So, I’ll start this one by begging forgiveness for the click-baity title. When getting ready to separate or retire, most of us experience some serious jitters knowing that the secure government paycheck/benefits are coming to an end. There’s a scary “leaving-the-nest” feeling to it. I jokingly console my friends that, “there are no homeless fighter pilots” as a reminder that we’re a fairly high-functioning group of folks and those who’ve gone before us demonstrate that we generally land on our feet, if not excel at life 2.0. What’s with the title? It’s about the choice not to own a home, to be houseless of sorts.

As I write this, I can’t swing a dead cat without seeing an offer to buy my very-not-for-sale house. Interest rates are running out of room to drop. Housing is scarce in many markets at the same time that the pandemic has turned our homes into dual-use buildings. Real estate can be an excellent investment in general. It diversifies a portfolio. It can provide tax advantages. It can provide passive income. What’s not to like?

There are a lot of ways to invest in real estate, but I’m going to focus on single-family homes bought by military members on active duty. I know dozens of fellow military members that (to the best of my knowledge) have done very well by purchasing and either selling or renting homes as they PCS’d along a career. I do caveat with “to the best of my knowledge” because I think some of them might have cherry picked some of their experiences when spinning yarns over a whiskey… So, what are some (monetary) reasons to buy a home on active duty?

- Potential for appreciation and capital gain. Historically, homes appreciate on average 3-5% per year in a healthy market. If inflation is 2-3%, then there’s good chance to beat inflation.

- Potential tax advantages. If you pay enough in mortgage interest (difficult to do with low interest rates) and property taxes (difficult to do with the $10K cap on state and local tax deductions) then you can join the 10% of taxpayers that itemize and potentially save on your tax bill.

- g. Assume $10K in property and state taxes (why are you paying state taxes on active duty?) You’d have to have a mortgage over $549,090 at a 2.75% rate to pay over $15,100 in interest in order to exceed the 2021 $25,100 standard deduction for MFJ.

- Potential to build equity. With low interest rates (e.g. 2-3%), more of your house payment does pay down principle in the early years of the loan than if your interest rate is higher (e.g. 5-7%). As long as the fair market value (FMV) of the home doesn’t decline, then whittling away at principle does indeed build equity.

If you then rent the home out after a PCS:

- Potential income. If the rent payment exceeds all expenses, you have more income (taxed at ordinary income rates).

- Potential capital gain. If the home’s FMV increases and you later sell it, you pocket the gain (minus your favorite Uncle’s cut).

- Potential tax advantages. If you have operating losses on your rental property, you can generally deduct $25K of them. That benefit phases out when your AGI hits $100K and is gone when your AGI tops $150K. Each year you operate the home as a rental, you’ll depreciate 1/27.5th of the value. That can be an enormous deduction and have a meaningful impact on your taxable income while you own the home. WARNING: Even with the military “2 in 15” extension on Section 121 gains, you still must pay ordinary income rates up to a max of 25% capital gains tax on depreciation recapture upon sale.

- Potential to defer capital gain and depreciation recapture. If you use a 1031 “like-kind” exchange, you don’t have to realize any gain or pay tax on any recapture until you sell the final property.

- Potential step-up in basis. Under current law, if you leave property to your heirs, they receive a step-up in basis to the FMV on the date of your death. A home you bought for $140K in 2009, but it’s worth $500K 30 years later when you die, it could be sold by your heirs shortly after with no tax on the gain.

With all of these upsides, why would you choose not to own a house, potentially at every duty station? Because things don’t always go the way you hope…

- Potential for depreciation. Ask anyone that owned a home in the late 2000’s about this one. I personally had the opportunity to offload a home that I bought in 2006 for $360K at the sweet price of $140K three years later. Even if a home’s value doesn’t do a Hindenburg, there’s no law of physics that guarantees steady appreciation, especially not appreciation that’s better than inflation.

- Potential for tax disadvantage. For years, itemizing deductions was the rage. The 2017 TCJA tax changes nearly eliminated that for millions of Americans. Tax laws change at the local, state and federal level and directly affect your bottom line.

