How Military Families Can Understand the New Tax Law (in Haiku)

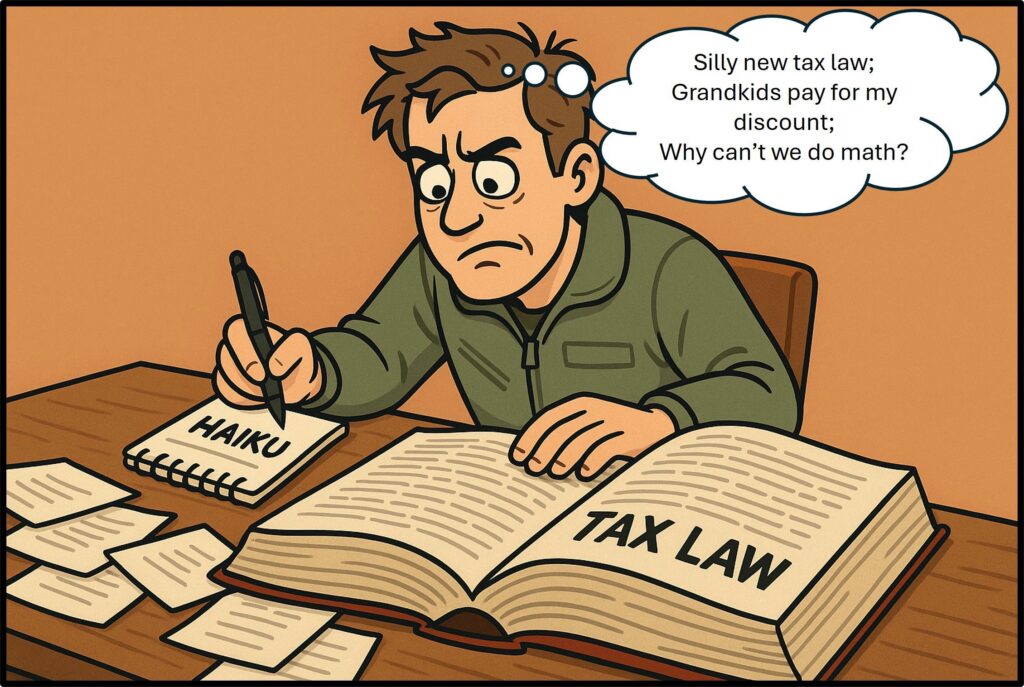

Long-time readers of my work know that occasionally, I drift into Haiku to get my points across or, when it’s a topic that needs some extra ‘splaining, to get my brain a-braining. The 4 July 2025 passage of the OBBBA spending and tax law has quite a few changes that affect many military and veteran families.

Yet, articles about tax law and personal finance are only so interesting. I know since I write them. But what if we could understand this new spending bill through 17 syllables?

There’s a bonus here, too. For each tax update, I asked my favorite robot overlord for some help in a sort of “two truths and a lie” fashion. See if you can pick out the human vs. AI Haiku!

Finally, you’ll note more than a hint of skepticism here. As a financial professional who leans hard into the lessons and truths of history and economics, and as a parent who would prefer not to saddle his kids and grandkids with national debt and smog, I’m not a fan of this bill. From a tax perspective, it generally gives crumbs to families earning the least while providing a smorgasbord to those who already have more than they know what to do with. It’s another round of trickle-down economics, a notion with a 45-year track record of trickling the other direction.

The 10% & 12% tax brackets grew a little bit.

Widened bracket joy—

But don’t spend it all at once.

Two bucks saved, woohoo.

They stretched out the bands

like yoga pants on paychecks.

Still taxed when you bend.

Big lower brackets

A few bucks feel good now

Guess how much Rich save?

Standard Deduction Increase

Raise the deduction!

So simple, you can’t cheat now—

IRS-approved.

More room to deduct,

But fewer reasons to care—

Itemizers cry.

Small change in tax bill

Good for smaller mortgage rate

Couch cushion money.

SALT Cap Increase (State & Local Tax)

Caps raised for the rich—

Their property tax weeps less.

Middle class still pinched.

State taxes were capped.

Now it’s a higher ceiling.

Phase out range takes tax cut back.

Temp cap forty K

Helps for post-COVID mortgage

Only 4-year help.

Charitable Deduction Without Itemizing

Give one K, feel proud.

No itemizing needed—

Halo on budget.

Charity at last

Gets you something concrete back:

A tax loophole hug.

Must give cash, not clothes.

Make sure to keep your receipts.

501(c)3.

