain rate, probably 15% to 23.8%.

- Roth IRA: If a child is working, then a Roth IRA should probably be first in the order of operations. Contributions can be withdrawn tax and penalty free at any time, and assuming these dollars are for retirement, the earnings should be tax free after age 59.5. The main downside is that many kids don’t earn income outside the home or in a family business.

- Teen Brokerage Account: Fidelity (not a recommendation) offers a brokerage account that is not a UTMA, but has parent guardrails until 18. It would not offer UTMA/UGMA tax provisions, and would also “harm” financial aid, but if you’re in the Fidelity ecosphere, it’s a consideration.

So, to simplify, let’s say a family has $7K to help a child out financially in the future, a good order of operations might look like:

Retirement Focus

- Roth IRA if the child is working and qualifies to contribute.

- If Roth IRA isn’t an option, then $5K into a Trump account and $2K into a UTMA whilst planning to tax-gain harvest and hopefully Roth Convert the Trump Account after age 18.

Twenty’s Focus

- $7K into a UTMA/UGMA would seem straightforward, but if the Trump account could be Roth converted after age 18, it’s possible the tax bill on earnings would be lower over a series of Roth Conversions than it might be significant capital gains later in life.

- Focusing on the UTMA/UGMA account requires intentionality. Gains should be harvested when the tax bill will be $0 so that the account has the highest possible basis when it’s needed for “Twenty’s Money.”

- A hedge would be to put $5K into the Trump account and $2K into the UTMA/UGMA. This could lower any workload from tax gain harvesting in the UTMA/UGMA and defer any tax gymnastics on the Trump account until age 18 or later.

Education Focus

- A 529 account is already the gold standard for education savings. Some states offer a tax deduction for contributions; the money grows without taxation; and the list of ways to use the money without paying any taxes is, you guessed, long but distinguished and growing each time Congress tinkers with the tax code.

- A UTMA/UGMA is a sound second place for education, primarily if families are allergic to the education focus and restrictions of a 529 account. Because UTMA/UGMA accounts must eventually be turned over to the child, mind the risk of pouring gas on a future fire.

- A Trump account is in last place here. The funds can’t be used for K-12 education, and the child has full control at 18. Most UTMA/UGMAs can be extended to age 21+, so a young adult who’s off the path could start doing some damage a few years earlier while starting a bogey-gathering turn for the taxman.

Cleared to Rejoin

The intersection of investing, saving, and taxes is literally what brought me to my second career, so anytime a new financial tool arrives, I’m admittedly excited. The Trump accounts are a bit of a head scratcher, but they do offer some opportunities, especially to wealthy families on the hunt for tax strategies. Expect to learn more about them as they become available in mid-2026. Until then, if you have $5K to save for junior, no need to wait!

Fight’s On!

Winged Wealth Management and Financial Planning LLC (WWMFP) is a registered investment advisor offering advisory services in the State of Florida and Texas and in other jurisdictions where exempted. Registration does not imply a certain level of skill or training.

This communication is for informational purposes only and is not intended as tax, accounting or legal advice, as an offer or solicitation of an offer to buy or sell, or as an endorsement of any company, security, fund, or other securities or non-securities offering. This communication should not be relied upon as the sole factor in an investment making decision.

Past performance is no indication of future results. Investment in securities involves significant risk and has the potential for partial or complete loss of funds invested. It should not be assumed that any recommendations made will be profitable or equal the performance noted in this publication.

The information herein is provided “AS IS” and without warranties of any kind either express or implied. To the fullest extent permissible pursuant to applicable laws, Winged Wealth Management and Financial Planning (referred to as “WWMFP”) disclaims all warranties, express or implied, including, but not limited to, implied warranties of merchantability, non-infringement, and suitability for a particular purpose.

All opinions and estimates constitute WWMFP’s judgement as of the date of this communication and are subject to change without notice. WWMFP does not warrant that the information will be free from error. The information should not be relied upon for purposes of transacting securities or other investments. Your use of the information is at your sole risk. Under no circumstances shall WWMFP be liable for any direct, indirect, special or consequential damages that result from the use of, or the inability to use, the information provided herein, even if WWMFP or a WWMFP authorized representative has been advised of the possibility of such damages. Information contained herein should not be considered a solicitation to buy, an offer to sell, or a recommendation of any security in any jurisdiction where such offer, solicitation, or recommendation would be unlawful or unauthorized.