- Potential to lower net worth. Pouring money into the principle on a home loan should increase net worth over time. But a few other things have to be simultaneously true. The home’s FMV needs to remain steady or increase. Your family needs to have excess cashflow to meet all other needs, including retirement savings. Finally, the dollars put into principle on the home should have a higher opportunity cost than the next best option. (More on this in a minute…)

If you then rent the home out after a PCS:

- Potential negative cashflow. It’s one thing to receive a rent payment that covers the mortgage payment. But it has to cover all of the other expenses to be cashflow positive. Even if you want to account for the present-year benefit of depreciation, it’s appropriate to factor in the present value of the future depreciation recapture tax bill. For example, if you depreciate the home $10K this year and sell it in 5 years with 2% average inflation, you still have a $2,264 phantom tax bill. Then there’s maintenance, repairs, tenant vacancy costs, utilities, property managers, HOA fees, etc. …

- Potential non-deductible capital loss. When you sell a personal residence at a loss, you can’t deduct the loss. When you sell a business property, such as a rental home, you might be able to deduct the loss. Let’s say you buy a home for $350K and add a pool for $40K. Your basis is $390K. The market softens and 3 years later when you PCS, you decide to rent it out for a few years because its FMV has dropped to $330K—which becomes the basis when you place it into service. You rent it for 5 years, depreciating it $12K per year, hoping that the market recovers. At the 5-year point, it’s worth $335K and you sell it. Your basis is $330K – $60K = $270K. Your wallet feels like it experienced a loss from $390K to $335K. Your tax forms say you have a gain from of $65K ($335K – 270K). Depreciation and a reduced basis at the beginning of a rental can make it hard to have a capital loss on a rental.

- Potential tax dis-advantages. As mentioned above, when your AGI is above $100K you start to lose the ability to deduct rental losses. You can carry the loss forward to future tax years, but you’ll either need to experience a decline in income, passive gains to offset, or sell the property to get any tailwind from rental operating losses.

- Potential hassle. We’ve all heard the stories- tenants, trash, and toilets… Even if you use a property manager, owning a rental home is owning a business and it comes with extra work. On top of that, you may find that other costs go up. Umbrella insurance might cost you a bit more. You may decide to form an LLC to wall-off your business properties from your personal assets. These can be important costs to project.

I was told there would be some math?