0.5% AGI Floor for Itemized Charitable

Half a percent floor—

Only if you itemize.

The saints just got taxed.

Give till it just hurts—

Not your wallet, just your pride.

IRS thanks you.

First gifts do not count

A real head-scratcher change,

Taxman, then good deeds.

Gambling Losses Limited to 90% of Winnings

Lost big at the slots.

IRS says, “Pay us first.”

Your pain isn’t real?

House always wins big—

Now Uncle Sam joins the fun.

Gambler’s regret, taxed.

Gaming tax-free fun?

Smokey side hustle gets taxed.

Pay on phantom cash.

Increased Educator Deduction Opportunities

Teachers buy markers.

Congress gives back a whole buck.

Keep the change, heroes.

Classroom expensive!

Deduct your sacrifice now.

Just not much of it.

Pittance was for profs

Coaches can deduct now too

Higher pay preferred?

Child Tax Credit Increased 10% + Inflation-Indexed

Ten percent more joy—

Unless you make too much cash.

No kids for the rich.

Kids now worth more cash!

What goes up must come down too;

Phases out too fast.

Inflation peg good,

Credit size is laughable

Pro-family law?

100% Bonus Depreciation Permanent

Buy it, write it off.

Is it used? Doesn’t matter.

Tax code loves your stuff.

Assets disappear

Like politician ethics.

Depreciate truth.

Business owner win!

Cost-segs and monster trucks now;

Recapture coming…

$20K from 529 for K-12 and Other Expenses

K through 12 gets love—

Just $20K of it, though.

Private school? Maybe.

529 law says:

“Tuition now, yacht later.”

The fund grows wiser.

Decent policy

More reason for 529

Homeschoolers left out.

$6K Deduction for 65+

Old age has a perk:

A six-grand deduction hug—

Thanks for still voting.

Retired but taxed.

Here’s six grand off, just for age.

Gift-wrapped arthritis.

SSA still taxed

Another promise broken;

Say ‘bye’ in two-nine.

Auto Loan Interest Deduction

Your car, your loan, tax.

Interest deductible—

Pay bank and save bucks?

Rev your engine, friend.

Tax breaks ride shotgun with you—

Congress approves wheels.

Car loan prevents wealth.

Value shrinks, payment remains;

Earn? Pay? Interest.

Energy Credit Reductions

Solar’s now passé.

No more credits to the sun.

Burn coal for a break.

Green dreams turn to dust.

The credit winds have shifted—

Hope rides a gas truck.

Tax incentivize?

Where is gas, coal deduction?

Cut nose to spite face.

Cleared to Rejoin

All jest aside, there are some significant changes in this tax and spending bill that all of us need to consider. The good news is that we have five months left in 2025 to plan. If you give to charity, own rental property, or operate a small business, it’s time to talk to your financial planner for sure. Most of the other provisions will be automatically captured during tax preparation, but schedule time with your financial planner this fall to see how the OBBBA affects you!

Fight’s On!

Winged Wealth Management and Financial Planning LLC (WWMFP) is a registered investment advisor offering advisory services in the State of Florida and Texas and in other jurisdictions where exempted. Registration does not imply a certain level of skill or training.

This communication is for informational purposes only and is not intended as tax, accounting or legal advice, as an offer or solicitation of an offer to buy or sell, or as an endorsement of any company, security, fund, or other securities or non-securities offering. This communication should not be relied upon as the sole factor in an investment making decision.

Past performance is no indication of future results. Investment in securities involves significant risk and has the potential for partial or complete loss of funds invested. It should not be assumed that any recommendations made will be profitable or equal the performance noted in this publication.

The information herein is provided “AS IS” and without warranties of any kind either express or implied. To the fullest extent permissible pursuant to applicable laws, Winged Wealth Management and Financial Planning (referred to as “WWMFP”) disclaims all warranties, express or implied, including, but not limited to, implied warranties of merchantability, non-infringement, and suitability for a particular purpose.

All opinions and estimates constitute WWMFP’s judgement as of the date of this communication and are subject to change without notice. WWMFP does not warrant that the information will be free from error. The information should not be relied upon for purposes of transacting securities or other investments. Your use of the information is at your sole risk. Under no circumstances shall WWMFP be liable for any direct, indirect, special or consequential damages that result from the use of, or the inability to use, the information provided herein, even if WWMFP or a WWMFP authorized representative has been advised of the possibility of such damages. Information contained herein should not be considered a solicitation to buy, an offer to sell, or a recommendation of any security in any jurisdiction where such offer, solicitation, or recommendation would be unlawful or unauthorized.