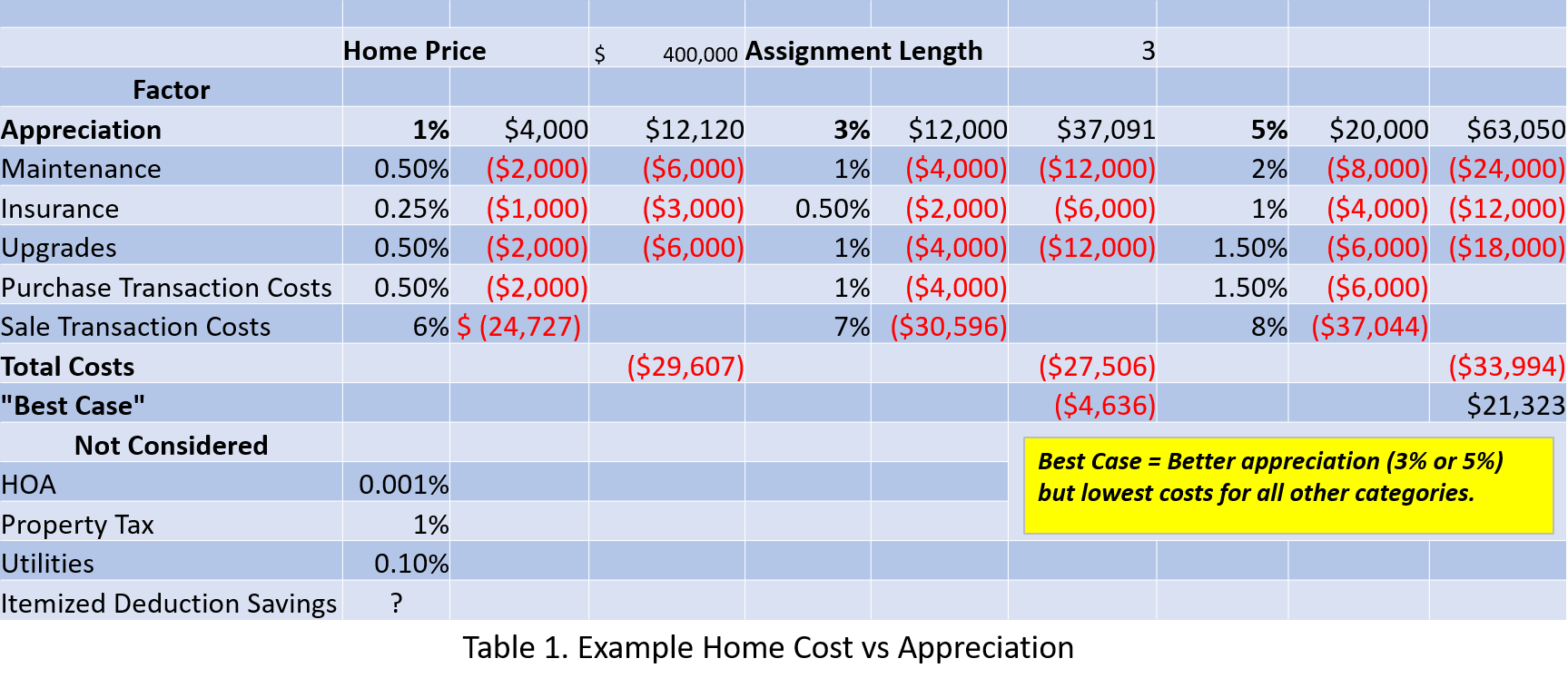

If you sell in a red-hot market, it’s pretty easy to just smile when you see five- or six-digits pop into your bank account but fail to show up on your tax forms. But did you really profit? Table 1 shows some example calculations that you should consider. The three columns represent various cases of home appreciation over a 3-year PCS ownership, 1%, 3%, and 5% compounded. The costs, such as maintenance, upgrades, insurance costs are not compounded, but are presented as a range of potential costs—e.g. maintenance costs could be from .5% to 2% per year. The row for total costs is based on selling after 3 years of appreciation and subtracting the very real costs of maintenance, homeowner’s insurance, upgrades, and transaction costs (closing, commissions, etc.) that you would not incur if you rented. As you can see, there’s a loss in each case.

The “Best Case” numbers assume that you have the listed appreciation, but all of the other costs are as low as possible (i.e., from the first column) which also implies that you get a discount on the sales transaction cost. In this case, you finally see a real profit from owning the home if it appreciates 5% per year.

Not factored in are HOA costs, property taxes, and utilities since you’ll likely pay those in one form or another as a renter. Additionally, since you’re unlikely to itemize deductions these days, there is no allowance for tax savings due to itemizing.

Some other math

FOMO is real. Your friends seem to be building a property empire and your just throwing money away on rent—that sucks, right? Going back to Table 1, we can see that in the least expensive case, you’d spend $5K per year on maintenance, insurance, and upgrades. What if you take that money and just invest it, say, into your “down payment” fund (mutual fund/ETFs, etc.) over the course of your PCS’g life? Worst cast, let’s say that you do that for 15 years of a 20-year career and your down payment fund earns an average of 9.3158%? You’d have about $150K for a down payment when you’re done PCS’g. Now, you’ll probably pay some capital gains tax on part of that $150K to access it for your down payment, and if you happen to happen to pull the same $150K down as capital gain from the sale of a primary residence, you might not pay capital gains tax on that. So, it’s important to factor in all the likely costs, but the reality is that you there’s more than one way to build equity. You might be able to build equity owning a home. You might be able to build equity putting the same dollars into more liquid, easy-to-manage assets.

Summing it up

There are excellent reasons to buy versus rent and vice versa. We’re pretty wired to look at the upsides of financial transactions. When buying a home that you’ll strongly consider selling in just a few years, it’s really important to consider costs that you won’t incur as a renter, so that you’re at least mathematically clear-eyed about the transactions. Conversely, not every home purchase is just about the math. Sometimes, buying a house because the family needs a source of grounding and permanence after a long deployment makes all the sense in the world, regardless of the numbers. Hopefully this article gives you a chance to consider owning a house, or being “houseless” for a while as you PCS around the globe. Fight’s on!

Winged Wealth Management and Financial Planning LLC (WWMFP) is a registered investment advisor offering advisory services in the State of Florida and in other jurisdictions where exempted. Registration does not imply a certain level of skill or training.

This communication is for informational purposes only and is not intended as tax, accounting or legal advice, as an offer or solicitation of an offer to buy or sell, or as an endorsement of any company, security, fund, or other securities or non-securities offering. This communication should not be relied upon as the sole factor in an investment making decision.

Past performance is no indication of future results. Investment in securities involves significant risk and has the potential for partial or complete loss of funds invested. It should not be assumed that any recommendations made will be profitable or equal the performance noted in this publication.

The information herein is provided “AS IS” and without warranties of any kind either express or implied. To the fullest extent permissible pursuant to applicable laws, Winged Wealth Management and Financial Planning (referred to as “WWMFP”) disclaims all warranties, express or implied, including, but not limited to, implied warranties of merchantability, non-infringement, and suitability for a particular purpose.

All opinions and estimates constitute WWMFP’s judgement as of the date of this communication and are subject to change without notice. WWMFP does not warrant that the information will be free from error. The information should not be relied upon for purposes of transacting securities or other investments. Your use of the information is at your sole risk. Under no circumstances shall WWMFP be liable for any direct, indirect, special or consequential damages that result from the use of, or the inability to use, the information provided herein, even if WWMFP or a WWMFP authorized representative has been advised of the possibility of such damages. Information contained herein should not be considered a solicitation to buy, an offer to sell, or a recommendation of any security in any jurisdiction where such offer, solicitation, or recommendation would be unlawful or unauthorized.